The 2018 Indian solar industry got off to a positive start, with the government allocating Rs 5,020 crore (US$790 million) for the expansion of various renewable energy technologies for the financial year 2018-19.

The Ministry of New & Renewable Energy (MNRE) set a target of commissioning 15.62 GW in FY 2018-19, which was 7.3% higher than the target for FY 2017-18.

Of the total renewable target of 15.62 GW, solar’s share was 11 GW, up from 9 GW in FY 2017-18. The largest allocation – Rs 2,045 crore ($321 million) – was set for capacity addition in the solar sector, while Rs 848 crore ($133 million) was earmarked for 200 MW of solar lighting devices and 20 MW of solar thermal applications.

Highs and lows

Q1 saw the Indian solar market record its best quarter ever, with 3.3 GW of new PV capacity installed. However, with the announcement of 25% safeguard duties on imports from China and Malaysia, the continued ambiguity over GST, and an upper limit tariff cap, the pace slackened. Indeed, solar installations plunged 52% to 1.6 GW during the second quarter of 2018 and 1.5 GW in Q3.

The dramatic decline in new capacity additions continued, with just 6.6 GW installed this year – less than half of the FY2018-19 target set by MNRE at the beginning of the FY.

The number of new projects in the pipeline has also slowed considerably, while big tenders issued by the Solar Energy Corporation of India (SECI) have been either postponed or cancelled, due to lukewarm responses, a no-show by bidders, and high tariffs.

Installation landscape

Overall, India ranks fifth in terms of installed solar capacity globally. This year saw cumulative capacity reaching over 26 GW, with large-scale solar projects accounting for 90% and rooftop solar making up the remaining 10%. Currently, solar projects totaling around 12 GW are under implementation, while new tenders for an additional 20 GW have been issued.

Looking to the sky, solar rooftop installations in India grew 75% YoY, with overall capacity touching 3.4 GW in 2018. Out of this, the commercial and industrial segment dominated with a 70% share, while the household sector comprised just 9%.

“75% growth in a year plagued by safeguard duty and GST uncertainty is absolutely fantastic. Growth in the residential market lags due to a combination of reasons: high upfront cost, lack of financing options from banks, and most importantly, lack of standard products and customer awareness,” Bridge to India MD Vinay Rustagi said in a statement.

The Indian Government has set a goal to reach 40 GW of grid-connected rooftop solar capacity by 2022. However, at the current rate, just 38% of this target will be achieved.

In terms of the utility-scale sector, currently half of the world’s largest solar parks are under construction in India. Indeed, 41 solar parks in 21 states with an aggregate capacity of 26 GW have been approved under Solar Parks and Ultra Mega Solar Power Projects scheme.

