The Pumped Hydro Storage (PHS) segment is gaining momentum in India, driven by the increasing focus on grid resilience and the demand for long-duration, grid-scale energy storage. Several states are issuing tenders and signing Memorandums of Understanding (MoUs) with project developers to initiate PHS project development.

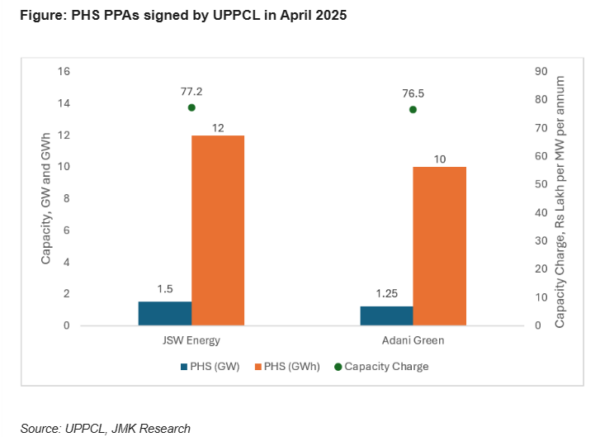

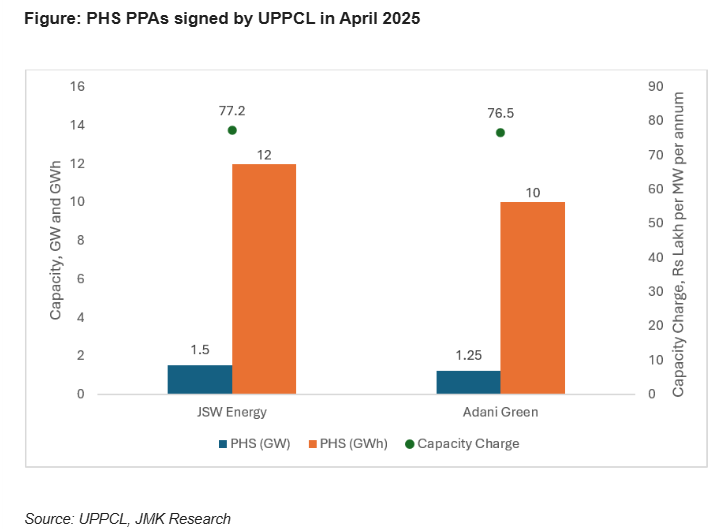

In April 2025, Uttar Pradesh (UP) became the latest state to enter the PHS market by signing Power Purchase Agreements (PPAs) for a cumulative capacity of 2.75 GW/22 GWh (8-hour solution). According to the agreements, the developers are required to commission this capacity within six years, by 2030. Additionally, in April 2025, the Uttar Pradesh Power Corporation Limited (UPPCL), the off-taker in the PPAs, issued a separate tender to procure 2 GW of PHS capacity. Once these capacities are commissioned, UP will be harnessing 35.4% of its 13.4 GW PHS potential.

The PPAs signed by UPPCL with JSW Energy and Adani Green outline a project tenure of 40 years, with fixed annual capacity charges of Rs 77.2 lakhs and Rs 76.5 lakhs per MW, respectively. These tariffs reflect a declining trend in PHS project costs, being approximately 9% and 48% lower than similar tenders from Maharashtra State Electricity Distribution Co. Ltd. (MSEDCL) in September 2024 and the Power Company of Karnataka Ltd. (PCKL) in March 2023, respectively.

In addition to UP, Maharashtra was another active state in the PHS segment in April 2025. Although it did not finalize any concrete PPAs, the Maharashtra government signed MoUs with the state power generation corporation, Mahagenco, and Avaada for a cumulative PHS capacity of 8.9 GW across nine sites in the state. Of this capacity, 3.6 GW will be set up by the Avaada Group, requiring a cumulative investment of Rs 15,000 crore.

In FY2025, the Central Electricity Authority (CEA) approved six PHS projects with a cumulative capacity of 7.5 GW. Therefore, UPPCL finalizing 2.75 GW of pumped hydro storage capacity in the very first month of FY2026 marks a strong start for the year, laying the groundwork for robust market expansion and bringing India a step closer to its long-term PHS goals. In the future, the unique characteristics of PHS – such as providing long-duration energy storage and enhancing system stability through spinning reserve and frequency regulation – make it an invaluable component of the national grid. The Central Electricity Authority (CEA) has projected a need for 27 GW/175 GWh of long-duration PHS capacity in India by 2031-32.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.