From pv magazine Global

To sum up, “The story of 2019 is likely to be – more auctions in countries which need more energy, more prices of $25-35/MWh, more utility-scale storage associated with PV. More mono. Probably some exits of current manufacturers,” Jenny Chase, head of solar analysis at BloombergNEF told pv magazine.

For pv magazine’s top 14 trends (in no particular order) for 2019, read on:

- Can we have some more please?

PV InfoLink predicts that module sales will be around 112 GW in 2019, due to China’s increased 2020 targets, and renewed market growth in India and the USA. It adds that 16 countries worldwide will achieve an increase of more than 1 GW in installed capacity next year. In Europe, this will include Germany, Spain, France, the Netherlands and Ukraine. Overall, China is still expected to account for roughly half of the global market with installations reaching around 43 GW. IHS Markit is even more optimistic, predicting that a record 123 GW will be installed – up 80% on this year. It also sees a market shift away from China, with two thirds of capacity located elsewhere, including Argentina, Egypt, South Africa, Spain and Vietnam, which are set to account for 7% of the 2019 market, or 7 GW of new capacity. Credit Suisse is not quite so buoyant, expecting just 94 GW next year, up from a paltry 80 GW this.

- A European renaissance

It may have lost its footing in recent years, however Europe’s once falling solar star is on the rise again thanks mainly to the growth of grid parity projects on the southern fringes of the continent; and calls for the setting of strong solar and energy storage industrial policy. Overall, association SolarPower Europe expects the EU market to grow 58% on the 5.91 GW installed in 2017.

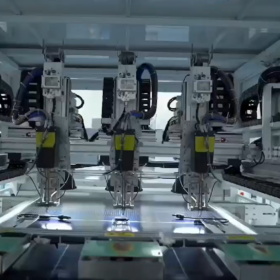

- Mono PERC’s march

In terms of technology, the predictions from across the industry are that 2019 will be the year of mono PERC (passivated emitter rear contact) products. PV InfoLink said they became a mainstream product this year, with the majority of production capacity expansions focusing on this technology. This led to a higher than expected total PERC capacity, rising from 33.6 GW at the end of last year, to 66.7 GW in late 2018. It is estimated that this capacity will expand by over 26 GW by the end of 2019, boosting it to more than 92 GW. Overall, it will account for a 46% share of the market next year. PV InfoLink predicted that if, as expected, mono PERC products reach 310 W – 35 W more than multicrystalline modules – in 2019, more global manufacturers will turn to the technology. Thinner wafers that reduce costs and increase cell efficiency will exacerbate the trend, while a new round of the Top Runner program in China could strengthen the attractiveness of p-type mono-products. It adds that PV manufacturers are expected to continue the trend seen this year of using larger wafers and modules, with 160 μm thickness mono wafers increasingly used.

- TOPCon breakthrough

PV manufacturers in Asia are importing deposition reactors from the EU to test the latest word in silicon solar cell passivation: TOPCon: two thin buffer layers sandwiched between silicon wafers and metal contacts, which are increasing the efficiency of conventional solar cells and setting new records. Equipment suppliers expect the technology to spread through the industry and boost their bottom line. “A lot of people see this [TopCon] as the next big step in photovoltaic technology,” said Professor Andres Cuevas from the Australian National University. “TOPCon rose to fame as a photovoltaic technology thanks to European research institutes. It is now entering commercialization thanks to European equipment,” added Martijn Lenes, Business Director at Tempress, an equipment manufacturer based in Vaassen, the Netherlands.

- Tenders rule

The move to tender-based support systems for the roll out of renewables will continue to gain momentum in 2019. According to German energy agency Dena, over 29 countries held such auctions in 2017, mostly for solar power, although wind and hydro featured too. It adds, “The number of countries using multi-criteria or pure price-based auctions is increasing rapidly … The European Commission demands auctions for RE support from its Member States and even in less developed countries the importance of auction as policy mechanism is increasing.”

