From pv magazine print edition 11/24

Energy storage installations generate returns through two primary streams: merchant revenue and contracted revenue. Contracted revenue often requires reform, market creation, and government backing to come to fruition, with key examples including capacity markets and large-scale tenders.

On the other hand, merchant revenue – which does not need an energy offtaker – is organic and can develop as more price volatility becomes present in existing market structures. In recent months, merchant revenues have become more important to the energy storage market and have led to optimistic outlooks in some key regions.

Building a profitable business case for merchant storage, or any asset for that matter, relies on low capital expenditure (capex) costs and/or high revenue. These two things have changed recently, creating growth in energy storage installations.

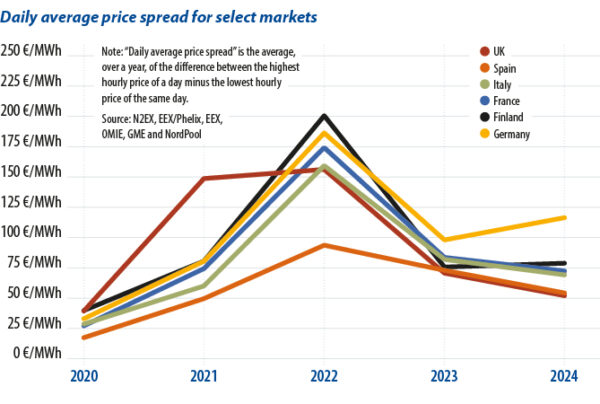

Merchant revenues have been increasing in a number of key regions. The picture here is slightly muddy as wholesale price volatility hit record levels during the energy crisis of 2022, triggered by Russia’s invasion of Ukraine. At that time, building a merchant business case for energy storage could have been easy but it would have been based on shaky foundations as the drivers behind that energy market volatility were temporary.

Since then, volatility has fallen but not back to previous levels and, crucially, is now rising again. This time, wholesale price volatility is being driven by something much more permanent: renewable energy installations, and solar in particular.

Storage arbitrage

In many regions, installed solar generation capacity exceeds peak electricity demand. On sunny days, more energy is generated than is needed. This has a profound effect on prices, which can routinely tumble to zero or negative values. Meanwhile, in the evening when electricity demand is often highest, solar generation declines and power prices often rise.

This pattern creates the perfect environment for energy storage “arbitrage” – charging when prices are low and discharging when prices are high. This is an important moment for energy storage, as installations of solar and wind power projects are only rising. This will add to electricity generation and supply volatility in the coming years and drive an even more robust business case for storage as time goes on. Some countries have set bold targets for renewables. Spain’s latest National Plan for Climate and Energy aims to achieve an 81% share of renewables in electricity generation in 2030, up from around 50% in 2024.

Better technology

While that has been happening in wholesale markets, suppliers of energy storage systems have been rapidly scaling up and innovating. Recent breakthroughs in the design of battery cells have increased BESS energy density, meaning that the most recently launched systems can store more energy than previous versions for the same space. That has been achieved by the optimization of battery cell interiors with more area dedicated to electrodes, increasing capacity while keeping dimensions and voltage unchanged.

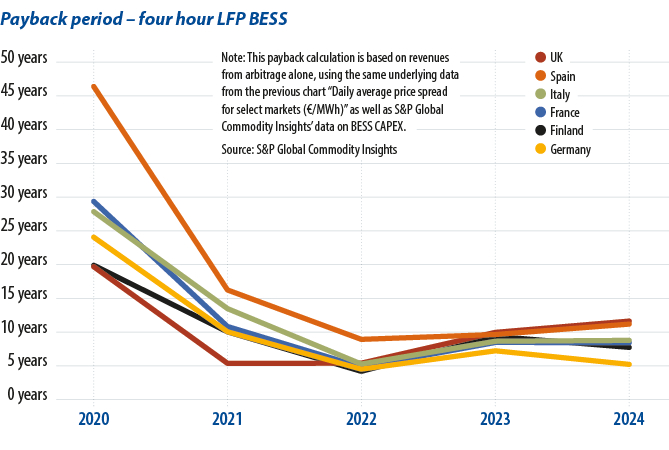

Rising BESS capacity and falling raw material prices for batteries have led to a significant decrease in energy storage system prices. This decline is also influenced by softer competition for battery cells due to a slowdown in electric vehicle market growth. We have seen prices for fully installed systems fall by about 40% since 2022.

Quick returns

With falling prices and rising revenues, the two key elements for building a profitable business case for energy storage are moving in the right direction at the same time. The return-on-investment (ROI) figure is a key indicator, showing how long it would take for capex to be paid back under current market conditions. ROI has seen some very significant declines in recent years. Not very long ago, it could take up to 80 or 90 years to make back an investment in storage by trading in day-ahead energy markets. Today, in many cases, the figure is less than 10 years. Add to that other revenue streams, such as real-time market trading, grid-backing ancillary services, and capacity market contracts, and the business case is very strong.

Falling prices and rising revenues are strengthening the business case for merchant energy storage going forward. But that may not translate directly to growth, due to the inherent risk in merchant markets. Greater development of contracted revenues plays a key role in driving down risk for investors and broader availability would open up access to capital to drive the industry forward. So despite the tailwinds behind the rise of energy storage, there is more to be done to unlock maximum growth for this critical industry.

About the authors: George Hilton is a senior analyst focusing on batteries and energy storage on the climate and sustainability team at S&P Global Commodity Insights. He joined S&P Global in 2020 and has seven years of experience in clean energy. Hilton focuses on energy storage in Europe, the Middle East, and Africa and is interested in how energy storage integrates with other industries.

Henrique Ribeiro is a principal analyst on the batteries and energy storage team at S&P Global Commodity Insights, focusing on Latin America and Iberia. He worked for 11 years on the metals pricing team where he helped to establish benchmarks on global battery metals prices, as well as steel and aluminum prices in Brazil, Chile, and Mexico.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.