The reimposition of ALMM [Approved List of Models and Manufacturers] mandate from April 1, 2024 is a positive for the domestic solar OEMs. The mandate requires solar projects awarded by central nodal agencies and state distribution utilities to source PV modules only from the manufacturers included in the ALMM list.

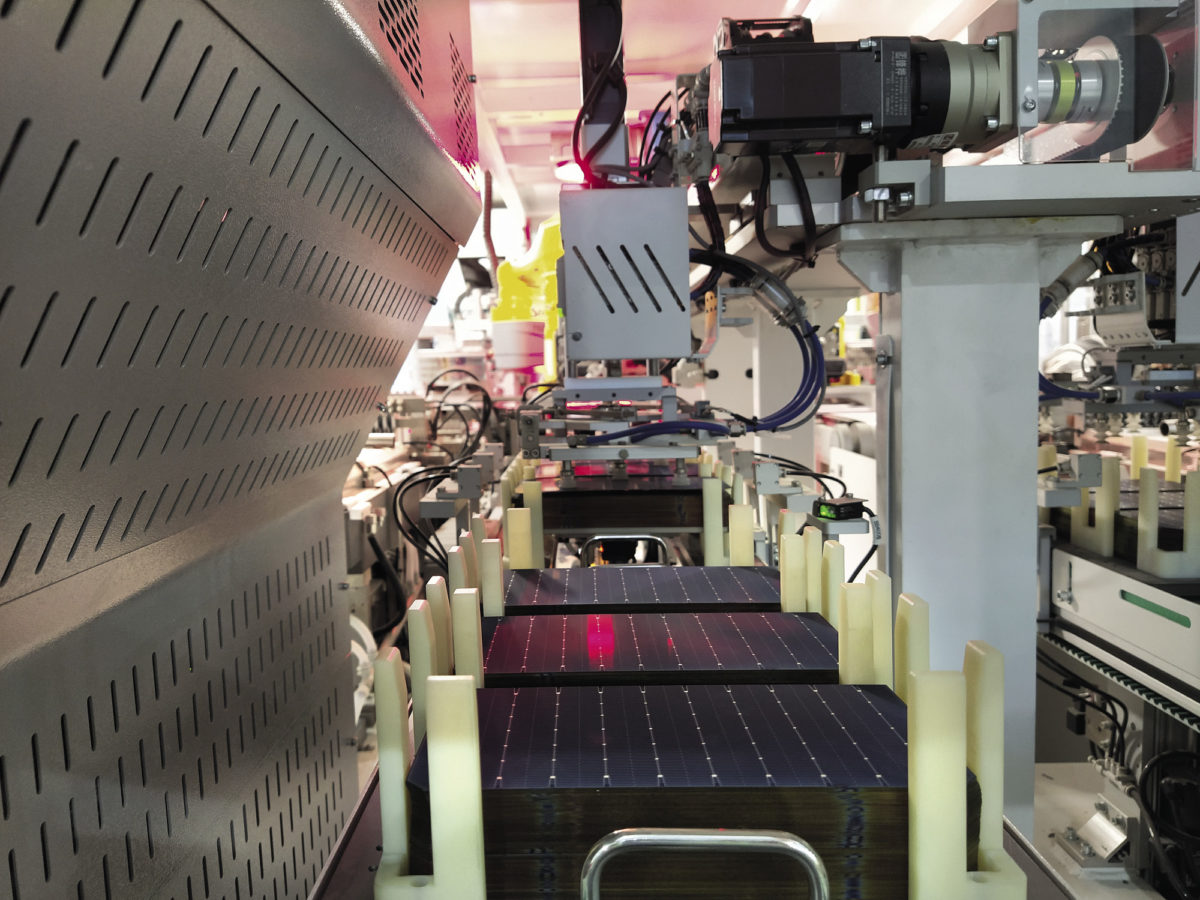

The list currently comprises only domestic solar OEMs and includes modules with an efficiency equal to or greater than 19%.

The ALMM requirement was mandated by the Ministry of New and Renewable Energy (MNRE) through its order dated 02.01.2019, to protect the consumer interests and ensure larger energy security of the country as solar PV power installations are generally set up for a period of 25 years and solar PV cells and modules used in plants require long term warranty.

The order was put under abeyance for FY 2023-24.

“The scale-up in domestic module manufacturing capacity over the past 12 months is expected to improve the availability of modules from domestic OEMs. However, the sector would remain dependent on imports for sourcing solar PV cells and wafers, given the limited cell manufacturing capacity and lack of wafer capacity in India. In this context, setting up fully integrated units awarded under the production-linked incentive (PLI) remains important to reduce dependence on imports,” Girishkumar Kadam, Senior Vice President & Group Head – Corporate Ratings, ICRA Ltd, told pv magazine.

From the IPP’s perspective, the earlier order exempted projects commissioning till March 31, 2024, from the ALMM requirement. “The Government has now relaxed this provision to a certain extent and has allowed ALMM exemption for projects which are in advanced stages of construction and wherein the order for modules (including the opening of letter of credit) is placed before March 31, 2024. This provides relief for IPPs with advanced progress in development and with expected commissioning post-March 31, 2024,” Kadam said.

Also, the order allows ALMM exemption for open access-based and captive solar projects, enabling these projects to source modules from the most cost-competitive sources. “Based on the prevailing cost of imported solar PV cells and modules, the sourcing of imported modules is relatively cheaper than the cost of sourcing modules from domestic OEMs after accounting for the import duties,” shared Kadam.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.