From pv magazine Global

Solar panel manufacturers JinkoSolar and Trina Solar recently reported that field tests show that tunnel oxide passivated contact (TOPCon) solar modules outperform p-type rear contact PV modules in monthly power generation. These studies were conducted by the manufacturers individually, and in the case of Jinko Solar, the results were confirmed by German agency TÜV Nord.

While the data from a generation perspective is encouraging, the results of this year’s Kiwa PVEL scorecard have shown that the technology is more vulnerable. Researchers at the University of New South Wales have also recently published the results of new research showing the vulnerability of TOPCon solar cells to contact corrosion.

In the case of the tests carried out by United States-headquartered independent test lab Kiwa PVEL, the results depend largely on the type of bill of materials (BOM) used.

“This year’s results have surprised us,” Asier Ukar, managing director of Kiwa PI Berlin in Spain, told pv magazine. In particular, less than 6% of the 388 models tested were top performers in all reliability tests (TC, DH, MSS, HSS, PID and LID+LETID); and 66% of module manufacturers experienced at least one failure in the tests.

“The failure rate at BOM level also increased to 41%, the highest ever,” Ukar said.

PV modules with the same model type can be manufactured from completely different BOMs, and these changes in PV module components can have a major impact on reliability and performance. On the other hand, “industry certification tests according to standard regulations are often not strict enough to identify these potential problems,” Ukar added.

For example, the International Electrotechnical Commission (IEC) test for thermal cycling is 200 cycles in a climatic chamber, while the Kiwa PVEL test is 600 cycles. This test models the behaviour under hot-cold thermal cycles, and the requirement to pass the test is that the module degrades less than 2%, and 84% of the modules tested passed the test; 11 manufacturers suffered a failure in this test.

“The average degradation rate for PERC and TOPCon was 0.6% and 0.7%, respectively, but five TOPCon BOMs registered a power degradation failure compared to only one PERC BOM,” Ukar said.

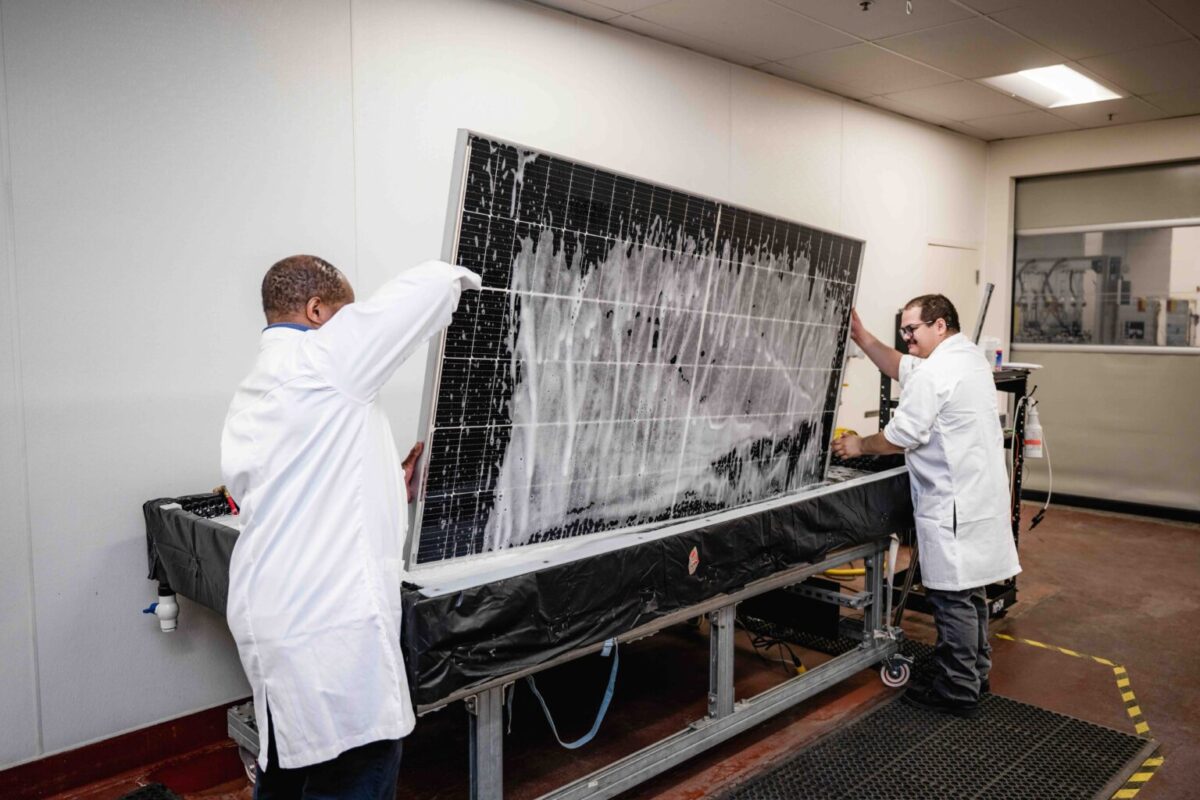

Another test, damp heat, subjects the panels to moist heat in a climate chamber. Kiwa PI Berlin subjects them to 2,000 hours – compared to 1,000 for the IEC – and the requirement to pass the test is that the module degrades less than 2%.

“In this case, 31% of the BOMs tested failed the test, and TOPCon is more affected than PERC,” Ukar said.

The mechanical stress, hail, Potential Induced Degradation (PID) and LID – LeTID tests generally yielded good results, but problems were observed in the UV-induced degradation (UVID) tests.

“The power loss after 120 kWh/m2 of UVID ranged from 0.6% to 16.6%. While HJT is affected and PERC degrades more than expected, TOPCon suffers much more,” Ukar said.

Everything points to TOPCon being the dominant technology in the next five years and, as with every technological advancement introduced by the sector, this improvement also comes with certain risks and challenges that must be understood and addressed.

“One of the main objectives in the race to deploy this technology in a way that meets expectations is to focus on its long-term durability, that is, how this technology behaves under the influence of environmental factors such as humidity or UV radiation,” Ukar said.

This approach brings with it the need to include extended-duration tests in the prequalification processes of manufacturers and their models, as well as adapting laboratory testing procedures with tests adapted to the risks that TOPCon introduces.

“The good news is that both the tools and the knowledge exist and are at the service of the industry,” Ukar concluded.

Author: Pilar Sánchez Molina

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.