Rethink Energy predicts the green hydrogen market to reach a $850 billion valuation in 2050, driven by the installation of over 5 TW of electrolysis capacity.

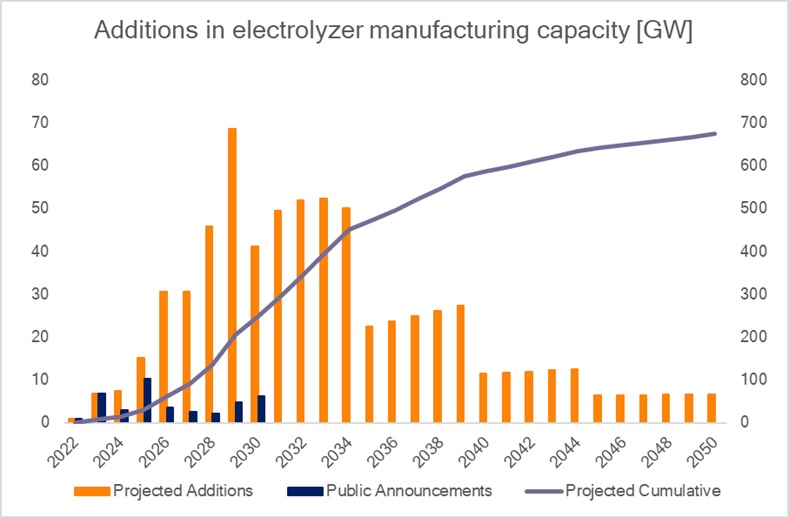

The report highlights the importance of approximately 650 GW of electrolyzer manufacturing capacity and expects cumulative sales of $2 trillion, resulting in a significant return on the $111 billion investment in electrolyzer gigafactories.

The hydrogen industry is poised to follow the trajectory of the LNG market, with key players including the United States, China, Australia, Chile, and select European and African countries dominating global supply.

While certain supply chain links and scarce elements may pose challenges, overall, the price of electrolyzers is expected to continue dropping. Green hydrogen is projected to be the leading hydrogen production method by 2039.

Hydrogen Europe says that global ammonia production, led by the Asia-Pacific region, has consistently risen over the past four years, reaching 185 metric tons (MT) in 2020. The organization highlights that renewable hydrogen supply costs would break even at approximately 3.0 €/kg with natural gas prices at 50 €/MWh (2025 price forecast by the IEA). However, if natural gas prices decline to historical levels of around 20 €/MWh, hydrogen supply costs would face significant pressure, moving the break-even point to around 1.6 €/t.

Ammonia currently accounts for nearly one-third of hydrogen consumption in Europe, making it the second largest consumer after oil refining. As the importance of crude oil refining diminishes, ammonia’s role is expected to grow.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.