The total value of acquisitions in India’s renewable energy sector surged by more than 300% to US$ 6 billion in the first ten months of 2021 (till October) from less than US$ 1.5 billion reported in 2020, according to an independent study released by the CEEW Centre for Energy Finance (CEEW-CEF) and the International Energy Agency (IEA). This signals enhanced appetite from companies to invest in climate-friendly technologies, and opportunities for investors to book profits and re-invest proceeds in new projects, or even exit completely.

The growth in acquisitions was supported by conducive global financial conditions and accommodative monetary policy maintained by the Reserve Bank of India. Adani Green’s takeover of SB Energy India, in October, at a reported enterprise value of US$ 3.5 billion was the biggest deal in the sector.

However, the ‘Clean Energy Investment Trends 2021’ study highlighted that solar PV capacity awarded in the first six months of 2021 fell sharply to just 2.6 GW from 15.3 GW (including 1.6 GW solar-wind hybrid capacity) reported in the corresponding period in 2020. This was largely as a result of a backlog of unsigned power sales agreements (PSAs) amounting to around 20 GW with the Solar Energy Corporation of India (SECI) at the end of 2020.

“A healthy level of mergers and acquisitions (M&A) activity signals continued interest to invest in Indian renewables, facilitating the entry of financial investors and allowing developers to exit at attractive returns. However, market uncertainty stemming from delays in signing power sales agreements, the timely availability and pricing of modules, and the persistent risk of retrospective contract renegotiation could prevent the flow of new investments rising to a level consistent with India’s 500 GW target,” said Arjun Dutt, Programme Lead, CEEW-CEF.

“Our analysis indicates that sectoral risks associated with the Indian market are higher than in other large renewables markets. However, if challenges related to reliability of power purchase and timely availability of land and transmission infrastructure can be addressed, financing costs could be considerably lowered, translating into even lower tariffs,” said Pablo González, Investment Analyst, IEA.

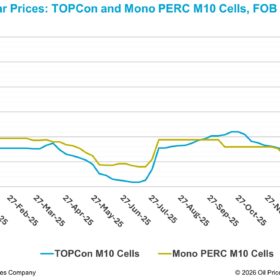

The study also highlighted that India’s renewable energy sector will face headwinds in the near term. An increase in prices of PV modules, driven in turn by rising raw material and shipping costs, could result in lower realized returns than those priced into tariffs at the time of bidding. Further, the Indian government’s decision to levy a basic custom duty of 40% and 25% from April 2022, on imports of solar modules and cells, respectively, is expected to increase module prices in the near term as well, as buyers advance their purchases to avoid the extra cost.

The study estimated that an increase of 20% in realized module prices, from those assumed in the most competitive tariffs (INR 1.99/kWh discovered in December 2020), could lower equity returns by around 45%.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

It is well known that water has a density of over 850 times that of blowing wind and this very fact is normally ignored by the assessors. Any small lined canal or distributary discharging 50 to 150 cusecs of water has a potential to extract sufficient energy. We have been working on this project for nearly 6 years and one of our development is generating 5 KW of consistent energy with an accelerated flow of roughly 1.6 to 2 meters per second, by constricting the passage to nearly ¼ of its size. We plan to install 10 such turbines in a constricted queue where the flow of a normally flowing canal is increased to about 1.6 meters per second. This train of turbines having a length of 70 feet is capable of churning out 50 KWs of good quality energy on a consistent basis. Roughly speaking 42 such trains per km of canal at suitable interval will be able to generate roughly 2MW of energy. With a conservative assessment the whole expense of over 160000 kms of such lined small distributaries can contribute 240 GW. Let us not forget that there will be no impediment or disturbance in the normal canal flow and the same can keep operating in a normal manner.

Another Important fact to be taken into consideration is that the power produced will be on 24×7 basis and will be very stable. This can be an ideal input for stabilizing the grid at the time of imbalance because of cloudy weather or dropping of the wind. The energy will be the cheapest form of renewable energy ever produced and it will be costing just 50 percent of the cheapest solar energy ever quoted. No extra land is required to be acquired as the canals are a state and center property and unlike wind and solar this asset is already in government possession. This may be converted into green hydrogen as according to estimates from the experts in the line, If the cost of renewable energy can be brought down to about 1 rupee per/KWh the cost of green hydrogen can come down to 2$ per kg which is the anticipated price of year 2030.