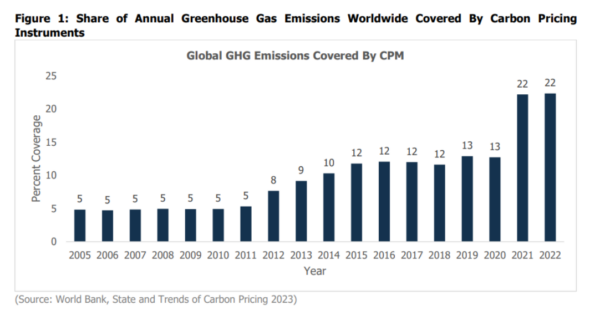

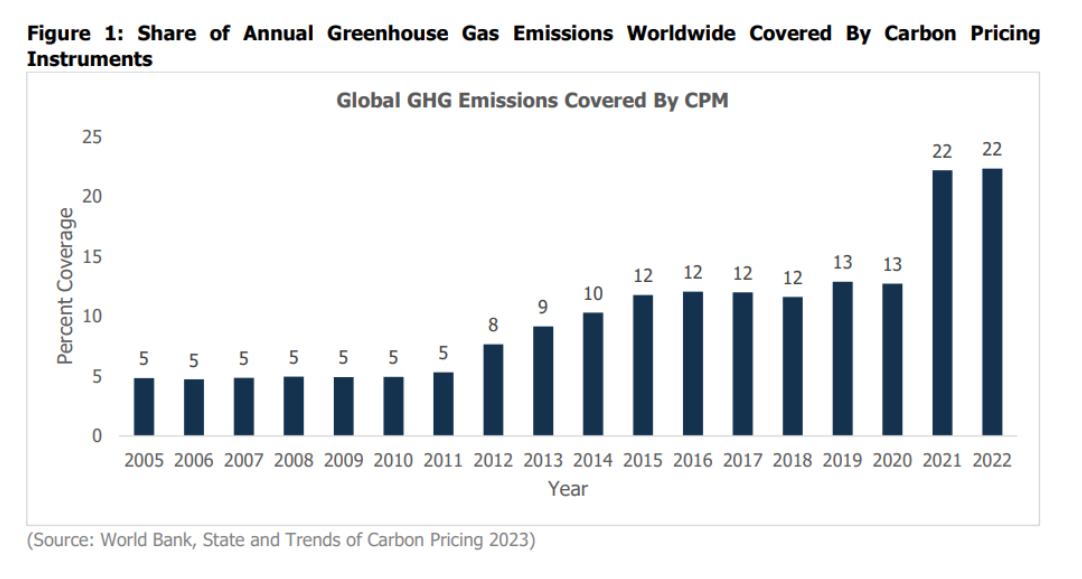

Carbon credits serve as a potent market-driven incentive, effectively catalyzing the reduction of greenhouse gas (GHG) emissions. These credits operate within the framework of international agreements such as the Kyoto Protocol and the Paris Agreement, thriving within carbon markets where projects designed to curtail emissions yield tradeable credits. These credits, in turn, can be purchased by entities seeking to offset their own emissions, thereby showcasing their unwavering commitment to fostering sustainability. The proportion of global annual greenhouse gas emissions covered by carbon credits has risen from 5% in 2005 to 22% in 2022.

However, the attainment of carbon credits is a formidable achievement, as projects undergo rigorous evaluation by impartial auditors to ensure strict adherence to established standards. Upon successful verification, these credits are introduced into various markets, effectively directing investments toward emission reduction initiatives and sustainable undertakings, particularly within developing nations.

Beyond their symbolic significance, these credits carry tangible benefits, acting as a catalyst in propelling the global transition towards a low-carbon future. By attaching quantifiable value to emission reductions, they serve to invigorate international collaboration in the ongoing battle against climate change. The adoption and incorporation of carbon credits into our practices signify an inspiring journey towards safeguarding our planet and embracing an eco-friendly, sustainable tomorrow.

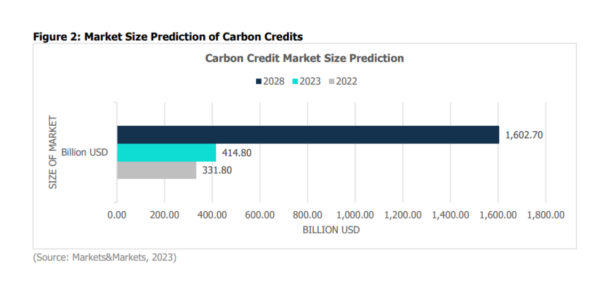

The popularity of the credits could be estimated by the fact that India alone has a market share of 17% globally with 35.94 million USD currently (the global market stands at 2 billion). By some estimates, the global carbon credits market would reach 100 billion USD by the end of 2030 as per Confederation of Indian Industry. It has also been estimated by MarketsAndMarkets that global market size would reach 1,602 billion $.

