A new study by the Council on Energy, Environment and Water (CEEW) finds that electric two- and three-wheelers are already more economical to own than their petrol counterparts.

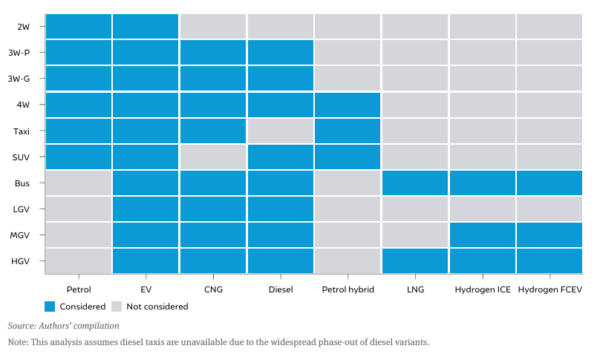

The study compared the total cost of ownership (TCO) of different fuel types within ten distinct vehicle segments and found that EVs offer significant savings—particularly in states with supportive EV policies. To estimate the TCO of different vehicles, it considered standard parameters including CAPEX, interest payments, discount rate, resale value, GST and cess, and fuel economy. It also considered state-specific parameters such as road tax, subsidies, and fuel prices.

The study report states that electric two-wheelers have a lower total cost of ownership (TCO) of INR 1.48/km than INR 2.46/km for petrol models. Three-wheeler EVs cost INR 1.28/km versus INR 3.21/km for petrol.

Further, EVs deliver major savings for commercial taxis, where daily operating costs matter most. For private cars, competitiveness varies by state—driven by differences in EV subsidies, charging tariffs, and upfront prices.

However, the TCO of e-buses needs to reduce significantly to compete with diesel buses. CNG and LNG buses have a lower TCO on average than diesel buses but are limited by the respective distribution infrastructure. Green hydrogen buses will remain uncompetitive till the late 2040s, post which green hydrogen fuel cell electric vehicle (H₂-FCEV) buses have a lower TCO than green hydrogen internal combustion engine (H₂-ICE) buses due to their higher fuel efficiency, stated the report.

For medium and heavy goods vehicles (MGVs and HGVs), EVs currently remained more expensive than diesel, CNG, or LNG in 2024, according to the CEEW study. LNG is the cheapest fuel at present for HGVs, but refuelling infrastructure is nearly non-existent. While the TCO of electric medium and heavy good vehicles will decline to become competitive beyond 2030, EV trucks will still be limited by a substantially lower range than diesel or gas-powered trucks (250 km per charge vs 600–800 km per refill).

To reduce the CAPEX burden on EV buyers, the report recommends battery financing schemes that decouple the battery cost from the upfront cost. “Decoupling the battery cost of the vehicle from the capital expenditure (CAPEX) and instead charging a monthly rental/equated monthly installment (EMI) for the battery pack may prove beneficial to reduce the CAPEX burden on EV buyers,” states the report. “The Government of India, through public banks and non-banking financial companies (NBFCs), can provide a fixed scheme for battery rentals across all vehicle segments rather than relying solely on original equipment manufacturers’ (OEM) schemes.”

EVs are less competitive in the M&HGV segment, primarily because of limitations in battery range and extended recharging times. To enhance their competitiveness in this segment, the report underscores the need for more research efforts to improve energy density and reduce charging durations.

CEEW

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.