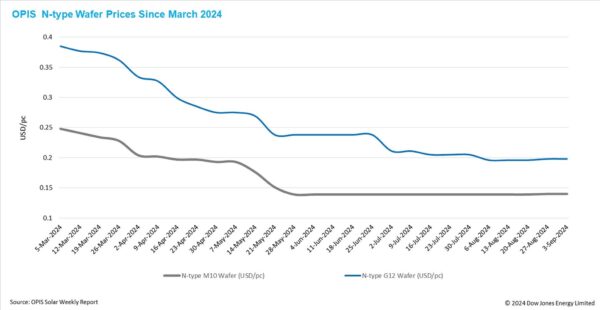

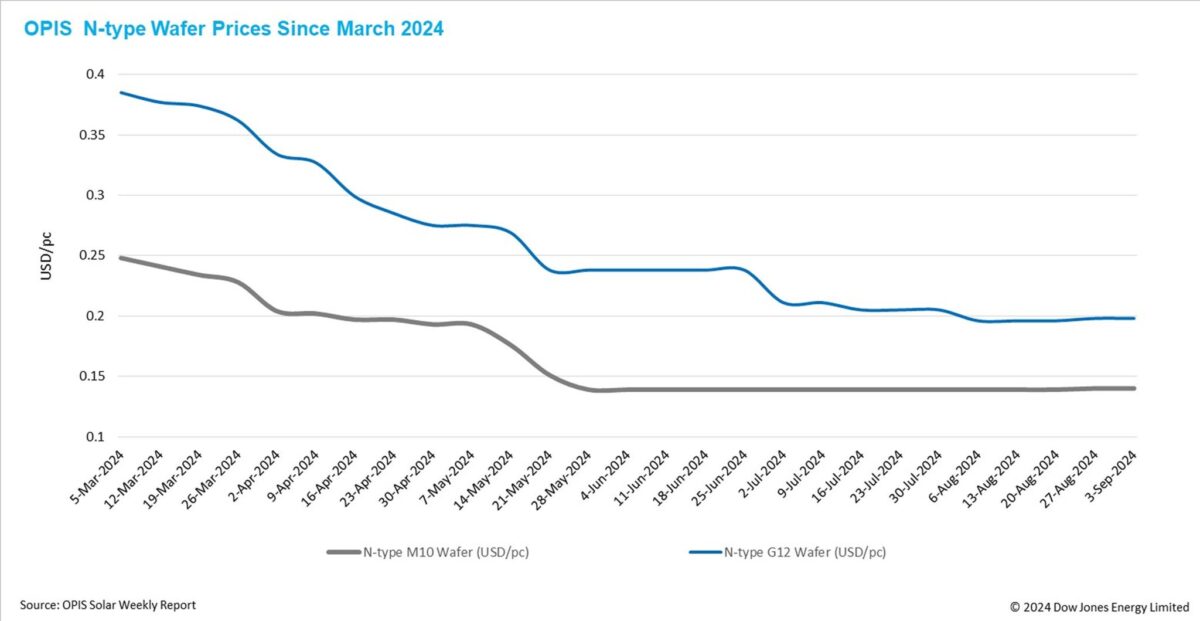

FOB China prices for N-type M10 and G12 wafers have remained stable this week at $0.140/pc and $0.198/pc, respectively, following a brief price increase driven by market leaders last week.

Cell companies, both in China and internationally, have so far shown limited acceptance of the recent wafer price hikes. The two leading wafer manufacturers managed to secure a slight increase of around CNY0.01-0.02 ($0.0014-o.oo28) per piece, varying by customer. However, Tier-2 wafer manufacturers were unsuccessful in their attempts to implement similar price increases, though this situation also presents a significant opportunity for them to clear inventory.

The sustainability of the wafer price increase is a topic of discussion among market participants, who believe that in an environment of oversupply, it will primarily depend on changes in supply.

A Tier-1 wafer producer is reportedly altering its operating strategy following recent leadership changes. The company, which previously maintained a high operating rate of over 90% for wafer production, has reduced it to around 70% since the last week of August.

Given the company’s substantial wafer production capacity, the factory’s decision to reduce output is expected to help restore the market’s supply-demand balance over time and gradually shift prices from loss-making levels back to a more rational range. Nevertheless, the likelihood of a sustained price increase in the short term appears diminished, as the company’s new leadership has reportedly directed the PV business to prioritize expanding sales and reducing inventory.

Another leading wafer manufacturer, focusing on an integrated production model across the solar supply chain, has reportedly kept output, sales, and inventory levels balanced in the wafer segment by using much of its production for in-house module manufacturing. This positioning may allow the company to continue pushing for wafer price increases, leveraging its integrated model to maintain cost advantages and potentially boost module sales while other manufacturers contend with rising wafer costs.

Some industry voices are concerned that rising wafer prices could prompt small producers, who have reduced or halted production, to quickly ramp up their operating rates. This rebound could potentially disrupt efforts to optimize production capacity and slow down industry integration in the wafer market.

Overall, market participants believe that the wafer market fundamentals remain largely unchanged, with overcapacity and high inventory levels still prevailing. A sustainable and substantial increase in wafer prices may only occur once excess capacity is fully addressed.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.