From pv magazine 01/23

Things are never quiet at Dachser’s location in Freiburg, Germany. The beeping of reversing forklifts fills the air. Vehicles maneuver empty trailers into the yard for loading. In a huge trans-shipment hall, heavy pallets move in all directions. The diesel engine of an approaching truck growls as it stops at the ramp, and its hydraulic brakes hiss. This activity is endless, for “time is money” in logistics yards, and it’s also the business model. Processes have been optimized over decades. But now, freight forwarders are adapting to change. Without a climate plan, the freight transport industry has no future.

For logistics companies such as Dachser, the shift to zero emissions will be no mean feat. While it only takes a few minutes to top up the tank of a truck with diesel, it takes hours to fully charge the battery of an EV, which presents a real challenge for logistics businesses with zero-emission aspirations.

“We want our diesel trucks to be on the move more than 20 hours a day,” says Andre Kranke, head of corporate research and development at Dachser. That was one of many reasons why conventional wisdom among freight forwarders was that fuel cells would become the propulsion system of choice in road freight transport. And yet, current signs are pointing in the direction of batteries. At the IAA Commercial Vehicles trade fair in September, market heavyweight MAN said that it would rely entirely on battery-electric drives. Even though other manufacturers did not reject fuel cells outright, they presented battery-electric tractor units with impressive ranges of up to 500 km.

This has piqued the interest of freight forwarders. A 500 km range already covers a number of use cases in the industry. Dachser, which is headquartered in Kempten, southern Germany, with branches throughout Europe, has been building up a fleet of zero-emission trucks for delivery routes in inner city zones since 2018.

Since then, the logistics provider has already opened up nine completely emissions-free urban delivery areas in Europe. Starting this year, its battery-electric trucks will also cover longer distances on rural roads and highways. Following Dachser’s lead, many more logistics companies could soon be embracing the technology.

Creating incentives

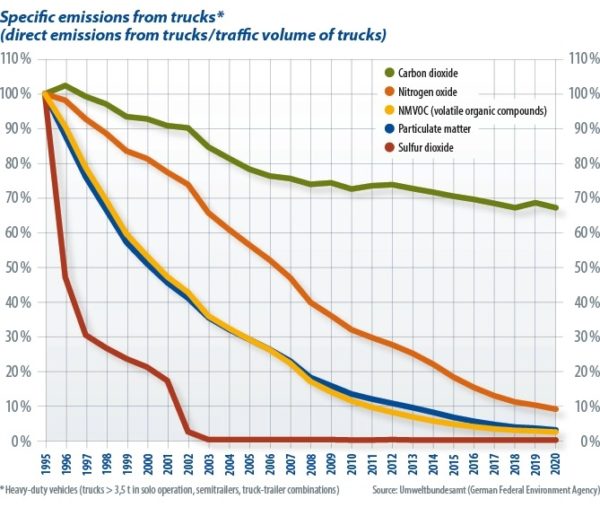

There are a number of reasons why freight forwarders and manufacturers are now paying more attention to zero-emissions delivery logistics. One is the EU’s tightening of limits on emissions from commercial vehicle fleets. From 2025, fleets will have to emit 15% less carbon dioxide or manufacturers will be subject to severe penalties. In subsequent years, the limit will be tightened even further. Those targets can no longer be achieved with more efficient diesel engines. The increasingly stringent exhaust emissions regulations of the European pollutant classes introduced in recent years has effectively reduced nitrogen and sulfur oxides. But for decades, only slight improvements in carbon dioxide emissions have been discernible. To comply with the new regulations, manufacturers will have to introduce new drive technologies to the market.

Logistics companies will also soon have to declare their CO2 emissions for the first time. That change is due to amendments in the Eurovignette Directive, which is the basis for national truck tolls. For the first time, a carbon dioxide component will be calculated in the toll. It is still unclear how much of a difference this will make in tolls in Germany but Dachser’s Kranke calculates that, for a 40-ton truck, there will be an €0.08 ($0.08) to €0.15 difference per kilometer between a modern Euro VI diesel and a comparable zero-emission truck. A zero-emission vehicle in long-distance general cargo transport would then save the freight forwarder up to €30,000 per year in toll charges compared with a modern diesel.

Baby steps

The logistics industry is where the passenger car industry was five years ago. In 2021, some 1,200 zero-emission trucks were newly registered in Germany, a market share of 0.5%. “Until two years ago, only a few e-trucks classed at 7.5 tons or more were available,” Kranke says. Available, he says, means that a vehicle must be registered in several European countries and that manufacturers provide a network of service workshops. That provision of workshops does not always coincide with the launch of new models, he says. In 2021, some 18-ton and 26-ton trucks with long ranges became available and Dachser ordered them.

Starting this year, the company will handle “shuttle traffic.” Kranke says, “We plan to use battery-electric trucks at three locations in Germany for routes of 200 km to 300 km.” These are routes to and from factories for delivery of raw materials or pick-up of finished products to take them to transshipment depots. These routes generally have shorter delivery distances of a few hundred kilometers. Most importantly, they are easy to plan because the route, and therefore the topography – and often even the payload – always stay the same. The easier to plan a route is, “the better it can be covered by battery-electric trucks,” says Peter Smodej, from Daimler Trucks’ corporate communications team. The routes have to be easy to plan because charging en route has not really been possible to date.

Currently-available vehicle charging speeds do not facilitate a complete charge within the legally mandated driver break time, which has prompted manufacturers and research institutes to develop a new charging standard specifically for trucks and the logistics industry.

