From pv magazine Global

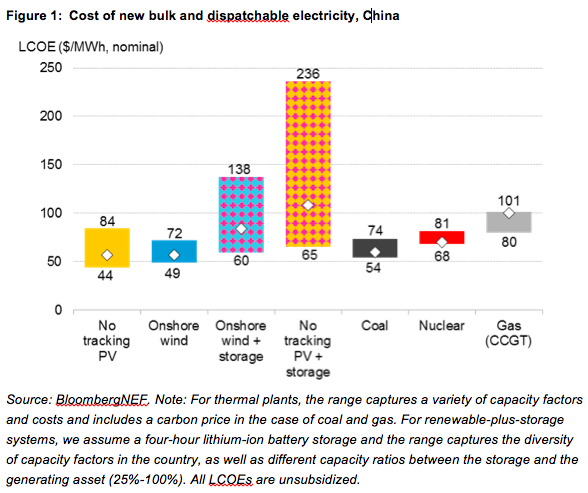

In its 2H 2018 LCOE Update, which has examined the cost competitiveness of nearly 7,000 projects and 20 technologies in 46 countries, BloombergNEF finds that solar and/or wind are the cheapest source of new energy generation in all major economies, apart from Japan.

“This includes China and India, where not long ago coal was king. In India, best-in-class solar and wind plants are now half the cost of new coal plants,” write the analysts in a statement released.

Indeed, although China’s 31/5 PV policy change has seen the world’s leading solar market contract by over a third this year, and higher interest rates in both China and the United States have placed pressure on financing costs, a “global wave” of cheap equipment has still reportedly pushed the benchmark global levelized cost of new PV (non-tracking) down 13% from the first half of 2018, to $60/MWh.

“Our global benchmark for new tracking PV sits at $46/MWh for the second half of the year, down 6% from $49/MWh in 1H 2018. The lowest tracking PV LCOEs in 2H 2018 are in Chile at $30/MWh and Australia at $37/MWh, the highest is Turkey at $92/MWh,” BloombergNEF Analyst, Energy Economics, Tifenn Brandily tells pv magazine.

He adds, “For non-tracking PV plants, our global benchmark sits at $60/MWh, down 13% from 1H 2018. The lowest figures for non-tracking PV are in India, Chile and Australia, where projects can achieve LCOEs as low as $28/MWh, $35/MWh and $40/MWh respectively. Projects with the highest LCOEs are in Japan (up to $279/MWh), Argentina (up to $191/MWh) and Indonesia (up to $185/MWh).”

Brandily points out that the figures exclude subsidies and are for projects that have reached financial close in the last six months or are currently under construction. “Our LCOE analysis covers only utility-scale projects, not residential ones,” he concludes.

The BloombergNEF report went on to say that if gas prices rise above $3 per one million British Thermal Units (MMBt), new solar and wind projects are likely to “rapidly undercut” both new and existing combined-cycle gas plants (CCGT).

Cost competitive

The case for co-locating batteries with renewables is also growing. “Our analysis suggests that new-build solar and wind paired with four-hour battery storage systems can already be cost competitive, without subsidy, as a source of dispatchable generation compared with new coal and new gas plants in Australia and India,” write the analysts.

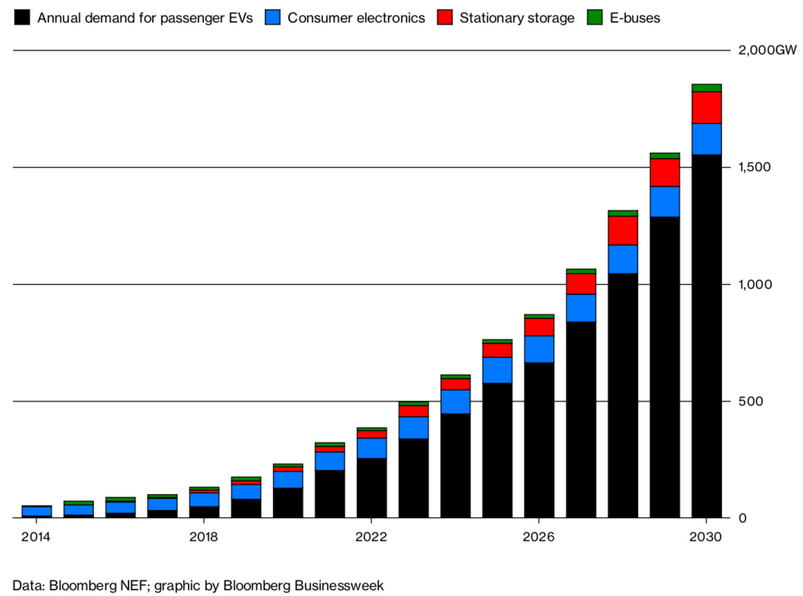

Against a backdrop of increased electric vehicle (EV) adoption, battery prices are set to decline by another 66% by 2030. This, state the analysts, will lead to cheaper battery storage for the power sector, “lowering the cost of peak power and flexible capacity to levels never reached before by conventional fossil-fuel peaking plants.”

Electric transport

In a separate news report also published today, Bloomberg Businessweek, citing data from Bloomberg NEF, said that EVs are on track to overwhelmingly represent the biggest share of lithium ion (Li-ion) battery users, outpacing the consumer electronics market from next year onwards. By 2030, stationary storage will also beat the latter, it says.

