This year, apart from interesting chases during the T20 Cricket World Cup, “100 GW by 2022” solar target will also be a topic of hot debate in India—at least among the industry and observers—with only three years left to meet the milestone.

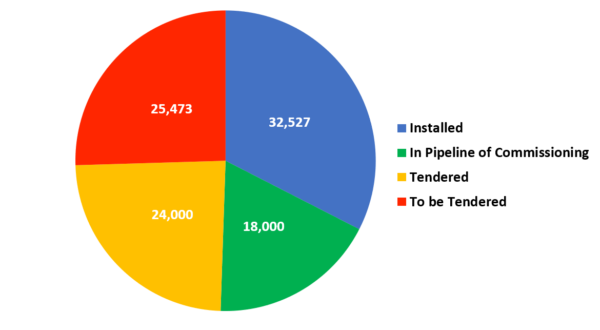

As per the Ministry of New and Renewable Energy’s response to a recent question in Parliament, India installed 32,527 MW as of December 2019. Around 18,000 MW is under different phases of implementation and 24,000 MW is under different phases of tendering. This leaves us with 25,473 MW yet to be tendered. To keep things simple, we need to commission 67,473 MW in next 36 months, i.e., 5.6 GW every quarter.

Image: MNRE

To be able to add 1,874.25 MW of solar capacity every month, the following 6 aspects need to be looked at cohesively. As neutral as the 6 balls in an over are in the game of Cricket, all these points are equally important to score 100 GW.

1. Is net-metering gross?

Out of 32,527 MW installed capacity, only less than 5,000 MW comes from rooftop—quite insignificant in the run-up to 2022 target of 40,000 MW rooftop solar. This means that around half of the installed capacity over next 36 months should from rooftop solar or distributed solar.

To achieve such a Herculean target, policy related to net-metering should be set straight and in sync with the ambition. Recently, in states like Uttar Pradesh, Maharashtra (revised guidelines released by MERC a week before) and Karnataka, we have recently witnessed net-metering regulations being changed retrospectively or subjecting customers to rate discrimination by imposing unfair charges on commercial customers.

The scenario calls for evolving a win-win model of metering that not only promotes the adoption of solar in both residential and industrial sectors but also ropes in the Discom factor. This will go a long way to realise the highly untapped potential of rooftop solar in India.

2. GST! Gee? or Yes!!

Of late, one of the biggest concerns in the industry is taxation under the Goods and Services Tax (GST) regime. Even parliamentary standing committee in its recent report emphasised on the need to immediately address the ambiguity and disputes related to GST.

While EPC businesses had to pay only 5% tax under the erstwhile value-added tax (VAT) regime, the current GST regime bifurcated taxation to 5% for balance of systems/BoS (equivalent to 70% of the plant’s cost) and 18% for services (equivalent to 30% of the plant’s cost). This effectively makes the total tax at 8.9%, which is far higher than 5%.

The logical bifurcation, however, would have been 90-10, wherein almost (actually more than) 90% of the plant’s cost is incurred for BoS.

Another ambiguity is GST applied on BoS when module supply is not in the scope of the EPC contractor. Is it 18% or 8.9% or 5% or as per HSN 84, 85 and 94 an effective of 13.5%?

If the ambiguity is resolved and a flat GST rate of 5% is levied or at least if the bifurcation is restored to 90% for BoS and 10% for services, it will be a huge sigh of relief to the industry stakeholders.

3. PPAs

In 2019 attempts by Andhra Pradesh government to renegotiate power purchase agreements (PPAs) impacted the investor ecosystem adversely. Year 2020 is a crucial juncture when India cannot afford such kickbacks. NSEFI has fought with RBI to carve out a special External Commercial Borrowings (ECB) status for solar to promote and facilitate seamless foreign investments into the country’s renewable energy sector.

