From pv magazine 08/2020

In rooftop PV, economies of scale were achieved through incentive schemes such as net-metering, feed-in-tariffs, and tax credits – spurring market growth. Now, the tale of DG solar continues to evolve in a similar fashion, this time with battery energy storage taking a starring role – one that is largely supported by inverter manufacturers.

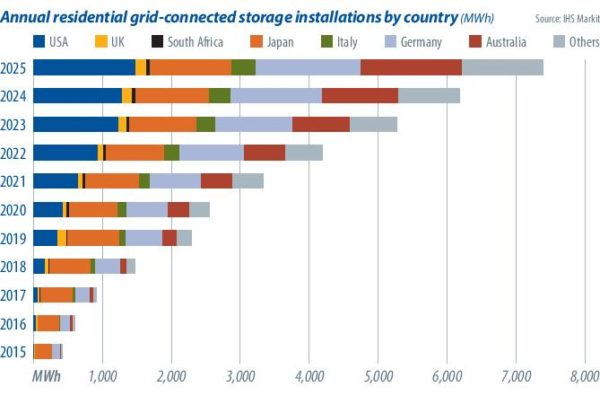

Whereas rooftop PV generators may have historically been seen as a threat to electric utilities, dipping into margins, today flexibility is needed and models are changing with the climate and times. Battery energy storage promises a worldwide rooftop renaissance. The future forecast is set on utility grid-connected PV system owners moving from playing a passive role within the grid to an active one – and independence is growing stronger than ever. In 2019, and again in the first quarter of 2020, residential grid-connected energy storage hit record numbers across key global markets. Global installations of residential energy storage are projected to grow from 971 MW in 2019 to 2.8 GW in 2025, according to analysts at IHS Markit.

Japan and Germany are currently the global leaders in residential storage, with a respective 2.6 GWh and 1.4 GWh of grid-connected capacity deployed at the end of 2019, according to IHS Markit figures.

The two nations are expected to remain the world’s market leaders in 2020, but geographic giants Australia and the United States are already snapping at their heels. “The major market drivers for residential energy storage are a mix of high retail electricity rates, high penetration of residential solar PV, and a desire by customers to increase their energy independence,” says Julian Jansen, head of energy storage research at IHS Markit.

Acquiring independence

While initial homeowner motivation to install solar panels has been largely prompted by financial independence from utilities in these key markets, early adopters of battery systems also drive for independence to obtain a more reliable power supply. The increased frequency and strength of natural disasters from climate change is elevating the crucial role that energy storage plays, notes Jansen. Last year’s wildfires in California, partly blamed on distribution network failures, led to subsequent widespread preventive power shutoffs. Total losses from the Pacific Gas & Electric power shutoffs in Northern California were estimated to be up to $2.5 billion. Similarly, Australia’s severe bushfires led to billions of dollars in estimated losses from power outages. The disastrous unforeseen events and accompanying power outages led to significant spikes in residential solar+storage demand in both markets, driven by the desire of homeowners to have reliable back-up power.

Before Covid-19 market implications took hold, analysts at Wood Mackenzie estimated that one in four California rooftop solar PV installations would include storage in 2020. This rapid uptake has been bolstered by state regulators decision to provide an estimated $613 million budget toward behind-the-meter battery incentives for low-income and vulnerable residents in high risk fire zones. Facilitated through California’s Self-Generation Incentive Program (SGIP), the 2020 battery storage allocation came largely in response to the wildfires as a means of blackout resiliency.

Tipping economics

Looking beyond California’s hefty battery incentive allocations, financial support from governments for distributed storage is a common thread that weaves through all of the leading global markets – as was the case with rooftop solar PV in its infancy stages. “Japan, Germany, Australia, and the U.S. have all been driven by clear incentives and or subsidies to deploy rooftop solar with storage,” says Rory McCarthy, principal analyst of energy storage at Wood Mackenzie.

But decreasing storage system costs coupled with increasing electric bills are pushing residential storage closer to a financial tipping point. Last year’s analysis of the European market from WoodMac noted that following Germany’s lead, residential storage is proliferating in other countries where market structures, prevailing power prices, and disappearing feed-in tariffs are creating an early-stage deployment landscape. Pre-Covid, the analysts forecast both Germany and Italy moving toward grid parity for solar+storage in the residential space in the coming two years.

