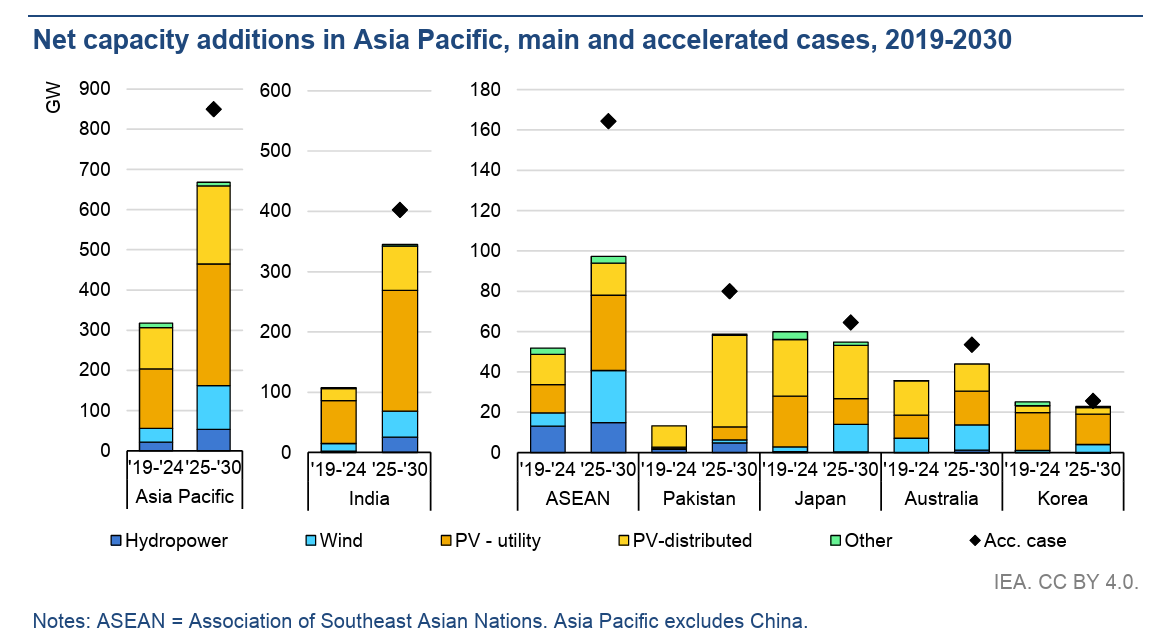

India is set to become the world’s second-largest market for renewable energy growth by 2030, according to the latest forecast from the International Energy Agency (IEA). The country is expected to add nearly 345 GW of renewable capacity — including solar, wind, hydro, and other sources — between 2025 and 2030, more than tripling its 2022 level.

This projection positions India just behind China in terms of national renewable energy expansion over the next five years. Utility-scale solar PV projects are expected to account for nearly 60% of this growth.

The IEA has revised its forecast for India’s 2025–2030 renewable additions upwards by nearly 10% compared to last year, owing to record auction volumes in 2024 for onshore wind and utility-scale solar PV, the launch of a new rooftop PV support scheme, and faster permitting for pumped storage hydro (PSH) projects.

In 2024, 63 GW of capacity were awarded – almost three times the volume of 2023 – with hybrid tenders (combinations of PV, wind and storage) making up over half. Although auction volumes fell in early 2025, a robust project pipeline supports continued deployment acceleration throughout the forecast period.

Hydropower additions are also set to rise sharply – more than tenfold compared with the previous six years – with the completion of large-scale projects and a tripling of PSH capacity by 2030 as the Central Electricity Authority streamlines permitting.

Under the IEA’s accelerated case scenario, India’s renewable energy growth could be 17% higher than the base forecast — potentially enabling the country to surpass its 2030 targets. “This growth could be achieved by addressing challenges related to the financial difficulties of many DISCOMs; improving the enforcement of renewable portfolio standards; and reducing delays in signing PPAs with auctions winners,” states IEA report.

