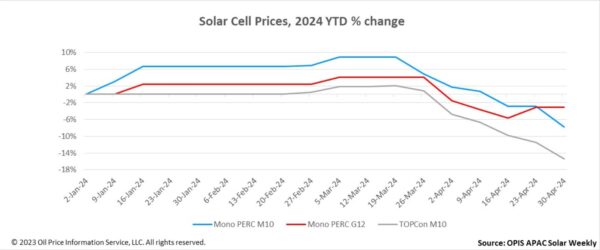

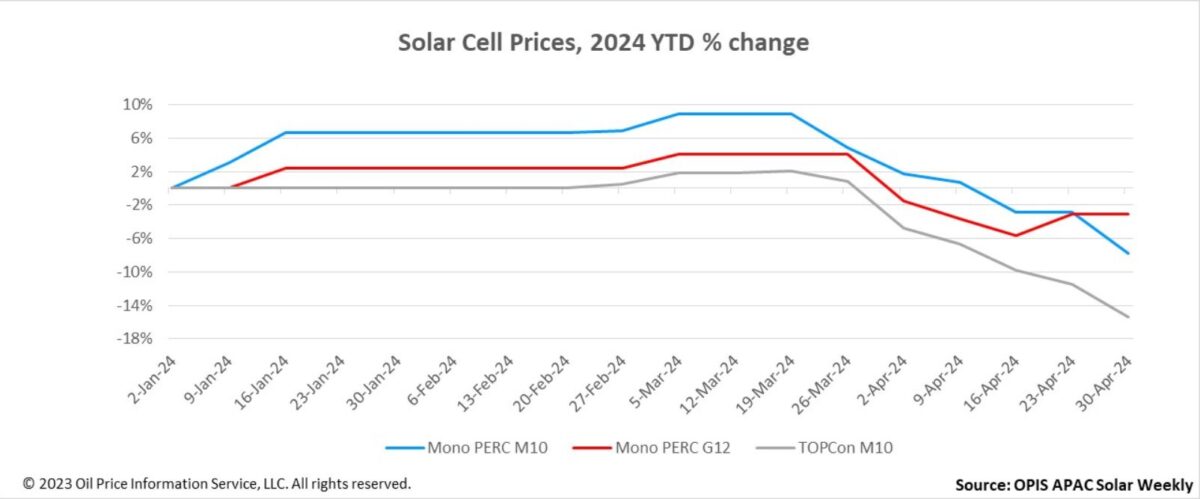

FOB China prices for both mono PERC M10 and TOPCon M10 cells extended declines this week, assessed at $0.0417/W and $0.0494/W, respectively, marking a decrease of 5.01% and 4.45% from the previous week.

FOB China prices for mono PERC G12 have steadied this week, holding at $0.0448/W. This stability can be attributed to the recent initiation of several ground-mounted solar projects in China, which has spurred demand for this cell type. The constrained production capacity for these cells has led to intermittent supply tightness.

In the Chinese domestic market, mono PERC M10 cells were priced at around CNY0.335($0.046)/W, while TOPCon M10 cells stood at approximately CNY0.397/W, as per the OPIS market survey. According to a major TOPCon cell producer, the current price trend of cells is closely mirroring the price trend of wafers.

In addition, this source stated that there are no indications of any demand factors favoring a reversal in the price trend, and the only foreseeable solution to reverse the current sluggish market is to wait for some production capacity to be gradually phased out.

Discussions have been ongoing about module manufacturers planning to scale back production in May. This has raised concerns among some insiders about the potential accumulation of cell inventory. A prominent cell producer therefore anticipates that cell prices will keep decreasing in May, with TOPCon cells likely experiencing a more pronounced decline compared to the mono PERC cells, as the production output of the latter continues to shrink.

“The present scenario in the TOPCon cells market is proving to be quite challenging,” the source added, “with even Tier-1 cell manufacturers relying on accepting OEM orders to sustain their operations.”

Another smaller cell manufacturer shares a similar sentiment, indicating that the price of mono PERC cells may hit its lowest point soon due to the production capacity shrinkage. Adding weight to this argument is the intention of a leading cell manufacturer to further decrease the production capacity of mono PERC cells in May, according to the source. Conversely, this source anticipates that another round of price cuts for TOPCon cells in May seems unavoidable.

According to a market watcher, some cell manufacturers recently found investing in building TOPCon cell capacity less cost-effective due to the pessimistic price trend of this product. This source further elaborated that earlier this year, in order to mitigate losses, a leading integrated manufacturer in nN-type products chose to partner with another lesser-known manufacturer to establish TOPCon cell production capacity. The objective is to bolster the module production of this major n-type manufacturer.

This model, where major players support smaller producers, share risks, and engage in mutually beneficial cooperation, could potentially set the course for the future of enterprise operations, the source added.

On the product sizes front, two prominent cell suppliers have confirmed with OPIS that they are set to commence mass production of n-type 210R (182 mm x 210 mm) sized cells in May or June. One of them noted that these 210R products are anticipated to make noticeable strides in the market in the second half of this year, presenting a crucial parameter for boosting module power output.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.