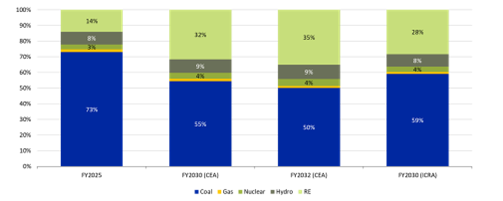

ICRA projects that the share of renewable energy (including large hydro) in India’s power generation mix will increase to over 35% by FY2030, up from 22.1% in FY2025, supported by an estimated 200 GW of new RE capacity additions. However, achieving this milestone hinges on speedy implementation of the ongoing project pipeline where the projects are bid out and the PPAs are signed, the development of adequate transmission connectivity infrastructure as well as timely bidding for new RE projects, along with the power purchase agreements (PPAs) signing by Central nodal agencies.

ICRA

After a sizeable RE capacity of 47.3 GW awarded in FY2024 and 40.6 GW in FY2025, the bidding activity has slowed sharply in the current year with only 5.8 GW awarded in 8M FY2026. Further, the unsigned PPA capacity remains sizeable at about 40-45 GW as on date.

“The decline in new project bids and delays in signing PPAs for large RE capacity by Central nodal agencies clearly reflects the concerns on the execution related to available transmission connectivity for the RE sector. Further, reported grid curtailments in Rajasthan for renewable assets, particularly solar assets during the solar hours in a few time blocks, due to grid stability requirement, is also a concern, given the absence of grid compensation clause in the PPAs for such cases,” said Girishkumar Kadam, senior vice president & group head – corporate ratings, ICRA, highlighting the grid inadequacy.

Kadam said that a focus on the enhancement of both the storage capacity and grid strengthening within the state as well as at inter-state level in a timebound manner remains extremely critical, as share of renewables increases in the generation mix.

As India grapples with variability in renewable generation, BESS have emerged as the important enabler for grid stability. The Government has introduced viability gap funding for BESS capacity along with extended transmission charge waivers for storage projects until 2028. The Central nodal agencies and state discoms have awarded standalone BESS projects aggregating to over 20 GWh since April 2024 to October 2025. Also, the share of round-the-clock (RTC), firm and dispatchable renewable energy (FDRE) and solar plus storage projects remained high at 0% of the total RE capacity awarded in 8M FY2026.

Further, the significant decline in battery costs over the past decade has helped reduce the cost of energy storage and adoption of BESS projects globally.

Based on prevailing battery prices, ICRA estimates the levelised cost of BESS-based storage for 2–4 hours at INR 4–7/kWh, down from INR 8–9/kWh in 2022, although still higher than pumped storage hydropower (INR 5/kWh). However, BESS offers advantages such as lower execution risks and shorter development timelines.

On the competitiveness of standalone BESS projects, Kadam said: “Although BESS projects have shorter lifespans and require replacement capex, sustained reduction in battery prices is expected to drive greater adoption, going forward.”

“The viability of these projects remains pegged to the capital cost. Based on the average battery cost of ~USD 70/kwh seen in 2025, along with associated taxes/duties and cost of the balance of plant, the capital cost is estimated in the range of $120-150/kwh. At these capital cost levels and prevailing interest rates, the cumulative debt service coverage ratio for standalone BESS projects lands in the 1.15-1.25x range. Nonetheless, the ability of BESS projects to adhere to the performance parameters like availability, round trip efficiency, depth of discharge, degradation, etc remains a key monitorable, given the limited track record.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.