Manufacturing progress

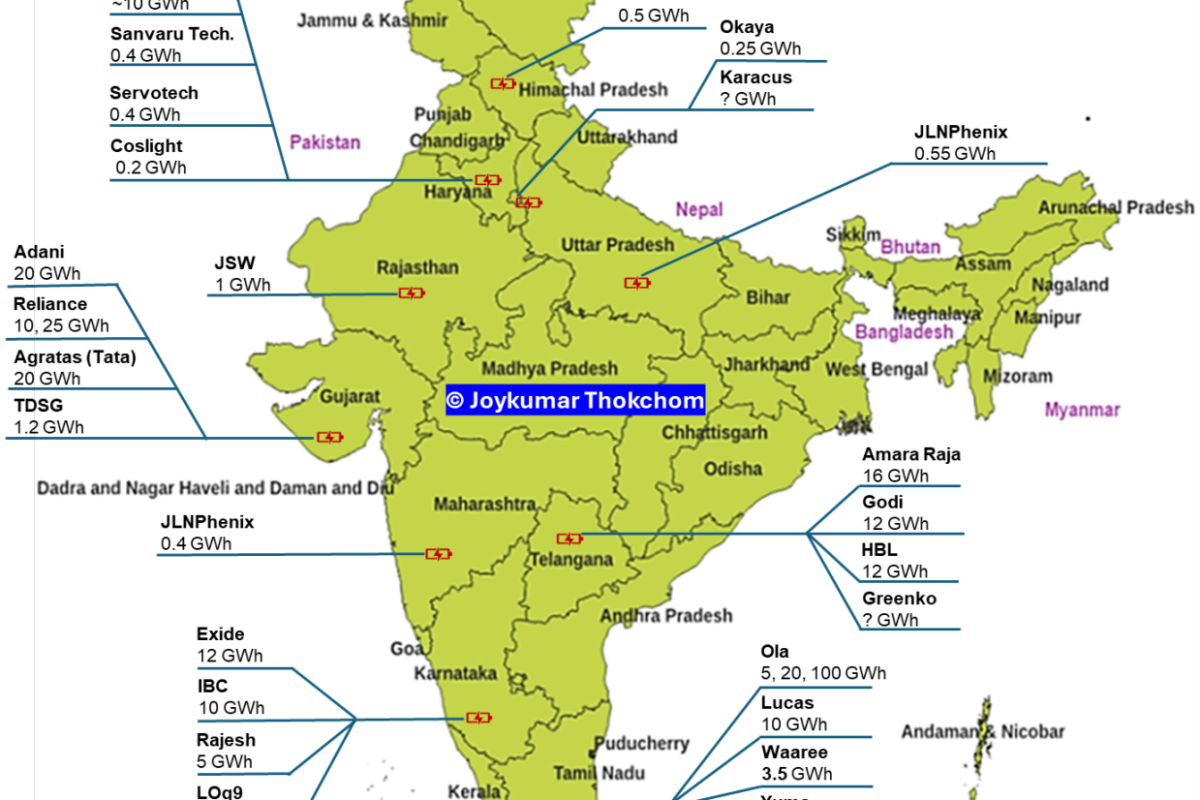

India’s push for domestic manufacturing — supported by policies such as the Production Linked Incentive (PLI) scheme, a 40% basic customs duty on imported PV modules, and domestic content requirements — has led to rapid capacity expansion, particularly in module production.

In 2023, India awarded PLI allocations for nearly 50 GW of cell and module capacity, 41 GW of wafer capacity, and 24 GW of polysilicon production. However, while targeted module capacity was achieved by the end of 2024, cell manufacturing reached only 20 GW with no wafer or polysilicon facilities commissioned. Delays resulted primarily from technical, financial and competitive challenges, particularly in upstream segments.

Consequently, IEA has revised India’s manufacturing capacity estimates for 2030 downwards from last year’s forecast – from 35 GW to 15 GW for wafers, and from 30 GW to 15 GW for polysilicon. In contrast, module manufacturing projections have been raised from 70 GW to 125 GW, driven by faster-than-expected capacity additions, strong domestic demand and rising exports, particularly to the United States. Despite ongoing delays, cell manufacturing is also expected to exceed previous forecasts, reaching 60 GW by 2030 (up from 50 GW) as domestic-content requirements are extended to this segment.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.