Yet still, the current price tag on storage as an addition to a solar installation can create a challenging selling proposition. “Looking across the world it is clear that it is still early days for residential storage, and it needs a better value proposition in most global markets in order to make it attractive and bring on stronger growth,” says WoodMac’s McCarthy.

And additional hindrances to the growth of the market have been introduced by the coronavirus. “The Covid-19 pandemic and the subsequent economic fallout has heavily impacted residential storage installations in Q2, especially in those markets implementing the strictest lockdown measures such as Italy and the United Kingdom,” says IHS Markit’s Jansen. While this has dampened the short-term outlook, IHS Markit still forecasts growth in global residential energy storage installations – albeit at a much lower rate of 4.5% in 2020. “Beyond this the market fundamentals remain strong, justifying an optimistic long-term outlook.”

Covid-19 aside, there is consistency among experts calling for more innovative business models for upfront cost absorption in storage. “As the economics of residential systems remain unattractive in many countries, an aggressive push for cheaper solar+storage systems is increasing demand for storage systems coupled with hybrid PV inverters to reduce full system costs,” says Jansen.

Storage-ready

And the trend among inverter manufacturers has gone mainstream. Veterans in the turnkey residential battery storage space – such as SMA, SolarEdge, and Enphase – are being joined by nearly every inverter manufacturer in the market. Fronius, Huawei, Solax, Sungrow – all of the world’s largest power electronics brands – have jumped on the battery bandwagon. “Storage-ready” has become the industry sales buzzword for inverters – and customers are buying – waiting for storage to come in at more affordable prices, without having to install an additional inverter for their batteries when the time arrives.

Jansen says that DC-coupled inverters below 10 kW DC are forecast to account for almost two-thirds of the quantities shipped to residential behind-the-meter energy storage systems in 2020. “Chinese vendors in particular are benefitting from this demand in countries such as Italy, the U.K., and Australia,” he says. A greater number of residential solar PV inverter manufacturers are looking to capitalize on the residential battery trend, and are entering the market with new inverter plus battery energy storage packages – either through their own white-labeled products or through partnerships with battery manufacturers.

DG-focused inverter manufacturer Growatt was one of the first Chinese inverter companies to develop energy storage products. Currently, the company’s off-grid and energy storage inverters cover a capacity range of 1 kW to 30 kW. “Last year, we launched the first storage-ready inverter in Australia,” says David Ding, Growatt’s founder, who lauched the company a decade ago and oversaw its international debut in the Aussie market. “Due to high battery prices, customers are currently using on-grid inverter applications. But in the future, as batteries become even cheaper, customers can easily upgrade to storage systems.”

New market entrant FoxESS, the Chinese underling of the world’s largest stainless steel manufacturer, Tsingshan Group, is targeting its inverter and storage product offering solely to the rooftop consumer. “With the shift of solar PV moving from utility-scale plants toward DG, particularly residential rooftop solar+storage, the requirements for inverters are changing,” says FoxESS CEO Michael Zhu. “Not only in sizing – moving away from the previous large, concentrated design to small string style – but also in the requirements of the inverter to offer a more intelligent grid-connection with storage.”

With its parent company owning the entire manufacturing supply chain, FoxESS seems to be on a mission to take share of overseas markets with downward costs for inverters and batteries. “Considering continuous declining costs, we estimate that an annual 15% to 20% reduction in costs is achievable for inverters and storage systems,” says Zhu. “That’s why we’re very optimistic about this market.”

Evolving models

Hybrid inverters, with on-grid and off-grid capabilities, are on the rise and are not only supporting homeowners to garner freedom from utility shortcomings of continuous power supply – but also serve as active participants in the new future energy market. Self-generation capabilities, with solar+storage homes shielding themselves off-grid, in residential microgrids, is seeing uptake. And while DG projects used to be seen as competition to electric utilities’ business models, today, they are seeing this as an opportunity to further support their needs.

“The emergence of virtual power plant (VPP) business models and utilities looking to procure balancing services from aggregated distributed storage assets, is creating additional revenue streams for customers and improving financial returns,” says Jansen.

Rooftop solar, electric vehicles, battery energy storage – distributed energy resources (DERs) are playing a vital role in the energy structure of the future – where residential ‘consumers’ are becoming ‘prosumers’ supported by the Internet of Things, AI and big data. And inverter companies are at the crux of the movement. “We are doing a lot of work in optimizing storage systems to support smart grids with fast response and smart dispatch,” says Ding.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

2 comments

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.