Cleantech Solar, a renewable energy solutions provider to corporations in India and Southeast Asia, has announced that a consortium of Keppel Corporation Limited (Keppel), Keppel Asia Infrastructure Fund LP (KAIF) and a co-investor of KAIF, through Cloud Alpha, is acquiring a 51% equity interest in Cleantech Renewable Assets (Cleantech) from its parent firm Cleantech Energy Corporation.

The remaining 49% of the equity interest in Singapore-headquartered Cleantech is held by its existing shareholder, Shell Eastern Petroleum (Shell), which will continue to support its future growth across India and Southeast Asia.

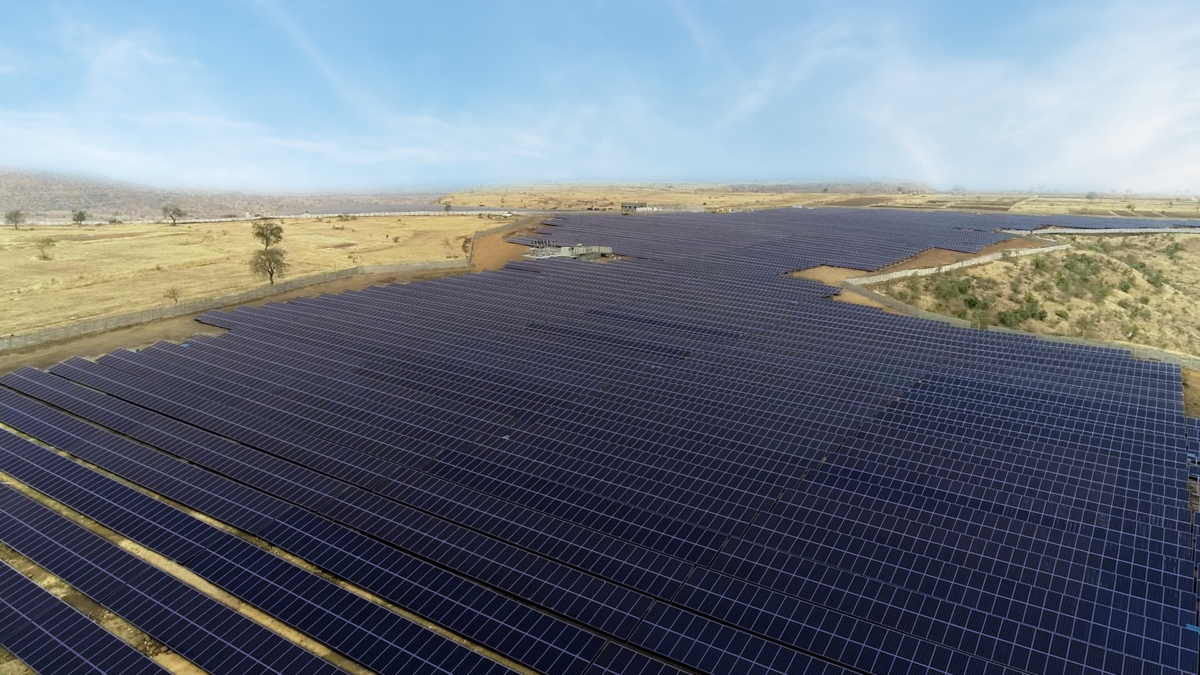

Founded in 2015, Cleantech Solar has a total capacity of over 600 MW across various stages of operations, construction, and development, with its assets located across India and six countries in Southeast Asia (Thailand, Malaysia, Indonesia, Cambodia, Singapore and Vietnam).

Cleantech aims to achieve a cumulative generation capacity of 3 GW over the next five years.

Loh Chin Hua, CEO of Keppel Corporation, said their investment in Cleantech allows them to not only tap the expertise and experience of Cleantech in solar energy projects but also explore opportunities for collaboration with other parts of the Keppel Group.

‘Through acquiring a majority stake in an established platform together with KAIF and a like-minded investor, we would be able to accelerate Keppel’s growth in the renewables space, as we work towards achieving and surpassing our target of 7 GW of renewable energy assets by 2030,” Hua added.

KAIF is managed by Keppel Capital Alternative Asset, a private fund manager under Keppel Capital. Launched in January 2020, the KAIF Partnership and its co-investment vehicles have aggregate commitments of approximately US$1 billion from global institutional investors.

The investment in Cleantech marks KAIF’s first renewable energy investment and will form its beachhead into the burgeoning solar energy sector in Asia Pacific. The fund, together with its co-investment vehicles, also has a 30% interest in the Gimi floating liquefied natural gas (FLNG) facility, which is currently undergoing conversion at Keppel Offshore & Marine.

Completion of the transaction is subject to and conditional upon certain customary conditions, including regulatory and other approvals. The transaction is expected to close in the first quarter of 2022.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.