From pv magazine Global

Thyssenkrupp nucera and Fraunhofer IKTS have launched a strategic partnership to develop and scale up the production of SOEC technology.

Thyssenkrupp nucera expects to reach 1 GW of manufacturing capacity by 2030. The German company and Fraunhofer IKTS are now setting up a pilot plant in Germany that is scheduled to start operations in around one year.

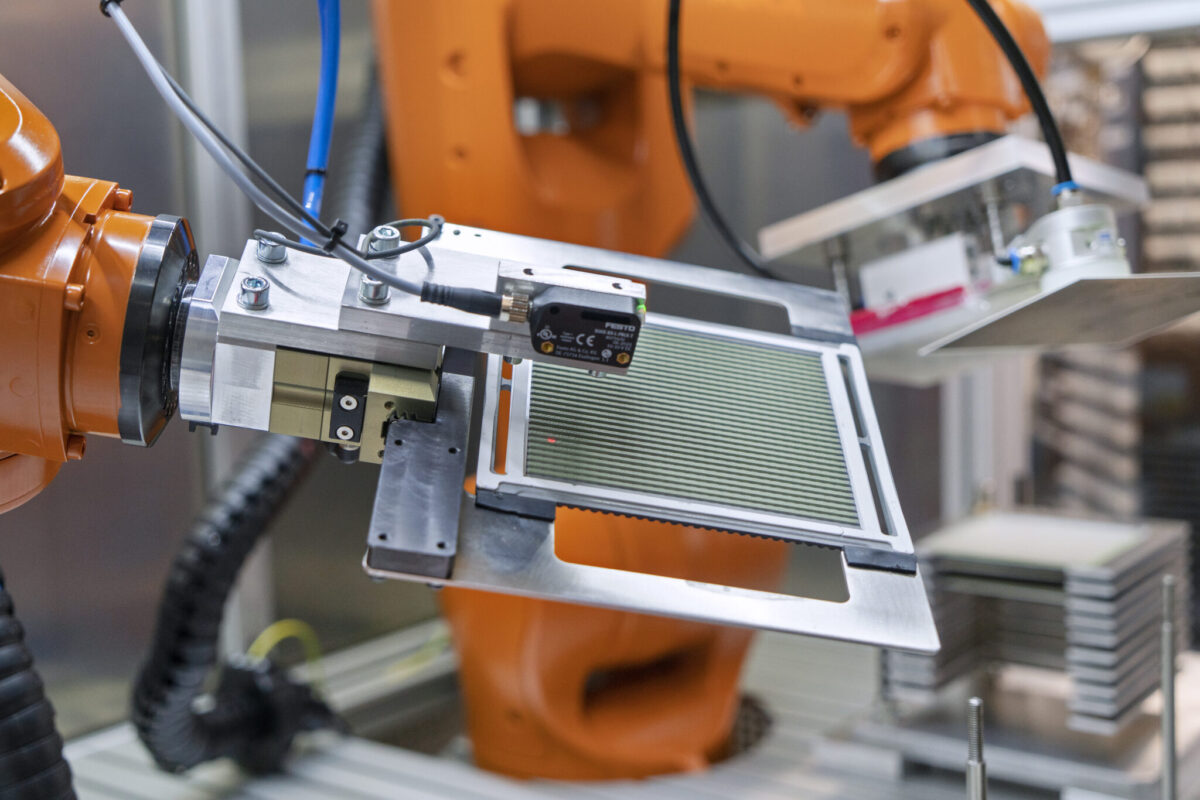

The pilot plant will help the company and the research institute to adjust the manufacturing process to the requirements of large-scale production while developing SOEC stack technology. Fraunhofer IKTS bases the tech on a gas-tight oxygen-ion-conducting ceramic electrolyte with screen-printed electrodes and pressed interconnectors made of a chromium-based alloy (CFY).

“We are using different materials with respect to other companies working on SOEC,” said Alexander Michaelis, director of Fraunhofer IKTS. “But we have less components, the automatization of this process is very promising, so we will have advantages when it comes down to mass producibility.”

Michaelis said that in their initial pilot line, they aim to produce several thousand stacks per year. He noted that SOEC electrolyzers use commonly available materials, mitigating risks of price fluctuations.

“In the first pilot line we are setting up together, we will be able to manufacture several thousands of stacks a year,” said Michaelis. “The challenge is to optimize the stack and reduce the costs. We will be then ready for gigawatt-scale production.”

“The two processes, together, are a way to convert water and emissions into multicarbon products. So from water, you can produce hydrogen, and then green syngas,” Michaelis added. “This is particularly very important for petrochemical applications.”

He said that Germany has the longest tradition in SOEC technology. The joint project will solidify local expertise to meet European demand for green chemical components, including aviation fuels, as they will be crucial for achieving a net-zero environment.

Ponikwar said SOEC technology is very cost-competitive, similar to alkaline electrolysis, and more efficient than polymer electrolyte membrane (PEM) electrolysis.

“We see a strong potential for reducing costs for the stack technology, which is a major cost component,” he added.

The German company, which already produces alkaline water electrolyzers, says there is an “obvious logic” to offering both technologies, as they have specific applications. SOEC technology, for instance, is the most likely choice in proximity to industrial facilities, whose byproducts are heat and water.

Michaelis said that using water steam rather than water is also an advantage.

“There is some latent energy in the water steam, which goes into the energy balance,” he said. “This translates into 30% less power to make the same amount of hydrogen.”

Despite the potential cost advantage, mass production requires significant upfront investment. The two parties have emphasized the importance of political collaboration and financial support.

“To implement new technologies, there are huge investment costs and steep learning curve; funding is typically required,” said Ponikwar, adding that the novelty itself and the current geopolitical and economic environment incentivize different institutions to collaborate.

The German company opened an office in Mumbai in 2023 with more than 30 engineers.

“Our interest in Germany does not mean we are not considering other regions. We need to be cost-effective,” said Ponikwar. “That would also mean that we could need to build manufacturing hubs outside of Europe, in the United States or elsewhere. India will be a quite interesting market.”

The company’s aim is to operate in different markets so it is ready to take opportunities arising from local market conditions and policies.

“In the future, when we will upscale production, we must make huge investments. There is no doubt that subsidies will be needed. We see a lot of political willingness at the state and federal levels,” said Michaelis. “We live in a global world. We are fighting for a strong foothold in Europe.”

SOEC technology can also serve the sustainable aviation fuels (SAFs) market in Europe, and possibly in Asia and North America as well.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.