- HJT hotting up

Demand for heterojunction technology (HJT) is on the increase, as can be evidenced by the numerous announcements throughout 2018. Indeed, just this month, Meyer Burger’s largest single shareholder, Sentis Capital, requested the former change strategy. It urged the Swiss technology company’s board to raise sufficient capital for it to set up its own GW-sized production facility for its heterojunction and tandem cell PV technology. While Meyer Burger did not explicitly back the shareholder’s call, in a white paper published in the August edition of pv magazine, scientists at the company argued that high efficiency cell concepts, and in particular heterojunction, will be among the best technologies solar can bet on to achieve further innovation focused on cost reduction. In August, the EcoSolifer Group announced work is back on track at its planned 100 MWp HJT bifacial PV cell production line in Csorna, Hungary, after a two year pause. The first cells are set to come off the production line in Q1 or Q2 2019. Meanwhile, by proving inductively coupled plasma can be used for HJT-cell production, German solar tooling provider Singulus Technologies and the Solar Energy Research Institute of Singapore at the National University of Singapore said in May that they would now work on ways to find cost-effective production methods with the aim of making a GW scale roll out of HJT cells viable. In March, Japanese electronics giant, Sharp announced the achievement of a 25.09% conversion efficiency, from a cell utilizing both heterojunction (HJT) and back contact technology. And Enel subsidiary, 3SUN said in February that it was in the process of converting its amorphous silicon factory in Sicily to produce bifacial HJT modules. Russian module producer, Hevel made a similar move last year, and had planned to increase the capacity of its fab in Novocheboksarsk by the end of 2018.

- An unstoppable tide

The number of floating solar announcements just keeps on increasing and has now become an unstoppable tide. As IHS Markit’s Josefin Berg wrote in the July edition of pv magazine, while the market has been around for more than a decade, until recently it has been limited to small and moderate size installations in a few countries. “In 2017, this changed, as 390 MW of new floating PV systems were installed worldwide, mainly as part of the Top Runner Program in China,” she wrote, adding, “In 2018, at IHS Markit we project that annual floating PV installations will surpass 1 GW, still mainly driven by China. After 2018, the lack of near-term pipeline in China will lead to some market adjustments, through which India, South Korea, Taiwan and a myriad of small markets fill a large portion of the demand gap left by China. In particular India is rising as a strong potential market on the back of a 10 GW target for floating PV. Over the next five years, we project 13 GW of new floating PV additions in the world.”

- Corporates for good

They may be notorious in the realm of data protection and privacy, with few green credentials to their names, however the corporates are helping to take renewables mainstream through the use of private or corporate PPAs. In 2017, a total of 5.4 GW of clean energy contracts were signed by 43 corporations in 10 different countries, according to BloombergNEF, up from 4.3 GW in 2016 and a record 4.4 GW in 2015. While the figures for 2018 were not out at the time of writing this, bets are on that this figure will again increase. Indeed, in 2017, most of the PPAs – 2.8 GW – were signed in the United States. According to the Rocky Mountain Institute this month, this figure is set to surpass 5 GW in 2018. RE100, which brings together corporations pledging to source 100% of their electricity from renewables, also sees a growing trend in the market.

- Is this the future?

Many manufacturers are busily converting large parts of their production capacities to half-cut cell technology. In addition to increased power output, HC modules boast improved performance thanks to better temperature coefficients, lower hot spot levels and lower operating temperatures, among other advantages. In 2018, half-cut cell modules appear to be making the transition common to many new technologies with PV manufacturing. And in echoes of other technologies such as PERC, once the transition begins, it can occur at pace across new production lines. Data collected by independent PV manufacturing analyst Corrine Lin has global module production capacity expanding from 104 GW in 2017 to 124 GW this year. Almost two thirds of that expansion, according to Lin’s information, will be in the form of half-cut cell production.

- Revamping and repowering

The concept of revamping and repowering is one of the newest terms in the solar industry, and is definitely one to watch. Indeed, as the installed base of PV systems ages, upgrading and improving operating plants becomes increasingly relevant to both manufacturers and PV plant asset managers. According to IHS Markit’s ‘PV Installation Tracker’, more than 40 GW of PV systems in Europe above 100 kW are more than five years old, and could be subject to component changes in the coming year, including repairs, replacement, revamping, and repowering. Revamping opportunities are not only related to defunct components, but also to the number of module and inverter companies that have exited the market in recent years. Added to this is the dramatic decline of component costs in the last few years – and the equally impressive improvements in components’ technology, quality and performance – which has also stimulated growth in revamping. However, while interventions create opportunities to increase the performance of the existing PV generation fleet, each one must be analyzed on a plant-by-plant basis and must also consider the policy and technical aspects.