The challenges

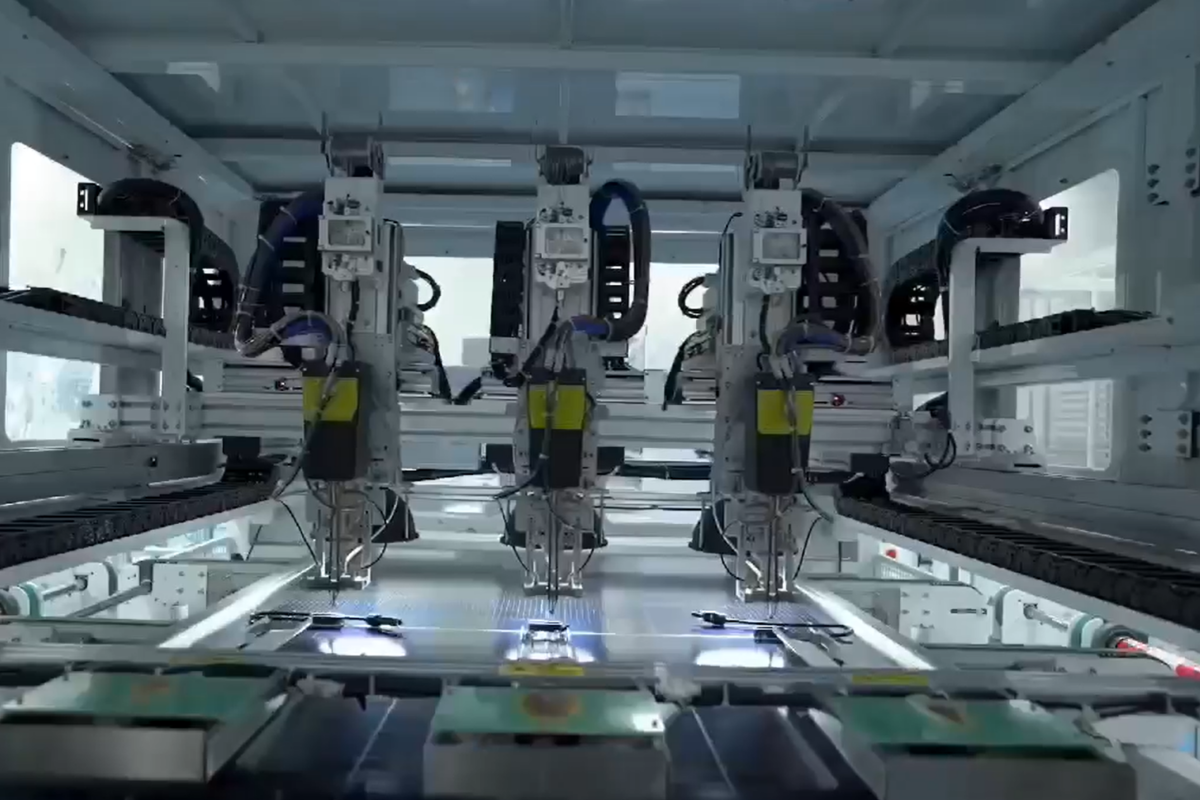

However, challenges remain. Land acquisition continues to be a major hurdle in setting up large-scale solar projects, for instance. Meanwhile, despite the government’s aggressive push for domestic manufacturing, there are not many takers for the incentives, because Chinese manufacturers still have a clear price advantage over Indian manufacturers, with products between 25-30% cheaper.

Advocates of anti-dumping duties on Chinese solar panels point out that India’s imported thin film products are sold to project developers at a very low price (between $0.65 and $0.80 per watt-peak), whereas production cost is higher (between $0.95 and $1.00 per watt-peak).

Looking ahead

Due to heightened volatility in the market, installations in 2019 are projected to be flat or will even decline, compared to 2018. Indeed, a Crisil report has projected that solar installations in FY19 will fall to 7.4 GW from a decadal high of 9.3 GW in FY2017-18.

Overall, the global analytical agency expects an additional 56 to 58 GW of new solar capacity between fiscals 2019 and 2023, but India will miss its 2022 target, it says. Even in the best-case scenario, the country will only reach 78 to 80 GW against the 100 GW solar goal.

Coal still remains a dominant energy source in India, although the country is looking to double the share of renewable energy from the current 21% to 40% by 2030, according to its Nationally Determined Contributions statement set out under the Paris Agreement.

By 2040, said the India Brand Equity Foundation in June, India’s electricity consumption is projected to touch 15,280 TWh and its renewable capacity will jump around seven times, to 384 GW. The use of renewables in place of coal will save India Rs 54,000 crore (US$ 8.43 billion) annually.

According to BloombergNEF, by 2050, 75% of India’s electricity will be from renewables, higher than in China (62%) and the United States (55%).

Global consulting firm AT Kearney forecasts that over the next decade, India will be a $6 billion to $7 billion capital-equipment market, with close to $4 billion in annual revenues for grid-connected solar generators.

For a review of the global 2018 solar PV market, visit pv magazine Global and see the top trends we predict for 2019.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.