There’s no doubting that Australian rooftop solar installations are on a tear and showing few signs of letting up. Green Energy Markets’ data show that rooftop installations grew 14% to 3.14 GW in 2023 – only 65 MW less than 2021, the record-setting year for rooftop PV installs.

While that is good news for the distributed generation segment, and for householders making savings on their electricity bills, it is leaving little room in the market for utility-scale solar. And, energy economist Bruce Mountain observes, it is increasingly putting the squeeze on wind.

“Rooftop solar has pulled prices down during all of the time that large scale solar has a market to the level that without storage, large scale solar is going to battle for grid supply,” Mountain told pv magazine Australia. “For grid supply, certainly in South Australia and Victoria, it [large scale solar] is struggling.

Mountain says that current prospects in Queensland is better for solar farm development, but that investors will have seen how quickly daylight wholesale prices have declined in South Australia and Victoria and would be reluctant to invest.

“Even though you’re not yet seeing the same wholesale price effects in Queensland, I think investors are likely to anticipate it.”

Installation data confirms the observation. Solar consultancy SunWiz found that while the rooftop PV segment remains strong, the large-scale is lagging. In 2023, SunWiz found 10 new solar farms were completed, for a capacity of 1.1 GW – down 60% on the 2.9 GW completed in 2022.

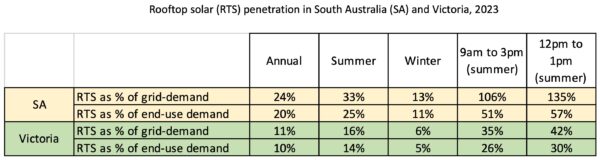

Rooftop solar percentages of total daytime demand tell much of the tale. During summer, rooftop PV is already supplying more than 100% of grid-demand during much of the day in South Australia, and 135% at midday. In Victoria, those numbers come in at 35% and 42%, respectively – figures that are still hugely impactful for large-scale solar project development.

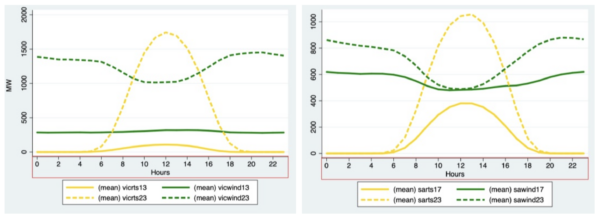

On electricity markets, Mountain said, one impact has been to squeeze wind generation from the market during peak solar production periods. When generation is annualized, the solar generation (dotted yellow) profile in Victoria (left) and South Australia (right) in 2023 resulted in wind generators being squeeze out of the market at the times of peak production (dotted green).

While difficult for wind projects and developments, this market development leaves little room for solar farms.

“The economics will be solar-plus-storage versus wind. Wind will spill during the middle of the day as we’re seeing now, but it has decent production through the sea breeze, pretty consistently year-round – so it gets the evening peak pretty consistently without the need for storage.”

There do, however, remain opportunities for large-scale solar in the short term, said Mountain.

“It probably still has a standalone market for mines and off grid supply and new supplies cause its economics fundamentally are very attractive – it’s very cheap and forecastable and all of those things.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.