From pv magazine Global

Global solar PV deployment is entering a phase of adjustment. After several years of rapid expansion, installation growth is stabilizing across multiple major markets. EUPD Research calculations suggest that global additions in 2026 may not exceed 2025 levels.

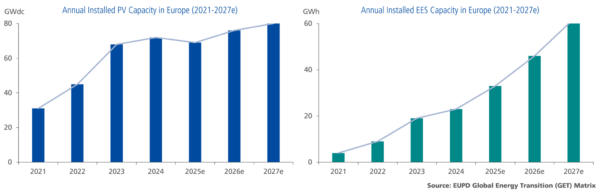

This shift is visible first and foremost in the world’s largest markets. China installed an estimated 365 GW in 2025, with annual PV demand expected to decline from this peak level. According to EUPD Global Energy Transition GET-Matrix©, in the United States (U.S.), installations are estimated at around 48 GW in 2025, marginally lower than approximately 50 GW in 2024, with additions expected to decline further in 2026 as incentive eligibility, trade enforcement, and permitting timelines increasingly shape deployment activity. Europe also recorded a decline, with installations in the 69 GW range in 2025, compared with over 70 GW in 2024, reflecting cooling residential demand alongside higher borrowing costs and tighter lending conditions.

While select Asian markets and the Middle East and North Africa (MENA) continue to expand, their growth is insufficient to offset deceleration across these core economies. As a result, global deployment momentum is increasingly determined by developments in mature markets rather than by headline growth in emerging regions.

At the same time, global manufacturing capacity continues to outpace deployable demand. Large-scale capacity build-outs in China and India now materially exceed domestic absorption, embedding structural surplus into the global PV market and reinforcing sustained downward pressure on pricing and margins.

Against this backdrop, energy storage is moving to the center of new system deployment. Grid congestion, curtailment risk, and price volatility are accelerating storage adoption across residential, commercial and industrial (C&I), and utility-scale segments. For C&I system owners, storage increasingly serves as a tool for mitigating exposure to volatile power prices, reducing dependence on grid supply during peak or constrained periods, and safeguarding long-term energy cost predictability. As a result, the ability to integrate storage is no longer optional, but is increasingly influencing whether projects proceed at all.

Together, these dynamics frame the global solar market entering 2026: a market no longer defined by uniform volume expansion, but by regional divergence, structural oversupply, and a growing emphasis on system integration and execution quality.

China: Demand stabilization, manufacturing surplus, and the rise of storage

China’s solar PV market has entered a phase of stabilization following years of rapid expansion. Installations are estimated at approximately 365 GW in 2025, indicating a clear plateau at historically high levels. Looking ahead, annual PV demand is expected to remain broadly within a range of 320–350 GW from 2026 onward, reflecting evolving grid conditions, regulatory adjustments, and system integration constraints.

While this sustains China’s position as the world’s largest solar demand market, domestic installations are no longer sufficient to absorb the country’s manufacturing base. Even at breakeven capacity utilization rate of 60%, China’s module capacity remains several times larger than annual domestic demand, structurally embedding surplus supply into the global market.

