Ind-Ra believes the growth in Indian renewable sector is led by the increasing power demand, competitive power price for bid out projects, increasing demand for green energy from corporate sectors, improving project viabilities from generating company perspective including reduction in solar module costs and improving receivables, strong future demand from green hydrogen manufacturing and a global push towards green generation. As a result, Ind-RA expects the continued regulatory push enabling the expansion.

Furthermore, global push to a shift in renewables including increasing capital raising constraints for grey power and higher funding availability for green energy sources also paves way for a faster execution of these projects.

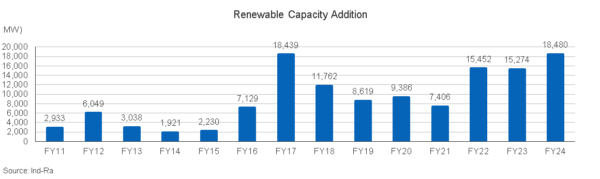

In line with the growth targets, the renewable capacity addition has picked up pace post a lull witnessed in FY 2021. Over FY 2022-FY 2024, the addition remained strong at over 15 GW each and much higher at 18.5 GW in FY 2024 and is expected to remain robust over the medium term. Renewable capacity addition is expected to remain at around 15-17 GW annually, owing to significant reduction in the module prices over the past 12 months and availability of liquidity.

Reduction in module prices and development of domestic manufacturing

As highlighted, module prices have come down, making the viability of solar projects better and increasing the returns for the developers as bid out tariffs have remained mostly flat on account of increase in interest rates. Furthermore, increasing domestic production capacities for cells and modules is also creating a stability and eliminating availability risk which is present in imports.

The growth in India’s cell and module manufacturing eco system is also boosted by the imposition of 40% basic custom duty on import of modules and 25% basic custom duty on import of cells.

The current capacity of domestic module manufacturing at around 27 GW is estimated to cross 100 GW over the next 3-4 years, which should bode well for the sector.

Technology improvements

With technological improvements in module manufacturing, a higher capacity utilisation factor (CUF) is made possible with only a marginal increase in cost. Cell designs have started to move from mono PERC technology offering CUFs of around 22% to TOPcon technology offering CUFs of over 24%. This ensures better resource utilisation.

Receivables cycle improvement leading to lower working requirement

Debtors across the power sector have declined meaningfully as reflected in the decline in the central public sector companies’ receivables beyond 45 days to INR 181 billion as of February 2024 from the peak of INR 527 billion is September 2022. The decline has resulted from the tariff hikes taken by discoms and the implementation of the Late Payment Surcharge (LPS) Scheme 2022, which has improved the payment behaviour of discoms leading to a better financial condition for generators. Tamil Nadu effected a tariff hike in September 2022 after a gap of 11 years.

The improvement in the payment behaviour of states with bad financial health would aid in an overall improvement in the sector financials. However, there would be an additional debt burden on discoms on account of availing these schemes, which, if not met with corresponding reforms including regular tariff hikes, continued reduction of AT&C losses and other operational improvements, could again lead to a pile-up in receivables for generating companies and would remain a key monitorable.

Large-scale renewable projects requirement for hydrogen production

Hydrogen and specifically green hydrogen is being developed as a fuel for the future to be used for mobility, conversion to ammonia, methanol etc. For a wide-scale pickup in hydrogen production, large scale renewable projects would be needed.

It is estimated that around 20 GW of renewable energy is needed to produce 1 mtpa of hydrogen. Cost and technological improvements in electrolyser systems could create a breakthrough, post which renewable capacity addition could further pick up pace.

Way ahead

The demand for power is expected to continue to increase annually by 7-8% over the next 3-5 years. For renewable power to provide for this increase, the annual capacity addition becomes imperative along with improvements on the storage capabilities to ensure grid stability and reliable supply.

The capacity addition could come under pressure in case of shortage of key input materials or a rise in their prices. Furthermore, battery storage, wind-solar hybrid, small hydro, pumped hydro storage and clubbing renewable generation with gas-based power generation would need to be explored.

In the absence of these, India could continue to remain dependent on thermal power to meet the growing energy demand as even with the high renewable capacity addition on an annual basis, the effective capacity addition remains limited to around one-third of thermal and challenges with providing base load power/round the clock power may continue.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.