How does the system work?

The world of carbon credits thrives under international climate agreements like the Kyoto Protocol and the Paris Agreement, incentivising greenhouse gas (GHG) emission reductions. Diverse emission reduction projects, from renewable energy to waste management, undergo rigorous validation to ensure authenticity. Once verified, carbon credits are issued based on reduced CO2e emissions.

These credits take centre stage in carbon markets, where they can be traded voluntarily or for compliance purposes.

Revenue generated from credit sales supports sustainable development and further investment in emission reduction projects. The market dynamics influence carbon credit prices, while their co-benefits include job creation, improved air quality, and advancements toward the United Nations’ Sustainable Development Goals (SDGs). This captivating symphony of carbon credits urges humanity toward a brighter, more sustainable future.

The Indian context of carbon credits

In India, the carbon credit system operates primarily under the Clean Development Mechanism (CDM) of the United Nations Framework Convention on Climate Change (UNFCCC). The process of carbon credit generation and trading follows a structured flow, adhering to guidelines set by relevant regulatory bodies. The journey begins with Project Identification and Development, where projects contributing to GHG emission reduction are selected. These encompass renewable energy projects, energy efficiency improvements, and waste management schemes, aligning with CDM and regulatory criteria.

The Project Design Document (PDD) is pivotal, outlining the project’s objectives, methodologies, baseline emissions, additionality assessment, and emissions reductions. Validation and Verification are critical turning points, with designated Operational Entities (DOEs) conducting independent assessments and rewarding projects that meet criteria with validation reports. Implementation and Monitoring are essential, with robust systems ensuring accurate emission reduction reporting. Verification and Certification culminate in Certified Emission Reductions (CERs) issuance based on verified emission reductions.

Carbon Credit Trading showcases CERs’ value, drawing entities to offset emissions or meet regulatory commitments. Retirement or Surrender of CERs concludes the journey, ensuring the integrity of emissions accounting. The effectiveness of the system is amplified by the Types of Projects Allowed Under the Carbon Credits Scheme, including Renewable Energy Projects, Energy Efficiency Projects, Waste Management Projects, and Afforestation Projects.

Indian authorities governing carbon credits play a vital role. The Designated National Authority (DNA) endorses projects and provides approval. The CDM Executive Board oversees global projects, ensuring compliance and issuing CERs. Accredited Operational Entities (AOEs) validate and verify projects, while the National CDM Authority coordinates projects within India, offering guidance and support.

While the carbon credit market in India is still in its early stages, it is growing rapidly. As of now, several players issue carbon credits in India:

• The Energy and Resources Institute (TERI): This think tank has issued over 3 million carbon credits from its projects in the renewable energy and energy efficiency sectors.

• The World Resources Institute (WRI): This non-profit organization has issued over 2 million carbon credits from its projects in the forestry sector.

The carbon credits that these entities have issued can be traded on a variety of exchanges, including the Chicago Climate Exchange, the European Climate Exchange, and the Intercontinental Exchange. Some of the trading places for carbon credits in India are:

• National Stock Exchange (NSE): The NSE launched a carbon trading platform in 2017.

• Bombay Stock Exchange (BSE): The BSE launched a carbon trading platform in 2018.

• Power Exchange India (PXIL): The PXIL launched a carbon trading platform in 2020.

As more and more companies and organisations look to reduce their greenhouse gas emissions, the demand for carbon credits is expected to increase.

Global context of carbon credits

In the fight against climate change, carbon credits play a significant role in the United States (US), the European Union (EU), the United Kingdom (UK), and Australia. The process starts with Project Identification and Development, where projects for emissions reduction are chosen, adhering to country-specific guidelines.

A crucial step involves preparing a comprehensive Project Design Document (PDD) outlining project objectives, methodologies, baseline emissions, additionality assessment, and anticipated reductions. Validation and Verification by accredited Operational Entities (DOEs) ensure compliance and project eligibility. Following approval, projects implement and monitor activities, reporting emissions reductions accurately. Verification and Certification by thirdparty verifiers lead to the issuance of carbon credits, held in central registries.

Carbon Credit Trading allows developers to trade credits in carbon markets, enabling entities to offset emissions.

Retirement or Surrender of Carbon Credits demonstrates compliance with reduction commitments, ensuring emissions accounting integrity. Regulatory bodies like the EPA (US), BEIS (UK), European Commission, and CER (Australia) oversee carbon credit programs. A variety of projects, from renewable energy to afforestation, contribute to global emissions reduction efforts.

