Avaada Group, an integrated energy platform, has closed INR 10,700 crore ($1.3 billion) in financing for its green energy ventures. This is the largest-ever equity round raised by any green energy company in Asia.

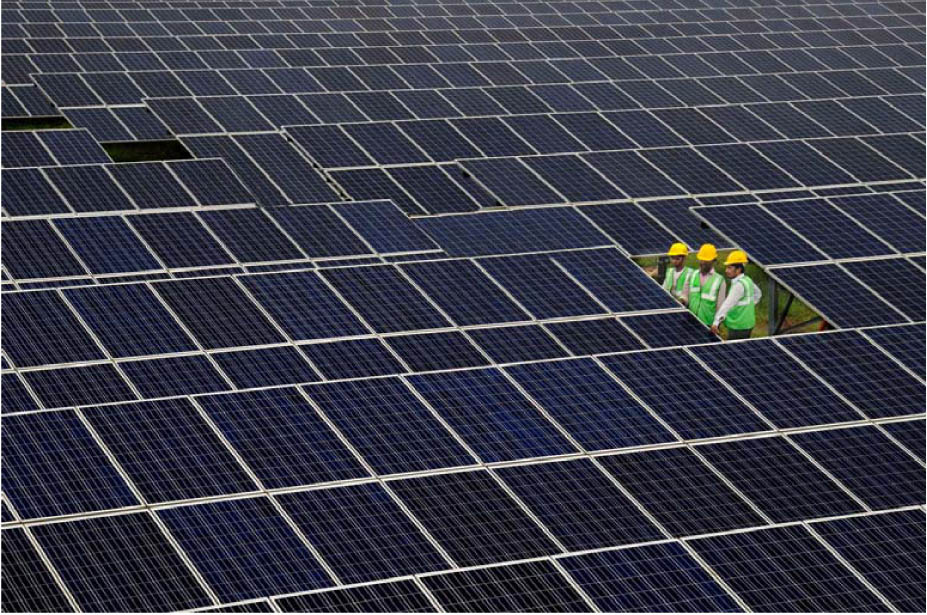

Avaada will use the funding to bolster its green hydrogen, green methanol, green ammonia, solar manufacturing, and renewable power generation ventures.

Avaada Group had previously won a production-linked incentive of $116.78 million for 3 GW of wafer-to-module manufacturing capacity. In the last three months, the Group has won almost 1.8 GW of projects from corporate customers and utilities.

The funding included $1 billion from Brookfield Renewables and $301 million from Avaada’s existing investor Global Power Synergy Public Co (GPSC).

Brookfield Renewables invested in Avaada through its Brookfield Global Transition Fund. GPSC, Avaada Energy’s existing shareholder with a 42.93% equity, has pledged to invest an additional $233 million in Avaada Energy following its $68 million announced in April. This brings GPSC’s total investment in Avaada to around $779 million.

Worawat Pitayasiri, president and CEO of GPSC, said, “Our decision to invest further in AEPL is based on our confidence in their strategic approach to the renewable energy sector, aiming to achieve at least 11 GW in 2026. AEPL’s commitment to renewable power generation aligns well with our focus on sustainable growth and innovation.”

Avaada Group currently operates a renewable energy portfolio of 4 GW with around 7 GW in different stages of implementation. It has diversified into manufacturing green hydrogen, green methanol, and green ammonia, and expanded its footprint into the solar PV supply chain with the manufacturing of solar cells and modules.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.