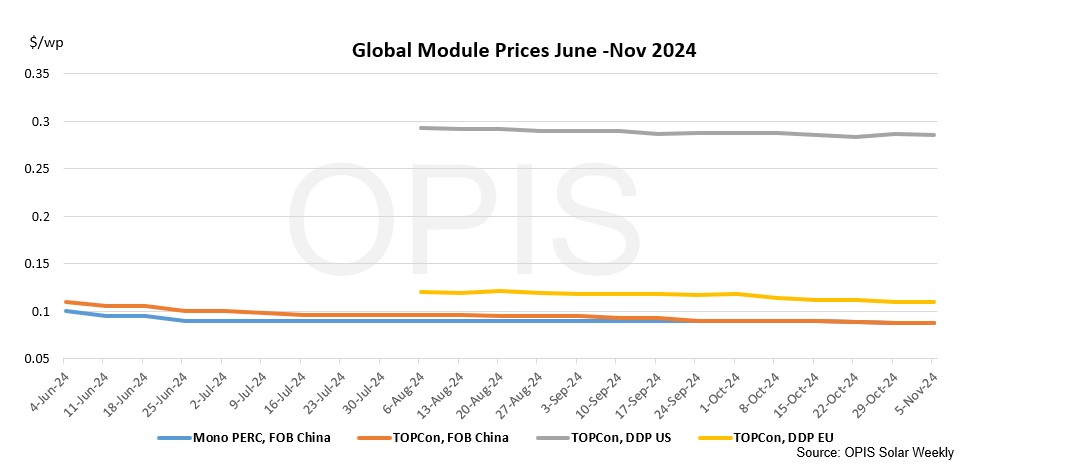

FOB China: The Chinese Module Marker (CMM), the OPIS benchmark assessment for TOPCon modules from China, was stable at $0.087/W Free-On-Board (FOB) China, with price indications between $0.085-0.095/W basis FOB.

Spot prices have softened in recent weeks as manufacturers push to offload “old stocks” before year-end. According to a Southeast Asian module buyer, several producers are clearing inventory ahead of launching new 2025 module specifications. October’s average module price was $0.089/W, a 4.3% month-over-month decline, according to OPIS data.

“We expect prices to go even lower for 2025 delivery as demand remains sluggish and inventory levels stay high,” a Tier 1 module seller told OPIS. The seller noted that dwindling demand for upstream solar cells may further pressure cell prices or at the very least, prevent any increases in the near term.

DDP Europe: TOPCon module prices slightly dropped, while overproduction of Asian modules remains high and European demand remains flat. OPIS assessed the average price at €0.101/W, down 0.98%, with indications ranging between a low of €0.080/W and a high of €0.120/W.

Freight rates for the China/East Asia-North Europe Ocean route decreased another 1% and were reported at $3,489 per forty-foot equivalent unit (FEU). This corresponds to $0.0083/W.

Asia-North Europe and Mediterranean ocean freight rates closed 30% lower in October than a month ago and have reached the floor set, according to market watchers.

DDP U.S.: Prices are down slightly this week, with OPIS assessing the spot price for utility scale TOPCon modules DPP U.S. at $0.285/W, while forward indications show the price slightly higher in the first quarter of 2025 at $0.296/W and Mono PERC modules for the same delivery period at $0.284/W.

Sources say additional guidance surrounding the domestic content bonus is expected by the end of the year. A utility-scale deal using TOPCon modules assembled with American-made cells (manufactured with imported wafers) was closed at $0.45/W with module delivery in June or July of 2025.

Last week, the agency adjusted the CVD rate for Jinko’s affiliates in Malaysia from 3.47% to 9.92%, and the “all others” rate from 9.13% to 12.32%, after acknowledging a “ministerial error” in its calculations. Following fresh subsidy allegations from petitioners, the DOC is also now investigating the “cross-border” provision of silver paste and solar glass in Southeast Asia.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.