Industry leaders have recommended buyers sourcing battery energy storage systems (BESS) look past sticker prices and headline figures during a pv magazine Week Europe 2025 webinar.

In a session on what to consider when purchasing BESS, held as part of pv magazine’s virtual conference last week, panellists discussed pricing, supplier and product reliability and the outlook for battery storage in Europe.

Ed Mulloy, Solution Engineer at Accure Battery Intelligence, advised that due to industry fixation on $/kWh, original equipment manufacturers (OEMs) are incentivized to “push the risk out of that number and instead put it in the contract.”

“The real cost of a battery goes far beyond the $/kWh,” he said. “It’s also in the contract and that’s where we see a lot of buyers winning and losing. The price may look good but you need to be aware of what liabilities you’re inheriting that could reduce savings.”

“A good contract has clear definitions, competitive benchmarked values, aligns with your real world use case and it gives you flexibility for future market or revenue changes,” Mulloy added. “A bad contract, even if the price is great, can quietly erode your returns throughout the lifetime of your project.”

‘Look at the price versus quality ratio’

In a panel on supplier selection and technology considerations, Stefano Alberici, VP of Technology EMEA at HyperStrong International, extended the discussion around pricing, advising buyers to look at the price versus quality ratio, rather than the price itself.

“The price itself is a little misleading. The price is due to the way you process your product, the way you make it, the way you test it, the way you calibrate it, the way you certify it. If you don’t want bad surprises on the site, all these things have to be done before that,” Alberici said, before adding that a focus on just price often leads to believe a product is expensive, rather than well-tested and higher quality.

“When we talk about factory acceptance tests or site acceptance tests or certifications, all these kinds of things have to be there,” Alberici added. “How can I invest millions of euros on a project that should last for twenty years, maybe even more, thinking that I have to hope that things are working now? No way.”

When asked about customer preferences in Europe, Edward Rackley, Head of Energy Storage at CRU Group, predicted the market will start to see more integrated products, whether AC or DC. “It’s a lot easier for an asset owner with a fault or who needs to discuss a warranty to pick up the phone to one supplier instead of looking at ten different component suppliers and trying to deconvolute that,” he said.

Alberici also recommended investors double check whether their system integrator is also located on the territory. “In my opinion, the sales process is not just selling the system, it’s selling the system and going up to the end of the lifetime,” he added.

‘All factories are not equal’

Conversation then turned to choosing a reliable supplier. Panellists told attendees to consider if their chosen supplier has a good track record and has manufactured at scale before. Communicating project use-case to suppliers was also recommended, as well as asking vendors for case studies and supplier details where possible.

Arthur Claire, Director of Technology at Sinovoltaics, added that it is important to clarify which factory a supplier is using to manufacture a product. He shared examples of clients realizing they were buying from a brand where the BESS was being manufactured at a factory they had never heard of before, rather than the brand’s main factory.

Claire warned specifically against the use of third-party factories that are used as extra capacity for tier one players. “You cannot expect the same quality,” he said. “All factories are definitely not equal, so clarifying which factory you’re using, [and] putting it in the contract, may be the right choice.”

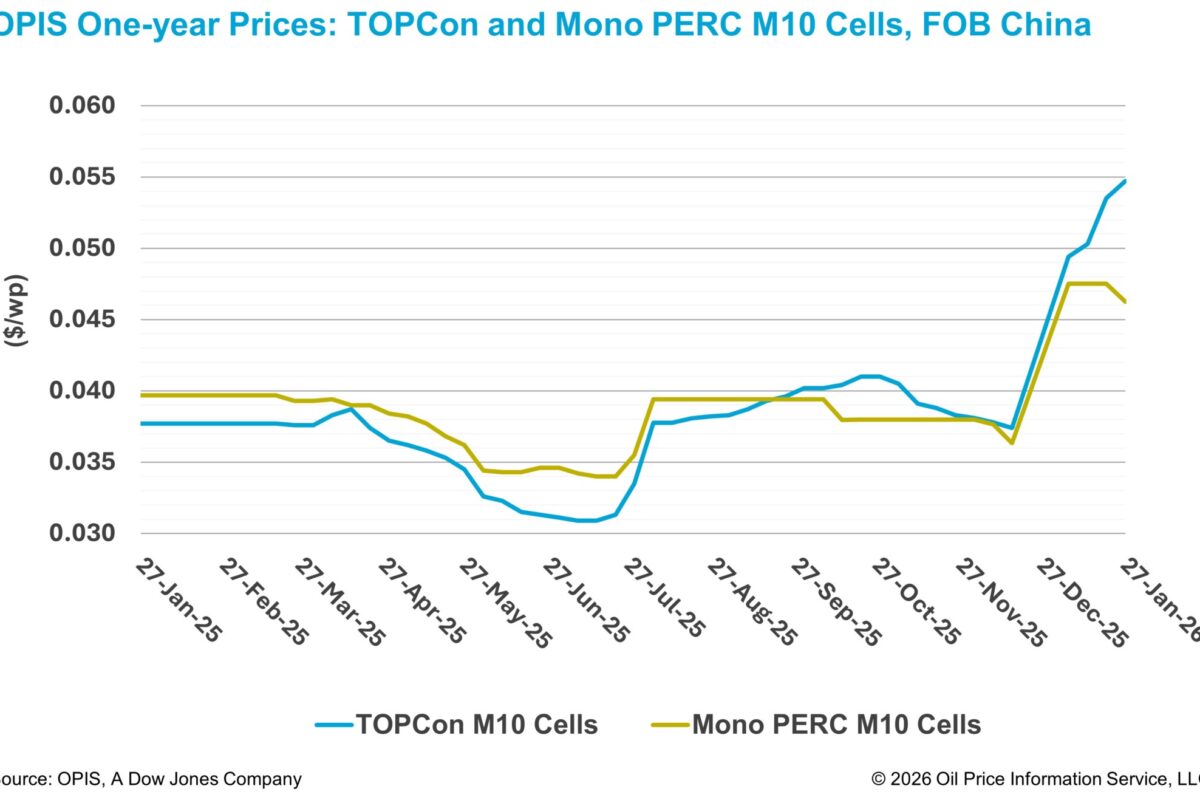

Rackley also delivered a presentation on the outlook for energy storage battery prices for European BESS producers, in which he said CRU is expecting lithium iron phosphate to remain the lowest-cost battery storage chemistry this decade, with technology costs offsetting rising near-term material prices.

“Industry oversupply, especially in the midstream, will persist, especially into the mid-term,” Rackley added. “We expect that will keep energy storage system prices low, which is great for procurers looking to source battery storage for their projects.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.