- Large-scale, big business

As of the start of 2018, 420 MW of battery storage coupled with utility-scale solar had been installed globally, said IHS Markit. It added that 40% of the total energy storage pipeline is comprised of solar-plus-storage projects, while it expects between 20 and 26 GWh of energy storage co-located with utility-scale solar to be deployed between 2018 and 2025. There are clear growth opportunities in the United States, Japan, South Korea, the United Kingdom and France, it added. With this growth, IHS’ Julian Jansen explained how new value is emerging for storage on the utility side of the meter, primarily from capacity requirements and the integration of utility-scale solar and island microgrids. This leads to greater growth in the longer duration energy storage segment, especially systems of two to four hours (and above) in duration, he said. In theory, energy storage can provide multiple use cases when paired with utility-scale solar: Time shifting generation; ramping; and distribution network support. In the growing world of datacenters, strong business cases are also emerging for solar and storage. This trend is definitely one which will continue to grow.

- Tracking the market

The benefits of bifacial are already well known, with some saying it is the most promising advance in solar for a decade. Among the advantages are energy gains that can range from single-digit percentages to more than 20%, compared with monofacial modules, depending on a wide array of variables. As Scott Stephens, Director of Technology Development at Clearway Energy, formerly NRG Renew, in San Francisco noted in October, although bifacial technology may cost $0.05/W more to install than a monofacial PV system, a conservative 10% bifacial gain easily outweighs the risk. “Bifacial modules represent the largest step function improvement in project economics for minimal technology risk since the introduction of trackers,” said Jenya Meydbray, Vice President of Solar Technology at Cypress Creek Renewables, based in San Francisco. On the back of this, not only is the bifacial module market continuing its upward march, but the bifacial tracker market is now on the cusp of huge growth. “Next year there will be explosive growth in bifacial tracker installations,” predicted Guy Rong, CEO of Arctech Solar, based in Kunshan. Others also agree. “The bifacial tracker is one of most exciting untapped opportunities in the solar industry; there will be a huge drive toward this,” said Dan Shugar, Founder of NEXTracker. Overall, NREL estimates that the market share for bifacial tracker systems will expand from a near-zero base today to a projected 10% market share in 2019, and 30% by 2025, compared with monofacial panels. Michael Woodhouse, an economic analyst at NREL, calculated that this would make the technology a multi billion dollar industry by itself. “That would represent a $20 billion to $110 billion market for bifacial technology,” he said.

- Significantly more efficient

From blockchain to drones, digitalization is transforming the energy industry. Indeed, not only can it help to bridge the shortcomings of the traditional grid, and enable regular consumers to trade energy with one another, but the digitalization of O&M in solar plants can make these management processes significantly more efficient – up to a factor of 10.

- Walk that talk

Cradle-to-cradle is a trend that pv magazine hopes will bear fruit as soon as 2019 and is something that we will personally be pushing as a mantra for the solar and energy storage industries. Indeed, we are all part of an industry that promotes and/or sells the dream of clean green energy, yet how many of us are really walking the talk? How many can confidently claim that manufacturing or production practices, or products and services are designed with a cradle-to-cradle concept in mind? How many of these are actually benefitting the environment we are claiming to help save? Yes, solar PV and energy storage may well be the key to the energy transition we have to see happening, but we cannot allow these industries to run on processes that are still harmful to both the environment and people. WE have to lead the way to a truly 100% clean green future, and that means looking at every aspect of our personal and professional lives. Europe is calling for the (re)establishment of a solar PV and battery manufacturing landscape. There is an opportunity here to build this on a true cradle-to-cradle foundation. Let’s join together and take action to REALLY change things.

For if not us, then who?

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

TOPCon technology sounds very interesting. Layering different solar reactive chemistries like perovskites or CIGS printing a layer to accept solar PV capture from more than one spectrum band gap could be the next big thing. Could this “buffering” layer topology allow mono silicone, with a sprayed on layer of perovskite and a third layer of a printed on CIGS layer produce a solar PV panel with a smaller foot print, but with a 35% perhaps more energy capture efficiency?