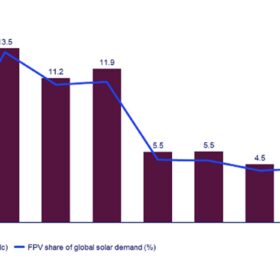

Wood Mackenzie predicts global solar growth will stagnate in 2025

Wood Mackenzie’s latest report forecasts that 493 GW (DC) of solar will be added throughout the world this year, compared to 495 GW in 2024. Solar module prices are expected to rise this year as manufacturers aim to recover profit losses from the past two years.

U.S. solar cell manufacturing begins, with sights set on supply chain gap

According to the U.S. Solar Market Insight Q4 2024 report, domestic module manufacturing will be able to keep up with the rapid pace of growth in the U.S. solar industry, and cell production is ramping up.

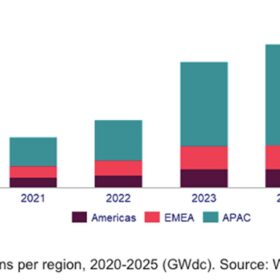

Wood Mackenzie forecasts 77 GW of floating solar globally by 2033

Wood Mackenzie predicts that the global floating solar market will be dominated by the Asia-Pacific (APAC) region and led by India, China and Indonesia through to 2033. The consultancy says growth will be driven by rising demand, decreased capital expenditure and supportive policies.

Major U.S. corporations embracing community solar

The Coalition for Community Solar Access (CCSA) noted that household names such as Microsoft, Google, Walmart, Starbucks, Rivian, Wendy’s, and T-Mobile are just a few of the Fortune 500 companies that have signed agreements with community solar developers.

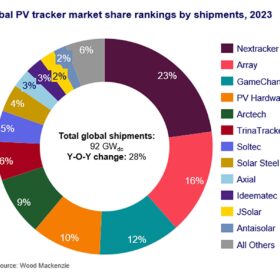

WoodMac says global solar tracker shipments grew by 28% in 2023

Global tracker shipments reached 92 GWdc last year, according to WoodMackenzies’ latest report. The US accounted for the majority of the global market, with three US-based manufacturers, Nextracker, Array Technologies and GameChange Solar, ranking as the three largest shippers in the world.

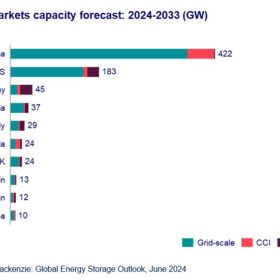

Global energy storage fleet to surpass 1 TW/3 TWh by 2033, WoodMac says

According to the latest forecast from Wood Mackenzie, the global energy storage market (excluding pumped hydro) is on track to reach 159 GW/358 GWh by the of 2024 and grow by more than 600% by 2033, with nearly 1 TW of new capacity expected to come online.

India leading the solar wave to become world’s second-largest module manufacturer

Continued government support, coupled with strategic investments in technology and infrastructure, will be crucial in realizing India’s renewable energy goals and cementing its position as a global leader in solar module manufacturing.

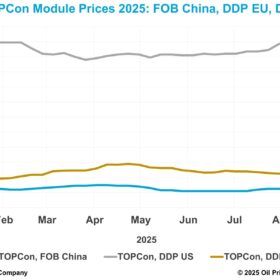

‘Module prices surprisingly keep going down’

As part of our Intersolar 2024 interview series, pv magazine spoke with Yana Hryshko, head of Solar Supply Chain Research for Wood Mackenzie, about overcapacity, declining panel prices and expected PV demand for the next years. She revealed that Chinese module procurement schemes are currently seeing unprecedented, “ridiculously” low bids, but she also noted that the $0.08/W threshold may now be difficult to exceed. Hryshko also expects many manufacturers to backpedal on previously announced capacity expansion plans and renegotiate module supply contracts.

Total U.S. solar module manufacturing capacity grows by 71% in Q1 2024

According to the U.S. Solar Market Insight Q2 2024 report, solar module manufacturing production capacity increased by over 11 GW.

Australian solar manufacturing through the looking glass

The Silicon to Solar report, partly funded by the Australian Renewable Energy Agency, outlines ways to restore solar manufacturing to the nation with a little help from the country’s major trading partner – China.