By 2030, it calculates that EVs, which are projected to number 30 million, or 55% of all new car sales by this date, will be the recipient of around eight out of every 10 batteries sold annually.

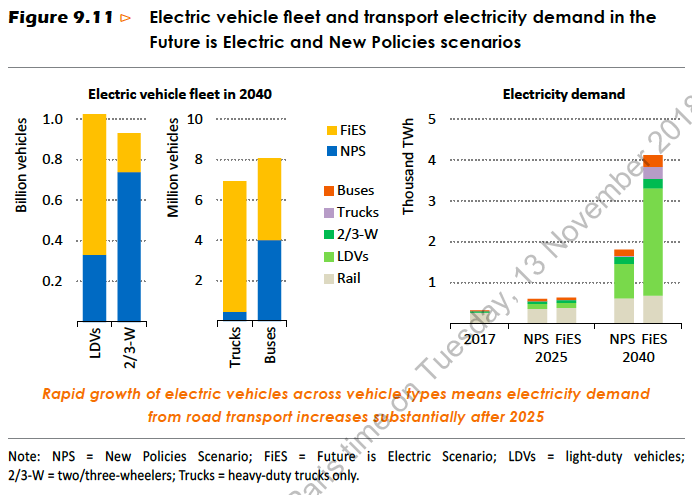

In the boldest (read: “We’re just kidding, we don’t believe this will actually happen”) scenario of its latest World Energy Outlook report – the Future is Electric, or FEiS – the International Energy Agency says that nearly half of the total projected fleet of over two billion road transport vehicles in 2040 could comprise EVs. In this scenario, “There are also 74 million electric light commercial vehicles, and 15 million electric heavy-duty vehicles (including buses and trucks). About 70% of two/three-wheelers are electrified too,” wrote the analysts.

This, however, results in an increase in electricity consumption by road transport vehicles of around 3,400 TWh by 2040, which is three-times the increase in its New Policies Scenario (which it believes is the most realistic), with strong growth in both advanced and developing countries (Figure 9.11).

How EVs can make a substantial contribution

According to Project Drawdown – a plan to reverse global warming proposed by a non-profit coalition of researchers, scientists, graduate students, PhDs, post-docs, policy makers, business leaders and activists – the world’s transport sector produces seven gigatons (Gt) of carbon dioxide-equivalent greenhouse gas emissions annually, or around 14% of all emissions.

In its list of 80 existing solutions to “drawdown” the concentration of atmospheric greenhouse gases on a year-to-year basis – by avoiding emissions and/or by sequestering CO2 already in the atmosphere – it ranks EVs at number 26, recognizing their potential to reduce emissions by 10.8 Gt.

“If EV ownership rises to 16 percent of total passenger miles by 2050, 10.8 Gt of carbon dioxide from fuel combustion could be avoided,” states the coalition. “Our analysis accounts for emissions from electricity generation and higher emissions of producing EVs compared to internal-combustion cars.”

It has further ranked electric bikes at number 69, with the potential to avoid 0.96 Gt of CO2; and trains, which have the potential with renewables to provide “nearly emission free” transport, at number 74.

Overall, it finds that the transport sector could save 45.78 Gt of CO2 by 2050 – interestingly far behind the food sector, which has the potential to save 321.93 Gt, and the energy sector, which could save 246.14 Gt.

Multi purpose

Not only do EVs pose a solution to reducing CO2 emissions, but they also offer a real way to cope with the integration of intermittent renewables into electrical grids – one of the many arguments against the ramping up of renewables.

Indeed, the rise of bidirectional inverters and decentralized intelligence (blockchain) has introduced the possibility of not only sun-to-vehicle charging, but also vehicle-to-vehicle and vehicle-to-grid charging.

When coupled with storage, strong business cases emerge, as founder and CEO of The Mobility House, Thomas Raffeiner told pv magazine earlier this year. “… electric mobility is not part of the problem, but part of the solution,” he said, pointing to a project the company is working on, on the Portuguese Island of Porto Santo.

“The Mobility House implements controlled charging on unidirectional EVs to flexibly support the local utility in reacting to renewable energy fluctuation. So at the time a cloud hits the solar plant, we can immediately stop charging, and the bidirectional cars can feed in, maybe only for a couple of minutes.

“Additionally, the stationary storage supports the system … That way we gain flexibility in controlling the charging behavior and provide a flexible asset to the utility. Through that we can support providing cheap electricity to the consumers. This is a perfect example of what electric cars can do for electric grids,” he said.

The article was amended on 20.11.2018 to include additional figures from BloombergNEF.

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

1 comment

By submitting this form you agree to pv magazine using your data for the purposes of publishing your comment.

Your personal data will only be disclosed or otherwise transmitted to third parties for the purposes of spam filtering or if this is necessary for technical maintenance of the website. Any other transfer to third parties will not take place unless this is justified on the basis of applicable data protection regulations or if pv magazine is legally obliged to do so.

You may revoke this consent at any time with effect for the future, in which case your personal data will be deleted immediately. Otherwise, your data will be deleted if pv magazine has processed your request or the purpose of data storage is fulfilled.

Further information on data privacy can be found in our Data Protection Policy.