PPA renegotiations have the potential to damage the reputation and stability of the market, which will be deemed as a risk for investors. It is therefore pertinent to contain this renegotiation fire before it spreads to other states. At the same time, strictly enforcing must-run status and an eagle’s eye on unwarranted curtailments is necessary to reinforce investor confidence.

4. Manufacturing policy

India needs a manufacturing policy that is scalable, secure, strategical and supportive and promotes both the growth and spread of solar while protecting the interests of domestic manufacturers.

While manufacturers in China enjoy a small advantage in labor costs, this has relatively little impact on prices. In the ever increasingly globalized world, today’s regional price differences in making photovoltaic modules are not inherent and not driven by country-specific advantages. Technological innovations could rapidly level the playing field and therefore should be India’s primary target.

Adequate support to R&D, targeting the entire supply chain, and creating and streamlining the process of availing incentives can go a long way in making India a global leader in manufacturing quality solar modules.

5. Payments

Payment delays have hit the solar industry pretty hard. As of December 2019, Discoms owed at least Rs 6000 crore to solar developers with payment delays in states like Tamil Nadu and Andhra stretching to a period of two years.

In order to provide relief to developers, the Centre enforced a payment security mechanism wherein Discoms are required to open letters of credit for getting power supply. The government has also formed a Dispute Resolution Committee to resolve contractual disputes in time bound manner and reduce the number of litigations.

Addressing the payment delays is going to be very crucial for solar proliferation in 2020 and if not addressed well, might have a cascading effect on upcoming projects which can sabotage India’s so far successful solar journey.

6. RPOs

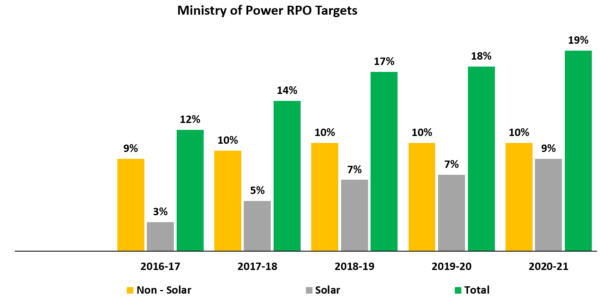

After India’s renewable energy targets were revised, Ministry of Power in 2016 notified the long-term growth trajectory for all States’ and Union Territories’ Renewable Purchase Obligations (RPOs), initially for three years from 2016-17 to 2018-19. Further to this order, in June 2018 the ministry issued a directive for the next 3 years until 2022.

According to this order, around 21% of the total power consumed by each state should be derived from renewables, excluding hydro power generation, with half of it coming from solar power generation.

NSEFI

This essentially means by the end of next year every state should have 9% of solar capacity installed in its energy generation mix. Though India as a whole has diverse renewable energy potential, renewable energy development is taking place only in limited pockets with maximum resources, while areas with moderate renewable energy potential are being neglected.

RE deficit states are unable to comply with their RPO requirements through short-term tenders, as inadequate RE power is offered and when offered they are entangled with high tariffs due to limited merchant RE capacity.

This calls for a nation-wide annual RE balancing mechanism through which States with higher RE potential can leverage their existing infrastructure for RE generation and sell this power to RPO deficit states annually. NSEFI is working towards proposing such an annual balancing mechanism.

To conclude

Addressing the aforesaid key issues can help India in sustainable proliferation of solar and cement its position as world’s solar leader. As Chairman Mehta rightly points out, in order to achieve target “We have to collectively ensure that the Prime Minister’s Great and futuristic vision does not get mutilated in the bureaucratic cobwebs and practical bottlenecks. The key lies in the implementation.” Hopefully, year 2020 will see more practical approaches in both solar policy and implementation.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by NSEFI.

The views and opinions expressed in this article are the author’s own, and do not necessarily reflect those held by pv magazine.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

It is need of today. Renewable energy along with Er vehicle are required to be enhance to save fossil fuels and environment control .The International clubs of Lions is also serving nation being Social service but technical support to nation.