India’s Director General of Safeguards, Customs and Central Excise (DGSCCE), Sandeep M. Bhatnagar, has proposed to impose a provisional Safeguard Duty at the rate of 70% on the imports of the solar cells and modules coming from China PR and Malaysia.

The director general has cited a case of serious injury to the domestic industry. It has recommended the duty be levied for 200 days.

The proposal has come amid the backdrop of the Indian Solar Manufacturers Association (ISMA) application filed on December 12, 2017. Bhatnagar made the proposal, subjected to safeguards investigation concerning the import of “solar cells whether or not assembled in modules or panels” into India, in a document dated January 05, 2018.

Findings

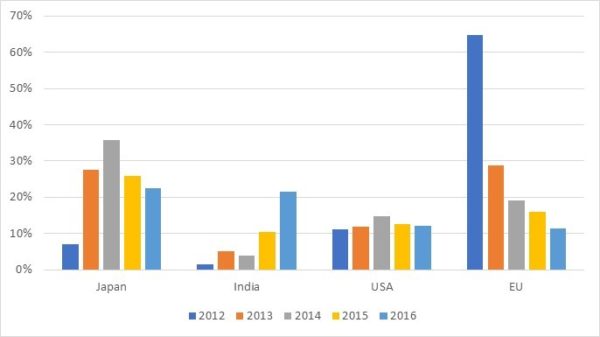

According to the DGSCCE document, India’s share of Chinese imports globally has increased from 1.52 % in 2012 to 21.58% in 2016, in contrast to the cumulative share of the EU and the U.S., which reduced from 75.93% in 2012 to 23.42% in 2016.

Source: DGSCCE

Taking the last three years into account, India has increased its imports from 18.51% in the first half (H1) of 2016 to 38.77% in H1 2017. In contrast, China’s exports to the EU and the U.S. combined reduced from 30.65% in H1 2016 to just 5% in H1 2017.

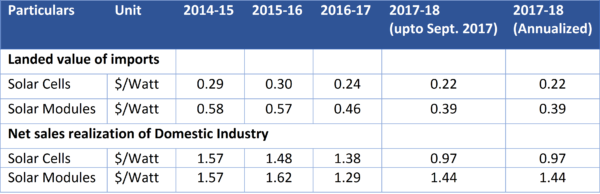

Another significant finding is the price deviation, which has severely damaged the domestic industry’s growth. As of September 2017, the average module price for imported modules was INR 24.77 ($0.39)/W, while domestic modules are priced at INR 92 ($1.44)/W.

Source: DGSCCE

This is one of the main reasons for the increase in imports. India increased its domestic solar module production from 237 MW in 2014-15 to 838 MW in 2017-18. Despite that growth, the market share of the domestic industry decreased from 13% in 2014-15 to 7% during 2017-18. During the same period, the market share of imports increased from 86% to 90%.

On account of this, many domestic producers have kept their production facilities almost idle and their heavy losses have served to cripple the domestic industry.

At the end of 2017, capacity utilization stood at just 53%, down from 78% in 2016-17. This in turn has had an impact on the decline in employment growth, and a sharp decline in productivity per employee.

Citing the findings, Bhatnagar stated: “There is a direct correlation between the increase in imports and serious injury already suffered by the domestic industry.

“Thus, critical circumstances exist requiring [the] imposition of provisional Safeguard Duty immediately in order to save the domestic industry from further serious injury, which would be difficult to repair if the application of this Safeguard measure is delayed,” he added.

However, another solar association, All India Solar Industries Association (AISIA), has opposed the proposed safeguard duty, citing that it will be detrimental to the Indian solar industry as a whole.

Instead, AISIA has recommended relieving those manufacturers from safeguard duty that come under Special Economic Zones (SEZ).

This content is protected by copyright and may not be reused. If you want to cooperate with us and would like to reuse some of our content, please contact: editors@pv-magazine.com.

The report notes that there has been “serious price undercutting” by international suppliers. However it fails to provide enough evidence basis which this interpretation has been drawn. Those details would help.

https://indiaenergyinsights.wordpress.com