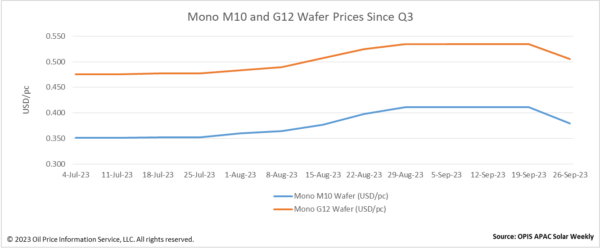

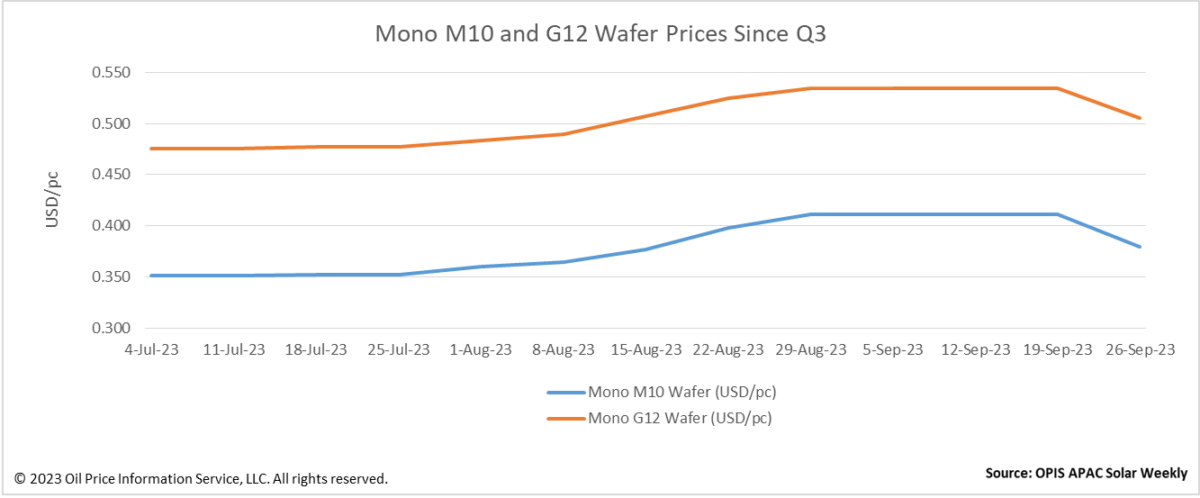

Solar wafer prices declined this week. This is the first time this quarter that wafer prices have decreased across the board.

The price of Mono M10 wafers dropped by 7.79% to $0.379 per piece (pc), while the price of Mono G12 wafers fell by 5.43% to $0.505/pc when compared to the previous week.

Wafer prices have decreased earlier than anticipated, multiple industry sources claimed. The increase in wafer output has outpaced demand to an excessive degree, which is the primary reason that has pushed wafer prices downwards, they concurred.

After the two leading wafer producers, Longi and TCL Zhonghuan dropped their list pricing for Mono M10 wafers to CNY3.1/pc in succession on September 25 and 26, an influential Tier-2 specialized wafer manufacturer reportedly offered Mono M10 wafers for CNY3.05/pc, according to a source.

This source stated that the market price will probably approach the price of this producer, adding that “this manufacturer has a certain market pricing power due to the expansion of production capacity; its newly expanded 40 GW wafer production capacity is currently being installed with manufacturing equipment on site.”

For another source, wafer inventory levels right now are still under control. However, because wafer prices are declining, wafer producers are concerned that, as they create more wafers, future wafer price declines may cause them to lose more money, the source said.

“However, this loss seems inevitable given that cell manufacturers have curtailed their wafer orders out of concern that wafer prices would continue to fall. Wafer stockpiles would build up as a result,” the source continued.

Looking ahead, the degree of the drop in wafer pricing may largely depend on the manufacturing strategies of cell makers and their enthusiasm for buying wafers, a source stated.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.