From pv magazine Global.

The first three months of the year saw India leapfrogged by Vietnam and the Netherlands at the top of a list of the biggest export markets for Chinese-made solar panels.

Previously the leading destination for modules produced by a manufacturing base more than two times larger than its domestic demand, India dropped to third as safeguarding duties on Chinese and Malaysian modules began to bite. Figures produced by the China Chamber of Commerce for the import and export of Machinery and Electronic Products (CCCME) indicated India imported 24.4% less Chinese panels than in the same period of last year.

Vietnam, which is benefiting from a new solar policy, imported 16.8% of the Chinese panels shipped from January to March, enough to provide 2.6 GW of generation capacity.

The burgeoning demand for PV in the Netherlands – combined with the removal of trade measures against Chinese products in the EU and protectionism in India – saw the northern European nation become the second largest recipient of Chinese solar modules in the first three months of this year.

With Japan and Australia rounding out the top five Chinese export markets, the CCCME figures showed those five accounted for 52% of the 16.68 GW of module capacity shipped in the first quarter – around 8.8 GW.

Trade sanctions skew market

Despite predictions from analysts that falling prices and economies of scale would ensure Chinese products remained competitive in the face of trade measures, the penalties applied to Chinese panels had a marked effect in the first three months of the year. With the Netherlands export market booming and Indian sales retreating, Chinese panel shipments to the U.S. almost disappeared in the reporting period, with just 10 MW of capacity attracting buyers as the stakes were raised in President Trump’s escalating trade war with the world’s biggest solar manufacturer.

With a newly re-elected Narendra Modi at the helm in India, industry calls to apply more long lasting anti dumping duties on Chinese panel imports are becoming more strident.

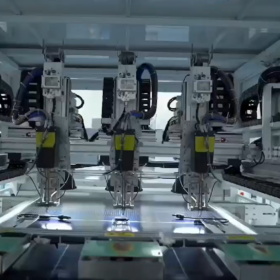

However, with strong new import markets emerging in Mexico, Turkey, Ukraine and the UAE, China’s first-quarter panel exports were still worth around $4.4 billion as they posted a 77% rise in volume compared with the same period a year earlier. And despite the big beasts of solar already possessing an annual module production capacity of around 93 GW – and China expected to be only a 40 GW marketplace this year – Chinese manufacturers show little sign of reining in their ongoing desire to build more PV production lines to feed almost 190 export markets.

With market research company IHS Markit predicting a 123 GW global solar marketplace this year, the China Photovoltaic Industry Association says a redoubling of cost-cutting efforts in manufacturing and ever growing production capacity will see Chinese exports continue to rise.

By Vincent Shaw

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.