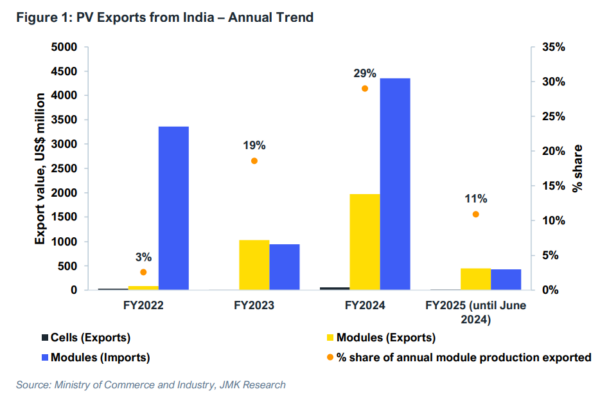

India exported around $2 billion worth of PV modules in fiscal year (FY) 2024. The export value of PV modules from India increased by more than 23 times in just two years between FY2022 and FY2024, according to a joint report by IEEFA and JMK Research.

The report says USA is the top destination with 97% and 99% share of India’s PV exports in FY2023 and FY2024, respectively. India also exports PV products to South Africa, Somalia, Kenya, the UAE, Afghanistan, Nepal and Bangladesh.

As per the report, despite increased logistics expenses, domestic manufacturers can earn 40-60% higher profit margins on PV module sales in developed nations like the US than in India.

Other driving factors for surge in PV exports include reduced demand for domestic PV modules following the delayed implementation of the Approved List of Models and Manufacturers in April 2024, and several countries considering India as a viable option for their “China Plus One” strategy.

The US has imposed steep tariffs on PV products from China to gradually phase out Chinese imports. The US government might extend these tariffs to imports from Southeast Asia (SEA), subject to the result of an ongoing antidumping and countervailing duty (AD/CVD) investigation by the US Department of Commerce.

The report states that with the expiration of the Free Trade Agreement and an ongoing antidumping and countervailing duty investigation, India can potentially replace Southeast Asian countries to become the leading PV exporting country to the US.

The report recommends that as India establishes itself as a viable alternative to China, balancing the demands of the export and domestic markets is important.I t is crucial to ensure adequate domestic supply, especially for market segments with smaller order sizes, such as residential rooftop solar. The supply-demand gap also affects solar module prices, a critical factor for the price-sensitive residential rooftop solar segment

Leading exporters

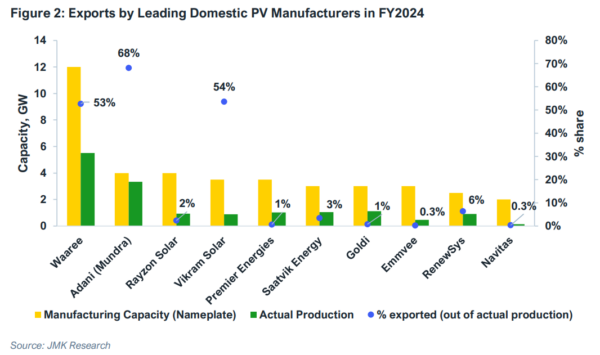

In FY2024, India exported over 5.8 GW of PV modules, which was at least three times higher than in FY2023. The nation exported more than 29% of its PV module production in FY 2024, the majority of which was shipped by Waaree Energies, Adani Solar and Vikram Solar – each of which exported more than half of its annual actual production in FY2024. Other leading players like ReNew and Tata Power utilised a significant portion of their output for captive consumption in FY2024.

Several other Indian PV manufacturers like Grew Energy, ReNew Power, Navitas, Solex Energy and Saatvik Energy are pursuing export markets and setting up supply chains abroad. Waaree Energies and Vikram Solar are also planning to set up PV manufacturing capacities in the US, taking advantage of the incentives offered under the Inflation Reduction Act (IRA).

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

3 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.