Solar module, cell, wafer prices to rise in Q2 2025, says TrendForce

TrendForce says solar module, cell, and wafer prices will rise in the second quarter as China accelerates installations ahead of looming regulatory changes. It notes that prices are expected to decline in the third quarter as demand eases.

Where will lithium-ion battery prices go in 2025?

After tumbling to record low in 2024 on the back of lower metal costs and increased scale, lithium-ion battery prices are expected to enter a period of stabilization.

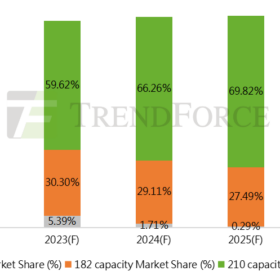

TrendForce says 210 mm module shipments surpassed 260 GW in Q1 globally

Cumulative shipments of 210 mm PV modules surpassed 260 GW in the first quarter of this year, according to Taiwan-based TrendForce. The analysts said that seven of the top 10 module makers now make 210 mm n-type modules, with Trina Solar, Risen Energy, Tongwei and Huasun all now mass producing panels above 700 W. “It is […]

Prices of Chinese EV battery cells fell by 50% at end of 2023, says TrendForce

Average sales prices of Chinese power cells at the end of 2023 were half of what they were at the start of the year, according to TrendForce. Despite the drop, the research firm says prices should stabilize in the second half of 2024.

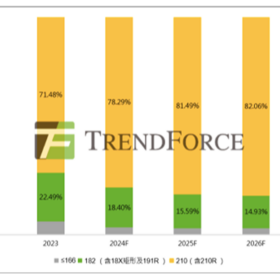

P-type solar products may be phased out by 2026 as n-type tech ‘rapidly’ expands

The rise of cost-effective TOPCon cell technology last year led to a ‘surge’ in production demand for solar n-type cell technology, with leading industry analysts TrendForce prophesying PERC cell capacities ‘may’ be phased out in two to three years. The company’s experts, however, warn that oversupply for p-type cells and modules may increase the price gap between n-type and p-type products in the upcoming months.

Top PV module manufacturers by shipment volume in 2022

TrendForce has ranked the top six module manufacturers by shipment volume in 2022, with Longi topping the list, followed by Trina Solar and JinkoSolar. JA Solar, Canadian Solar, and Risen Energy rounded out the top six, in a year dominated by large-format modules.

PV product prices resume downward trend, says TrendForce

TrendForce says polysilicon will be 3.2% cheaper in March than in February. This will lead to lower wafer, cell and module prices and will effectively spur installation demand.

Global solar installations may hit 350.6 GW in 2023, says TrendForce

TrendForce says solar demand could grow by more than 53.4% this year due to lower module prices and delayed projects from 2021 and 2022 that are now going online. China will be the largest market this year with 148.9 GW, followed by the United States with 40.5 GW, India with 17.2 GW, Brazil with 14.2 GW, Germany with 11.8 GW, Spain with 11.4 GW, and Japan with 8 GW.

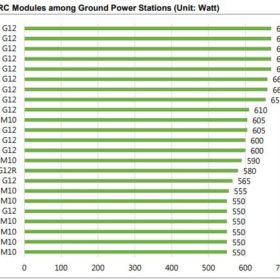

Solar panel sizes continue to get larger and improve LCOE, says TrendForce report

A new report from the Taiwanese market research company shows growth in the production of modules over 600 W and increased format size. Cells and wafers are getting larger as well.

Solar panel demand expected to reach 125.5 GW in 2019, TrendForce says

According to the Taiwanese market research company, PV panel demand will increase by 16% over 2018 shipments. TrendForce also believes this growth trend will continue in 2020.