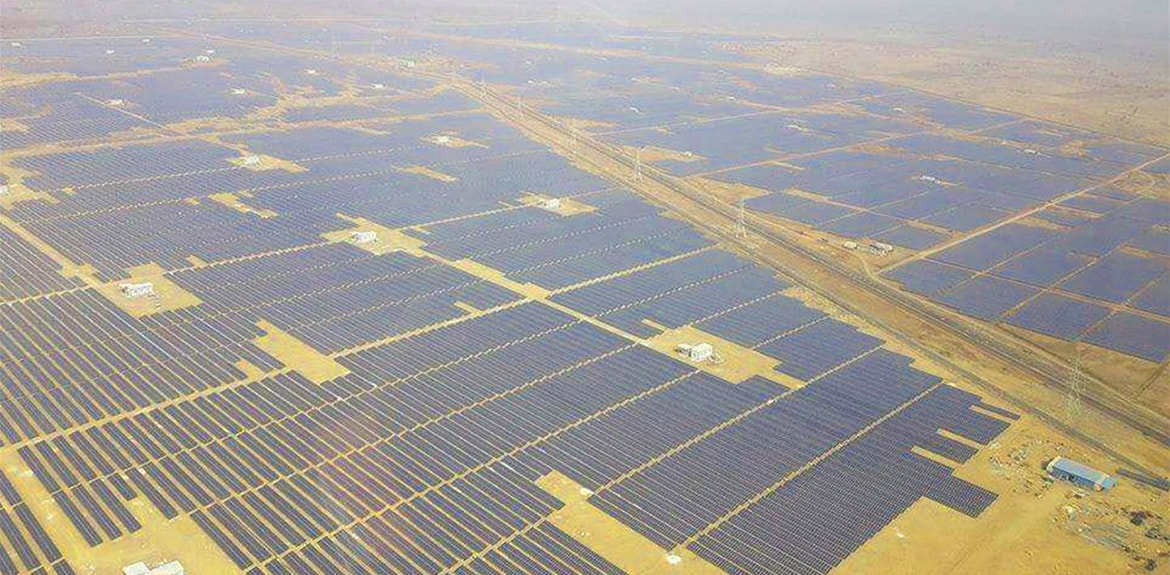

India’s total installed solar capacity stood at 28,057 MW as on December 31, 2018. This included 24,202 MW of utility scale and 3,855 MW of rooftop solar. Further 17,658 MW is in pipeline, according to analyst Bridge To India (BTI)’s quarterly India Solar Compass report.

Only 1,446 MW capacity was added during October-December 2018, including 990 MW in utility-scale solar and 456 MW in rooftop solar, as per report findings shared by PTI.

Utility-scale solar capacity addition was down 46 per cent over the corresponding quarter of 2017. In contrast, rooftop solar grew robustly at a matching pace of 47 per cent over previous year, it said.

Leading states

State-wise, Andhra Pradesh and Gujarat added the maximum capacity (200 MW) during the quarter.

However, Karnataka (5,328 MW), Telangana (3,501 MW) and Rajasthan (3,081 MW) continued to lead in terms of commissioned capacity for utility-scale solar.

Leading players

In 2018, Adani (740 MW) commissioned the maximum capacity, closely followed by Acme (720 MW). Essel Infra (460 MW) stood third.

GCL, Risen Energy and JA Solar (all Chinese) were the leading module suppliers, while Swiss company ABB and Chinese companies Sungrow and Huawei led in inverter supplies.

Sterling & Wilson and Mahindra Susten were the leading EPC (engineering, procurement and construction) contractors.

2018: Overall, an extremely testing year

Module prices fell to US$ 0.20 per watt, down 44 per cent over the previous year. But, most of this fall was offset by 25 per cent safeguard duty and 5 per cent GST as well as more than 10 per cent rupee depreciation.

An unprecedented 51,118 MW of new tenders were issued in 2018, with 15 GW tenders in December 2018 quarter alone. However, tender design did not meet market expectations, leading to cancellation of 16,725 MW of tenders in 2018 and another 9,238 MW of undersubscribed tenders, PTI quoted from the report.

Commenting on the report, Vinay Rustagi, managing director, BTI, said: “2018 was an extremely testing year for the solar market. Pretty much everything that could go wrong, did go wrong. Issues such as safeguard duty and GST created uncertainty for the entire industry, costs went up, execution challenges mounted and to make matter worse, DISCOMs cancelled many tenders because of unrealistic tariff expectations.”

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.