Early coal plant retirement first hurdle in reducing discom debt

The Indian power distribution sector needs bold policy choices such as the closure of old, inefficient coal-based power plants to improve its financial viability. Early retirement of expensive coal power contracts will result in significant savings for the states as they can contract cleaner, cheaper renewable power.

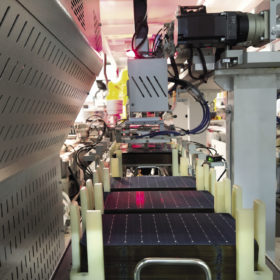

Commercial and industrial rooftop solar set to surge

Rooftop solar is the obvious choice to save on electricity costs for businesses as they look to preserve capital and find ways to cut expenses post Covid-19.

Historic-low interest rates will power ahead astonishing solar cost reductions

An Ieefa report has suggested the cost of generating electricity from solar will be near zero in the world’s sunniest regions by 2030-40 – despite what the naysayers at the International Energy Agency might think.

Solar tariffs below Rs 2.55/kWh financially unviable now, says Ieefa

To earn reasonable returns on solar projects, developers must factor in the various risks and correctly estimate the cost of every component before bidding.

Gigawatt scale ‘ultra-mega’ solar parks driving India’s energy transition

India hosts numerous 1 GW-plus solar parks, two of which are the largest commissioned in the world. The huge sites have been instrumental in driving economies of scale and continue to attract global capital and some of the most recognized renewables developers.

A few policy tweaks would boost renewable energy investment, says IEEFA India

Removal of solar trade duties, discom reforms, and better central-state government coordination are prerequisites to increase renewable project development in the country.

Indian government leading by example in renewable energy adoption: IEEFA

Government incentives driving state-owned enterprises’ investment away from the soon-to-be stranded fossil fuel based assets are a way of further boosting investment in the renewable energy sector.

AIIB expects $100 million annual investment in India’s renewables sector

The Beijing-headquartered Asian Infrastructure Investment Bank—which recently approved a US$75 million loan to Tata Cleantech Capital—sees private-sector investment flowing into the nation’s solar and wind projects next month onwards.

IEEFA: India needs a multi-technology approach to renewables integration

In addition to accelerated deployment of battery based energy storage systems, the country needs to look at a combination of technologies to manage peak electricity demand whilst maintaining grid stability at least overall cost.

Gujarat may lead the renewables race by adding 4-5 GW annually: IEEFA

The state—which had 8.5 GW of renewables capacity (2 GW solar, 6 GW wind and 0.8 GW biomass) operational as of March—is expected to add a staggering 46 GW to reach 55 GW mark by 2029-30.