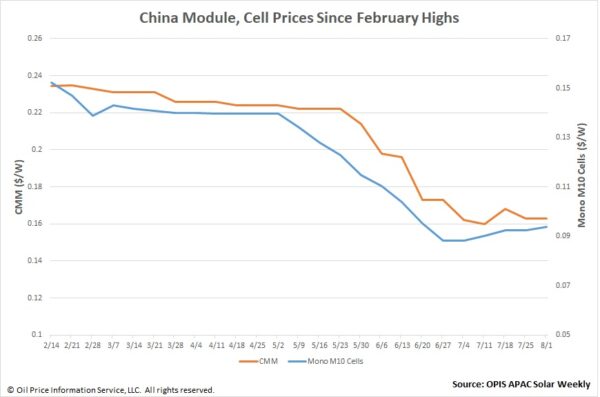

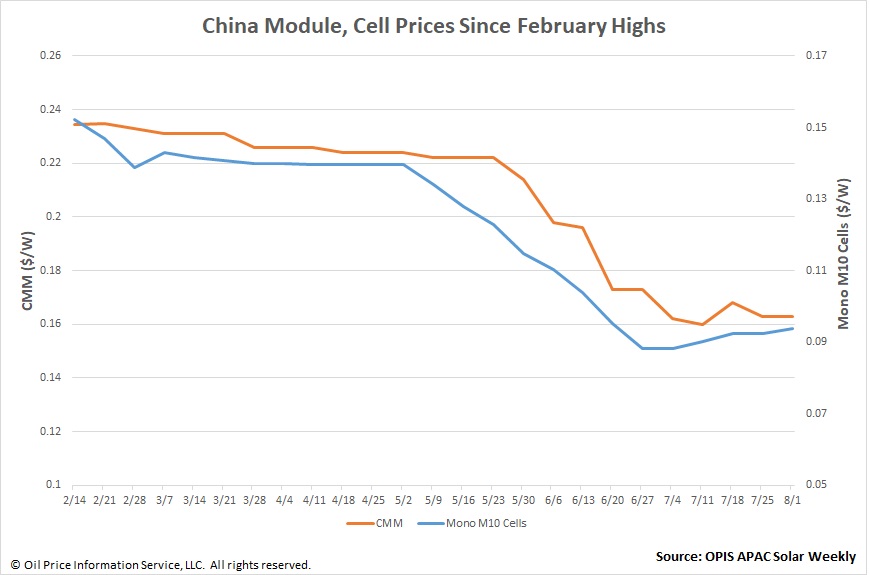

China module prices held steady this week as market players weighed the challenge of raising prices against increasing upstream costs.

The Chinese Module Marker (CMM), the OPIS benchmark assessment for modules from China, stayed at $0.163/W. TOPCon module prices likewise remained at $0.170/W.

While the market eyes rising prices in the upstream segments, most manufacturers are taking a wait-and-see approach, according to OPIS’ market survey. Mono M10 cell prices increased 1.73% this week to $0.0939/W. The cell segment has the lowest inventory level across the whole supply chain, meaning cell prices could increase further, a source said.

Yet hiking module prices is challenging as the market deals with oversupply and intense rivalry among sellers, concurred multiple sources. Numerous recent low price bids for China projects from vertically integrated players have eroded the breathing room for manufacturers who only make modules and lack the advantage of low production costs, according to a source.

International markets are similarly gloomy as they sit on significant module inventories. Due to the backlog from this year’s first and second quarters, one maker stopped replenishing its European warehouses this June, a source at the firm said. Echoing the sentiment, another source said regions like Europe and South America “do not simply have the conditions for price increases due to the enormous backlogs of modules.”

According to the production schedule of module makers. China is expected to produce roughly 47 GW of modules in August, according to one source. Module makers could cut manufacturing if cell prices continue to rise, the source added.

OPIS, a Dow Jones company, provides energy prices, news, data, and analysis on gasoline, diesel, jet fuel, LPG/NGL, coal, metals, and chemicals, as well as renewable fuels and environmental commodities. It acquired pricing data assets from Singapore Solar Exchange in 2022 and now publishes the OPIS APAC Solar Weekly Report.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.