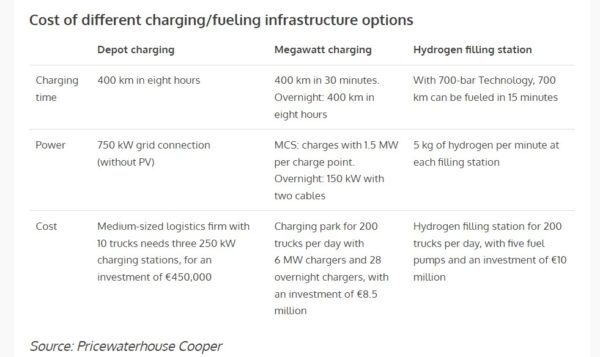

The megawatt-charging standard (MCS), is intended to enable charging at up to 1,500 kW. Smodej points out, however, that this high-power charging must first reach the truck-stops and depots. A service area with space for 20 trucks during the rest period must therefore have a connected load of at least 20 MW because all charging points must theoretically be able to provide full power at all times. Time is money, remember. Technically, this will be a huge challenge because connections to the medium-voltage networks are often quite far from the rest stops.

Part of the reason why battery technology is now finding its way into trucks is that hydrogen propulsion will not be available as a viable alternative for a long time to come, and the state of the technology does not currently offer any advantage over battery-electric trucks. Truck hydrogen tanks are filled at 350 bar. At such low pressure, a hydrogen tank for a range of more than 1,000 km would take up too much volume. This would mean less general cargo would fit on the truck. As a result, models available today only have a range of 400 km to 450 km, Kranke says. He is hoping for cryogenic hydrogen to reach the 1,000 km threshold.

No hydrogen advantage

Expensive charging technology and the challenges for power networks are often used as arguments in favor of fuel-cell trucks. But analysts at Pricewaterhouse Cooper could not identify any cost advantage in investing in hydrogen refueling infrastructure. The cost of a charging park consisting of six MCS chargers and 28 charging columns, at 250 kW, amounted to €8.5 million, enough to supply 200 trucks per day. A hydrogen filling station with the same capacity would cost around €10 million, according to the consultancy.

Whether with electrons or molecules, refueling on long-distance routes is going to be expensive. If European road haulage is to run on battery electricity and make extensive use of charging on the road, 42,000 charging stations will have to be built in Europe, the German Association of the Automotive Industry has estimated.

A joint venture set up by Daimler, Volvo, and VW Traton wants to build the first 1,700 truck charging stations in Europe, as a start. These will not be megawatt-scale facilities yet, but they will still cost €500 million. Extrapolating from what those 1,700 charging stations would cost, 42,000 charging stations will run to about €12.6 billion. Facing figures like that, it is clear what an important role charging at depots, or at factories and industrial parks served by trucking companies will have to play.

Not an afterthought

Changing the type of drive unit and expanding charging capacity at the depot are associated with high risks for freight forwarders; not least, because companies lack expertise in this area. “Up to now, electricity has been more of an afterthought for us,” says Kranke. The switch to more and more e-trucks requires a re-planning of depot power supplies. Until now, trans-shipment depots needed a grid connection for lighting, ventilation, and office equipment. “Only at trans-shipment terminals with refrigeration units could consumption be a little higher at times,” says Dachser’s head of R&D, who is involved with integrating renewable energy systems at the company’s sites.

The consumption of a tractor unit shows that electricity is no longer a minor issue. On average, the vehicle covers just over 200,000 km per year. Dachser moves around 4,000 such trucks. If they were all battery-powered, annual consumption would amount to 700 GWh. Solar panels on the depot roof can only play a supporting role in generating such volumes of energy – namely, to minimize the scale of the grid connection.

At the depot, the e-trucks are charged at 140 kW. The fast processes of a logistics company rule out slower, cheaper charging, says Kranke. To counteract the high cost of electricity, Dachser is planning a 400 kW system on the roof of its transshipment depot in Freiburg, which is one of the three local sites where the e-trucks will be based.

Plants of this size have already been built at ten Dachser locations in Germany. Over the next few years, 20 MW of solar will be installed on the roofs of the company’s European subsidiaries to help charge the e-trucks. Combined with storage and intelligent load management, Kranke says that the PV will ensure the peak loads created by rapid charging are effectively capped. That saves costs but not all the headaches. Observing maximum load-bearing capacities of the warehouse roofs and fire safety regulations, as well as the technical design of the equipment and infrastructure, are also new experiences for the company.

At Dachser, handling the development of the new infrastructure on its own is out of the question and smaller freight forwarders, with less capital and personnel, are not in a position to take any risks when it comes to selecting the right drive technology. Hydrogen trucks are still seen as having a future by all industry participants.

“When it comes to very long ranges and flexibility, we’re betting on the hydrogen-based fuel cell,” says Daimler Trucks’ Smodej. Daimler established a joint venture with Volvo for fuel cell purposes in March 2021. A dual strategy makes sense, he says, because the two technologies complement each other. Ultimately, it is a matter of careful planning, calculation, and trial and error to determine what will ultimately pay off the most, according to Kranke.

For the moment, battery-electric models would be cheapest, especially if they are not charged on the road. And Kranke also puts the onus on businesses whose production sites are served by the trucking companies. Charging infrastructure at those locations would be helpful. “Companies are increasingly focusing on ESG [environmental, social, and corporate governance] strategies and welcome the use of zero-emission trucks,” Kranke says. Companies that are not in a position to offer anything in this area could lose business.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.