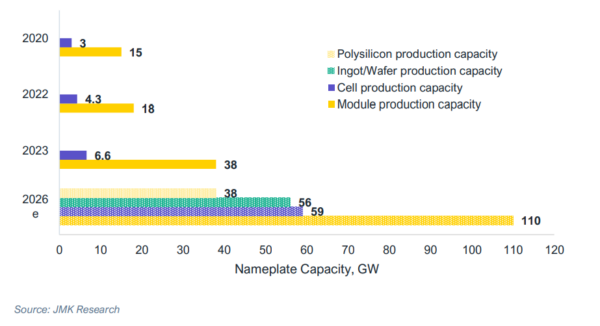

India is set to reach 110 GW of solar PV module capacity by FY 2026 with 72 GW of new manufacturing capacity coming online in the next three years. The significant jump will make the nation self-sufficient and the second-largest PV manufacturing country after China, finds a new joint report from the Institute for Energy Economics and Financial Analysis (IEEFA) and JMK Research & Analytics.

The report notes India will also have a notable presence in all upstream components of PV manufacturing. Cells capacity will reach 59 GW, ingots/wafers 56 GW, and polysilicon 38 GW by FY 2026.

“The future of the Indian PV manufacturing sector is bright. The favorable policy environment created by the Indian government is helping the PV manufacturing industry to grow rapidly, which is evident in the frequent announcements of expansions or new investments in the sector,” says the report’s co-author Vibhuti Garg, Director, South Asia, IEEFA.

“After India attains self-sufficiency in two to three years, the next course of action should be to challenge and compete for dominance in both quality and scale in the global PV module market. Despite the aggressive market drivers, there are minor hurdles that are impeding the growth of the PV manufacturing industry. Therefore, policy stability is necessary to sustain investor confidence in the market,” she adds.

IEEFA/JMK Research

The report finds that India’s cumulative module manufacturing nameplate capacity more than doubled from 18 GW in March 2022 to 38 GW in March 2023. Further, compared to FY2021-22, Indian PV exports (by value) have already risen by more than five times in FY2022-23.

“The production-linked incentive (PLI) scheme is one of the primary catalysts spurring the growth of the entire PV manufacturing ecosystem in India. Besides the augmentation of infrastructure in all stages of PV manufacturing, from polysilicon to modules, it will also lead to the simultaneous development of a market for PV ancillary components, such as glass, ethylene vinyl acetate (EVA), and backsheets,” says the report’s co-author Jyoti Gulia, Founder, JMK Research.

The results of both tranches of the PLI scheme show that there will be an increase of 51.6 GW of module capacity and at least 27.4 GW of integrated “polysilicon-to-module” capacity in India in the next three to four years.

While the PLI scheme is a supply-side measure, the government has also taken steps to increase the demand for locally-made solar PV modules. One such step was the introduction of domestic content requirement (DCR) for solar power in several government schemes, such as the Pradhan Mantri Kisan Urja Suraksha Evam Utthaan Mahabhiyan (PM-KUSUM) Scheme and the Central Public Sector Undertaking (CPSU) Scheme.

One of the key steps taken by the government to boost demand for domestic solar PV modules was the introduction of the Approved List of Module Manufacturers (ALMM) in 2019. The report notes that even after applying higher basic customs duty (BCD) on imported modules, the cost differential compared to domestic modules is negligible.

“In such a scenario, the ALMM acts as an absolute trade barrier protecting the interests of domestic manufacturers. Thus, over the past year, ALMM has been the most important driver for the development of domestic PV manufacturing,” says the report’s co-author Prabhakar Sharma, Consultant, JMK Research.

“The latest ALMM list, updated on 27 February 2023 by the Ministry of New and Renewable Energy, includes 70+ domestic manufacturers with an enlisted capacity of 22,389 MW,” he adds.

The report also identifies some hurdles holding back the domestic PV manufacturing industry from realizing its full growth potential. Chief among them is over-reliance on Chinese imports for upstream components of PV modules, such as polysilicon, ingots/wafers, and more.

“With the Chinese government mulling restrictions on the outflow of the critical technology used in the manufacture of these upstream components, it is imperative for countries targeting integrated PV manufacturing at scale to identify alternate sources of supply for these raw materials,” says the report’s co-author Nagoor Shaik, Senior Research Associate, JMK Research.

The report recommends that the government augments the PLI scheme to also include more upstream components, PV equipment machinery, and ancillary components for more holistic development of the PV manufacturing ecosystem.

“Further, to help smaller manufacturers that have limited capital available, the government can look at a scheme providing upfront subsidies for setting up manufacturing units,” Shaik says.

The report notes that the recent deferment of ALMM will provide relief to project developers. However, this decision may lead to a short-term setback for domestic manufacturers and could delay domestic manufacturers’ expansion plans, especially non-participants of PLI.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.