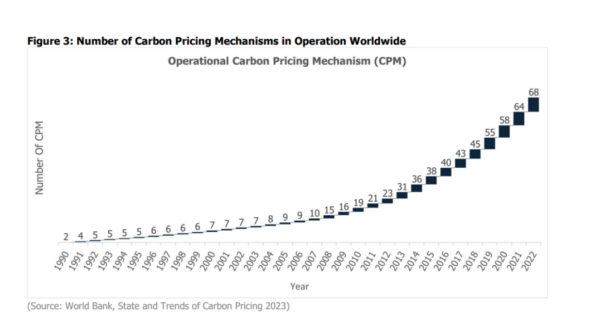

Collectively, these countries incentivize emissions reductions, promoting sustainability for a low-carbon future. Carbon credits prove a powerful tool in combating climate change, inspiring global commitment to environmental preservation. Carbon Pricing Mechanisms have seen a monumental rise since its advent in 1990 as can be seen in figure 2 as per World Bank which clearly shows that companies around the world has embraced carbon credits.

How does India march ahead of global counterparts

The Indian carbon credit system, operating under the Clean Development Mechanism (CDM) and the United Nations Framework Convention on Climate Change (UNFCCC), stands ahead in several aspects:

1. Extensive Use of CDM: India actively utilizes the CDM framework, registering numerous emission reduction projects. Leading in CDM project registrations reflects its proactive stance in adopting clean technologies and attracting international investments.

2. Emphasis on Sustainable Development: India’s system prioritises sustainable development co-benefits. Projects generating carbon credits must showcase positive impacts on social, economic, and environmental aspects, aligning emission reductions with broader development goals.

3. Inclusion of Diverse Project Types: India’s system covers a wide range of projects, including renewable energy, energy efficiency, waste management, and afforestation. This comprehensive approach ensures emissions reduction across sectors.

4. National CDM Authority: India has a dedicated authority facilitating and coordinating CDM projects. It streamlines processes, provides guidance, and enhances efficiency.

5. Integration of Policies and Incentives: India implements policies like feed-in tariffs and renewable purchase obligations, creating a favourable environment for renewable energy projects and incentivizing emission reductions, fostering the carbon credit market’s growth.

The current regulation and way forward

The Carbon Credit Trading Scheme (CCTS), outlined in the draft by the Ministry of Power, stands as a pivotal force shaping India’s regulatory framework concerning carbon credits. A significant stride in this direction was taken through the introduction of the Energy Conservation (Amendment) Bill in 2022, which established the groundwork for the forthcoming Indian carbon credit market. The draft blueprint envisions the establishment of the India Carbon Market Governing Board (ICMGB) as the central entity responsible for the oversight and regulation of the carbon credit market.

This board boasts representation from critical ministries including Environment, Forest, and Climate Change; Power; Finance; New and Renewable Energy; Steel; and Coal. The multifaceted responsibilities of the ICMGB encompass policy formulation, regulatory framework establishment, and trading criteria definition for carbon credit certificates.

Playing a key role within this framework, the Bureau of Energy Efficiency (BEE) assumes the roles of both the ICM Administrator and Secretariat for the ICMGB. The BEE will be entrusted with devising protocols and processes for project registration under the voluntary mechanism, devising trajectories and objectives for entities operating within the compliance mechanism, as well as the issuance of carbon credit certificates. Additionally, the Bureau will be instrumental in crafting mechanisms to ensure market stability, alongside delineating procedures for Accredited Carbon Verifiers.

The role of the ICM Registry, tasked with maintaining meticulous transaction records and establishing links with other registries, falls under the purview of the Grid Controller of India Limited. Overseeing trading activities and safeguarding the interests of both sellers and buyers, the Central Electricity Regulatory Commission (CERC) is designated as the ICM Trading Regulator. The draft underscores the significance of the compliance mechanism, which obligates entities to curtail GHG emission intensity in adherence to established norms. Complementing this is the envisioned voluntary mechanism, designed for non-obligated entities to enrol on projects aimed at reducing GHG emissions and thereby acquiring carbon credit certificates.

India’s approach gained traction subsequent to COP26, marked by the identification of 12 GHG mitigation activities eligible for trading within the ambit of the Paris Agreement’s Article 6.2 mechanism. This endeavour is oriented towards the creation of a robust domestic market that bridges financial gaps concerning the nation’s ongoing energy transition. Through these initiatives, India showcases a steadfast commitment to the decarbonization of its economy and the fostering of sustainable development in the collective mission to combat climate change.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.