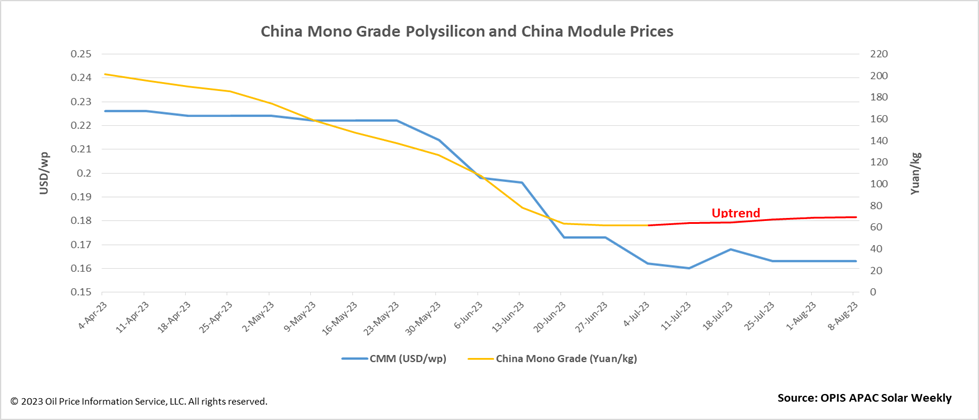

China Mono Grade, OPIS’ assessment for polysilicon price in the country, increased for a fifth week running, edging up 0.95% to CNY69.29 ($9.58)/kg. China’s polysilicon notches up toward the psychologically significant figure of CNY70/kg in a week that saw higher price quotes and lower-than-expected polysilicon output.

The main reason for lower output is the expected maintenance of polysilicon factories during the summer, explained one source. The unexpected reason affecting output is the reduced pace at which overall production capacity is increasing, the source added. Current polysilicon prices mean companies have “no incentive to burn money and speed up” the rate at which they increase production capacity, he further explained.

Wafer prices increased this week as polysilicon prices upstream keep rising and wafer demand from cell manufacturers downstream remains high. Mono M10 wafer prices climbed slightly by 1.11% week to week to $0.364 per piece (pc).

The demand for wafers is being ensured by downstream cell producers’ strong operating rates, according to sources. Additionally, there has been an upward trend in the price of cells, which in turn supports the rise in wafer prices.

The price of Mono M10 cells increased as well this week, rising 0.32% week to week to $0.0942 per W. The low inventory of cells and the high demand for cells from module producers are what keep the price of cells strong. Given that high cell prices haven’t yet stopped module manufacturers from placing orders for cells or resulted in lower operating rates for module factories, a source even predicts additional price increases for cells.

The Chinese Module Marker (CMM), the OPIS benchmark assessment for Mono PERC modules from China, held steady for a second week running at $0.163 per W in a market where participants continue to weigh the difficulty of raising module prices against growing upstream costs. The price of TOPCon modules likewise stayed at $0.170/W for a second consecutive week.

Concerns about the intense competition in the module market recurred during OPIS’ weekly survey. The production capacity of modules continues to expand, with “the fight over price being very serious” as many new entrants try to quickly expand their market share and existing companies seek to increase their performance growth requirements, according to one source.

Demand fluctuates in different ways depending on the export market in question but generally speaking, China exported too many modules in the first half of the year, according to a market veteran who added that module inventories are building and will keep doing so as China continues exporting a large amount of modules in the third quarter. This accumulated inventory will only decrease at the beginning of the fourth quarter, he also said.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.