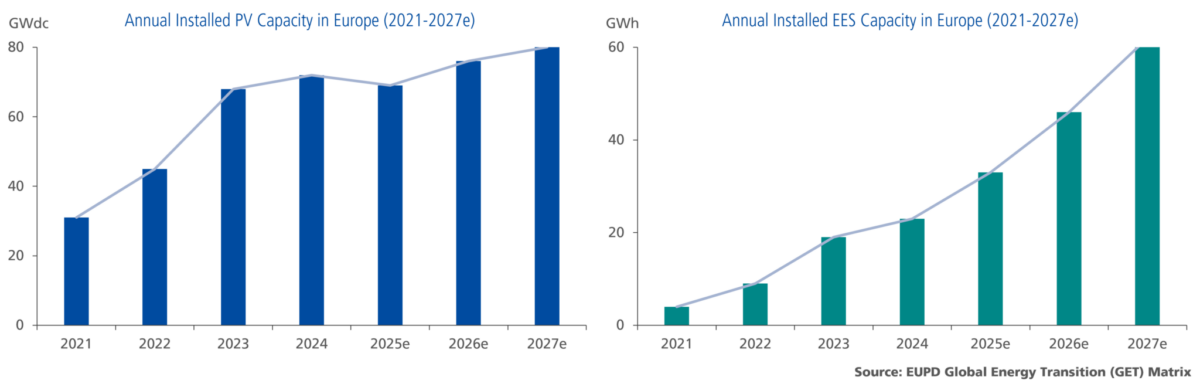

As a result, persistent surplus capacity continues to set the global price floor for PV modules, exerting sustained pressure on pricing across international markets and shaping competitive conditions well beyond China’s borders. However, China’s recent announcement to cancel the VAT export refund, reducing it from 9% to 0% as of April 1, 2026, could create a glimmer of hope for slightly less price pressure. In combination with recent increases in raw material and component costs, as well as rising silver prices, this development is expected to have a positive impact on PV module price levels in 2026.

At the same time, China’s domestic energy transition is increasingly shifting toward energy storage. Grid congestion, curtailment risks, and system balancing requirements under the 15th Five-Year Plan are accelerating battery storage deployment at a faster pace than PV additions. Storage and PV-plus-storage system integration are becoming central to project viability, redirecting domestic investment toward system-level solutions rather than standalone generation.

U.S.: Incentive tightening and trade barriers redefine market access

After a period of accelerated growth following the Inflation Reduction Act, the U.S. solar market entered a phase of adjustment in 2025. Changes in incentive eligibility, project timing rules, and trade enforcement have increased uncertainty across the development pipeline and reshaped deployment economics.

Annual solar PV additions are estimated at approximately 48 GW in 2025, down from around 50 GW in 2024, with installations expected to moderate further to roughly 43 GW in 2026. Residential demand is normalizing as tax credit structures evolve, while utility-scale deployment is increasingly shaped by permitting timelines, interconnection bottlenecks, and heightened execution risk.

At the same time, U.S. module imports from Southeast Asia have declined sharply compared with 2024 levels. While imports from the region reached approximately 49 GW in 2024, shipments fell materially in 2025 as trade enforcement intensified and domestic manufacturing capacity expanded. Tighter scrutiny of supply chains linked to Chinese ownership, alongside uncertainty around incentive eligibility under Foreign Entity of Concern (FEOC) provisions, has reduced the availability of previously relied-upon imported supply.

Rather than enabling a smooth transition toward domestic sourcing, these dynamics are increasingly resulting in supply displacement and project delays, as portions of the import base become ineligible for incentives while domestic alternatives remain limited or higher-cost.

Battery storage remains structurally supported by grid integration needs, capacity markets, and growing commercial and industrial and utility-scale demand. As a result, storage deployment has proven more resilient than PV. However, uncertainty around localization requirements, incentive eligibility, and compliance obligations is increasing selectivity in project development and placing downward pressure on returns.

Europe: Stabilizing installations shift growth toward storage and execution quality

Following several years of accelerated expansion, Europe’s solar PV market has entered a phase of normalization. Annual installations have stabilized at approximately 65–70 GW since 2024, reflecting cooling residential demand and higher borrowing costs alongside tighter lending conditions across core markets such as Germany, Italy, and the Netherlands.

Europe’s demand mix is shifting decisively away from residential installations toward C&I and utility-scale projects. As rooftop incentives fade and grid export conditions tighten, growth is increasingly supported by corporate energy strategies, ESG compliance requirements, long-term cost considerations, and the commissioning of projects awarded in tender cycles.

This transition places EPC companies and C&I buyers at the center of market access, technology selection, and system integration, according to PV Commercial & Industrial EPCMonitor©. Procurement decisions are increasingly shaped by bankability, service reliability, regulatory compliance, and long-term partnership capability rather than headline equipment pricing (see Brand Leadership & Sustainability Rating – Europe).

In parallel, energy storage has moved to the center of Europe’s market momentum. While solar PV growth slowed across several major European markets in 2025, battery storage installations expanded sharply, with capacity estimated to exceed 29 GWh, representing an increase of more than 36% compared to 2024 levels, according to the EUPD Electrical Energy Storage Report© H2 2025. Rising occurrences of negative electricity price hours, growing grid stabilization requirements, and a stronger focus on maximizing on-site consumption are reinforcing storage as a core system component rather than an add-on.

