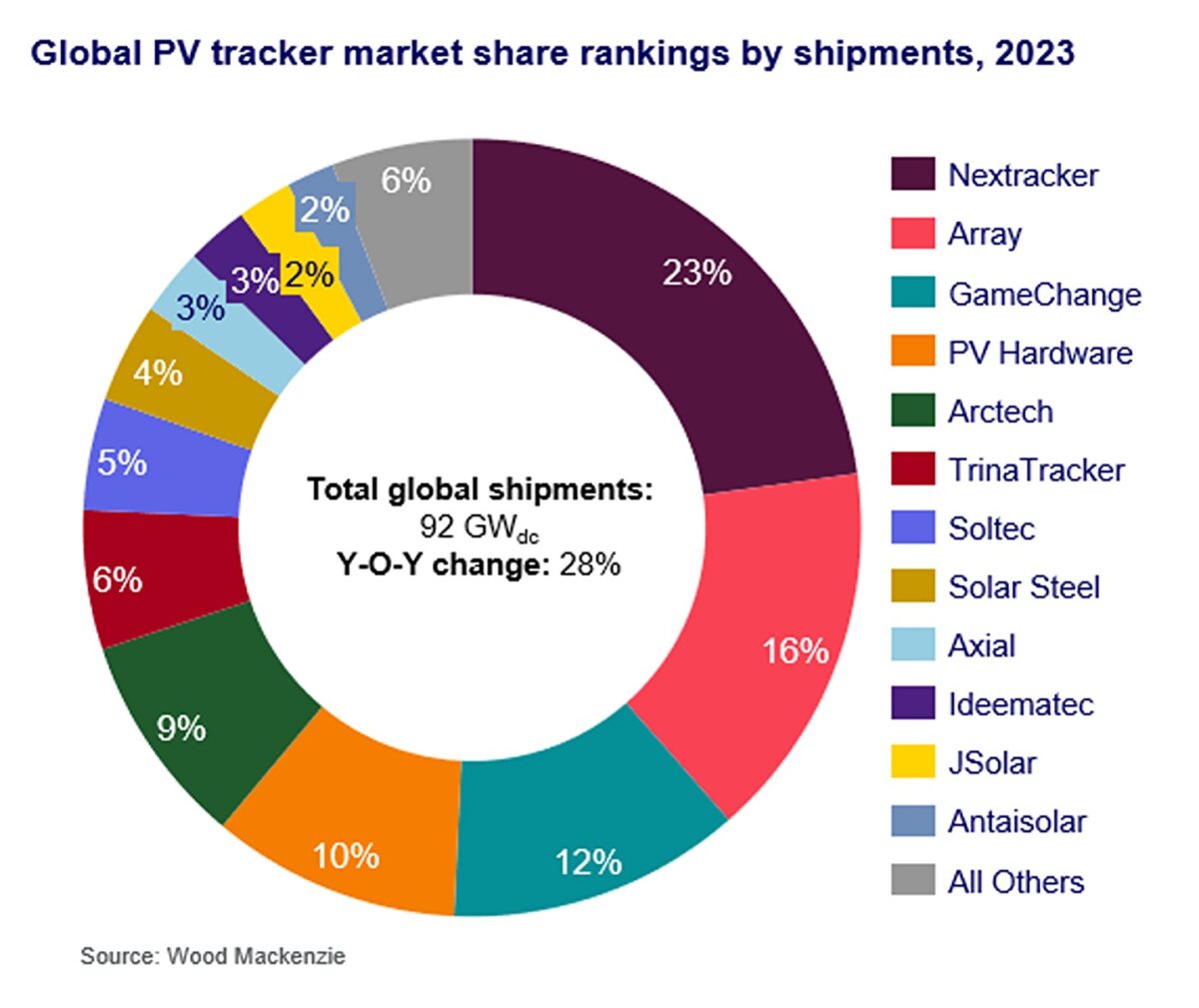

Global PV tracker shipments grew by 28% in 2023 to 92 GWdc, according to Wood Mackenzie’s Global solar PV tracker market share’ report 2024.

WoodMac’s analysis found the top 10 vendors accounted for 90% of the global market share. For the ninth consecutive year, US-based manufacturers Nextracker and Array Technologies took first and second place, with the former extending its lead position with 20% annual growth.

GameChange Solar, another US manufacturer, made it to third in the rankings for the first time thanks to 55% year-on-year growth. Together, the three companies accounted for more than 50% of global tracker shipments and 90% of the US market.

The US is the world’s largest individual market for PV trackers. It experienced 10% year-on-year growth last year, to over 37 GWdc of shipments. WoodMac says the market was buoyed by Inflation Reduction Act incentives which kickstarted construction for many new large-scale projects across the country.

In contrast, China’s tracker market fell to 4.3 GWdc in 2023. WoodMac says Chinese manufacturers experienced much higher demand for fixed-tilt products, as low installation costs were a main drivers for developers in China. Despite the drop in demand, Chinese manufacturers TrinaTracker and Archtech climbed into the global top six of tracker shipments, as they expanded their regional presence in the Middle East, central Asia and Latin America.

The largest European market was Spain, representing more than 50% of the continent’s demand. Spanish manufacturers PV Hardware, Solar Steel, Soltec and Axial all feature in the global top ten of tracker shippers.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.