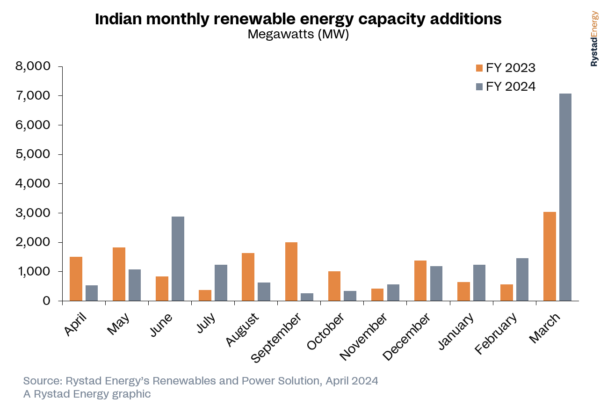

Rystad Energy’s latest data reveals monthly renewable energy installations in India surged to a record 7.1 GW in March 2024, more than doubling the previous record of 3.5 GW set in March 2022. Of the record 7.1 GW of renewable capacity added in March, more than 6.2 GW was new solar capacity—a significant addition considering the Jan-Dec. period of 2023 saw 7.5 GW of new solar installations.

The increase in RE installations in March helped India reach its highest-ever annual installed capacity of 18.5 GW for the fiscal year ending on March 31, 2024.

Rystad Energy stated that the [annual] growth in RE capacity was primarily driven by solar installations, which were up 23% on levels from the 2023 financial year, driven by the commissioning of numerous projects within India’s inter-state transmission system network and ultra-mega solar park schemes. In particular, states such as Gujarat, Rajasthan, Madhya Pradesh and Maharashtra have contributed to this expansion.

Notably, Adani Green, the renewable energy arm of Indian conglomerate Adani Group, made significant strides in the first quarter of 2024 by installing approximately 1.6 GW of solar capacity in the Kutch district of Gujarat. This initiative is part of a wider hybrid renewable energy park that will see up to 30 GW of combined solar and wind capacity installed in Khavda in the coming years.

While the recent increase in renewable capacity is encouraging, further boost in annual additions is imperative to meet the nation’s RE goal to achieve 500 GW of non-fossil fuel capacity by 2031-32. To achieve the 500 GW target, India must install around 30 GW of non-fossil fuel energy generation capacity annually, which includes solar PV, hydropower, onshore wind and nuclear energy.

“With the commencement of India’s general elections earlier this month, the country’s emphasis on renewable energy comes as no surprise. Despite ambitious climate goals to reduce carbon dioxide emissions, achieving them is only achievable if the country maintains the fervor witnessed in recent months. However, critical challenges persist: ensuring grid stability alongside the higher integration costs that come with introducing more renewable capacity. A strategic solution lies in balancing this clean energy embrace with targeted exports, enabling India’s growth visions for the power sector, without compromising national climate goals,” says Rohit Pradeep Patel, vice president of renewables and power research at Rystad Energy.

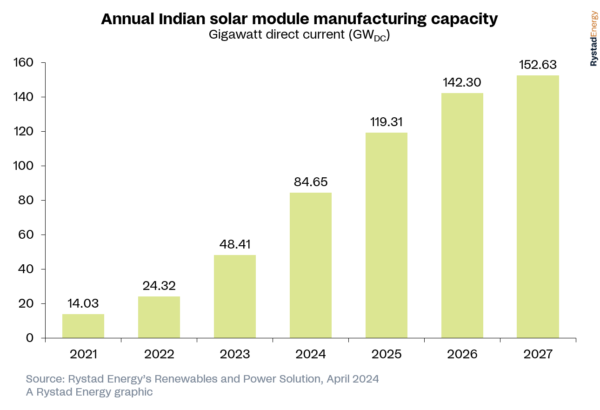

On the supply chain side, the ramp-up of solar installations in India has created substantial demand for solar equipment.

Historically, Indian developers heavily relied on Chinese imports due to their competitive pricing over domestic manufacturers. In response, the Indian government introduced initiatives like the Production Linked Incentive (PLI) scheme to empower domestic manufacturers to boost their production capabilities, thus enhancing their price competitiveness to meet local demand. Additionally, governmental support measures like the Approved List of Models and Manufacturers (ALMM) mandate and the basic customs duty on imported solar modules further assisted in bolstering the domestic solar industry.

Supported by these measures, India’s solar panel production capacity hit 68 GW as of March 2024 and the nation started expanding its reach by exporting panels.

The US has emerged as a major export destination due to its high demand for solar energy and the potential for strong profit margins. The Uyghur Forced Labor Prevention Act (UFLPA) in the US also played a role in this shift towards Indian exports.

Despite millions of panels being shipped from India to the US, Indian manufacturers encounter stiff competition from their Southeast Asian counterparts who are able to lower their production costs by utilizing material inputs from China.

However, exports from India are expected to increase as the US imposes duties on panels from Southeast Asian counterparts, which are expected to be as high as 254% and set to be implemented from June 2024, making these panels significantly costlier than ones from India.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

Comprehensive and factual reporting – I thank you.