India: Rapid manufacturing expansion adds to global oversupply

India’s solar PV manufacturing capacity is expanding at a pace that significantly exceeds the growth of domestic installations. While annual PV demand is expected to remain in the range of 40–45 GW, announced and under-construction module capacity continues to scale well beyond what the local market can absorb.

Even at breakeven capacity utilization factor of approximately 65%, this capacity expansion would result in a structural surplus of roughly 90 GW per year by 2027, which would need to be absorbed outside the domestic market.

This surplus is being added to an already oversupplied global PV landscape, reinforcing sustained downward pressure on module pricing. Although Indian modules continue to trail Chinese modules in terms of price and, in many cases, efficiency, India’s rapid manufacturing expansion is nevertheless contributing additional volume into a market already shaped by persistent excess capacity, particularly from China. As a result, competitive intensity is increasing across export markets, with potential pricing pressure extending regionally and tightening margins globally.

Middle East: Utility-scale growth reinforces the central role of EPCs

Solar deployment across the Middle East continues to expand, driven primarily by centrally tendered utility-scale projects. Growth is supported by government-led procurement and long-term power purchase agreements, with deployment paced by tender schedules rather than supply availability.

Market access in the region is defined by execution capability and bankability, placing EPCs and developers at the center of project delivery and supplier selection. While component pricing remains relevant, success increasingly depends on financing alignment, delivery track record, and the ability to execute at scale under strict timelines.

As a result, Middle East functions as a selective, execution-driven market, offering limited scope for opportunistic volume placement despite continued growth.

In this context, EUPD Research in cooperation with pv magazine is organizing the EPC | Project Developer Awards & MENA Leadership Reception alongside the World Future Energy Summit. The invitation-only event will take place on 13 January 2026 at Aloft Abu Dhabi, bringing together senior EPC executives, project developers, and energy leaders from across the region.

Conclusion: From 2025 signals to strategic positioning in 2026

The global solar PV industry is entering a phase where scale alone no longer guarantees competitiveness. Manufacturing capacity continues to expand, but market access is tightening, pricing pressure is becoming structural, and deployment outcomes are increasingly shaped by policy design, execution capability, and system integration rather than by volume targets.

With demand in China peaking, installations in the U.S. and Europe constrained by trade rules, financing conditions, and project execution timelines, and energy storage becoming a prerequisite for project viability, the cost of pursuing volume-led strategies without clear market positioning is rising sharply. Oversupply is no longer cyclical, but embedded in the global market structure.

In this environment, competitive advantage will be defined by how effectively companies choose markets and segments, align early with regulatory and compliance requirements, integrate storage and system-level capabilities, and build partnerships that secure durable access to projects. Achieving this increasingly depends on data-driven market intelligence and structured market prioritization, areas where EUPD Research supports manufacturers and system suppliers in translating complex market dynamics into actionable strategy.

For manufacturers and system suppliers, the next phase of the solar market will reward speed, focus, and disciplined execution. Leadership will belong not to those who pursue scale indiscriminately, but to those who identify where value is emerging and move first with the right technology, positioning, and market intelligence.

About the Authors:

Markus A.W. Hoehner is the Founder and Chief Executive Officer of the EUPD Group and Hoehner Research & Consulting Group. With more than 30 years of experience in renewable energy market intelligence, sustainability strategy, and international consulting, he has built the EUPD Group into a globally leading provider of research, certification, and industry platforms. Markus advises stakeholders worldwide on market trends, strategic planning, and decarbonization pathways. He can be reached at hoehner@hrcg.eu.

Daniel Fuchs is the Chief Customer Officer of EUPD Group. He has extensive international experience in sales, marketing, customer engagement, and strategic event management within the renewable energy and cleantech industries. His work focuses on building customer-centric growth strategies, strengthening global partnerships, and supporting market development across the solar, energy storage, and sustainability sectors. He can be reached at d.fuchs@eupd-research.com

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.