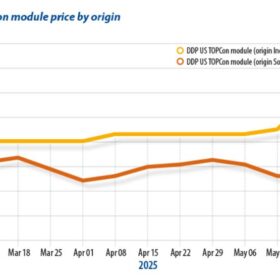

Trade headwinds fragment PV prices

Tempestuous trade conditions and policy uncertainty have led to module price fragmentation in the United States. Ahead of an expected reduction in manufacturing capacity utilization, leading manufacturers in China produced a high volume of cells in the spring. OPIS editorial director Hanwei Wu explains the latest market developments.

MaxVolt Energy launches smart lithium inverters

MaxVolt Industries Energy has launched wall-mountable, high-efficiency inverters with inbuilt lithium battery for residential and commercial solar applications.

ALMM list for solar cells features six manufacturers with 13 GW of combined annual capacity

The ALMM List for solar cells features FS India (First Solar’s India arm), Jupiter, Emmvee, Mundra (Adani), Premier Energies, and ReNew with a combined annual solar cell production capacity of 13 GW.

Green hydrogen: The future fuel driving industrial decarbonisation

Green hydrogen serves as a foundational pillar to pursue industrial, macro-scale decarbonisation and developing more sustainable energy system for the future.

Battery storage operations in India’s power exchanges became profitable for the first time in 2024: Ember

New battery projects commissioned in 2025 could deliver internal rates of return (IRR) of 17% by operating in power exchanges, owing to falling upfront costs and rising revenue potential, says the Ember report.

Afghanistan starts building 40 MW of solar

Afghanistan has started building a 40 MW solar project, with completion expected within 18 months.

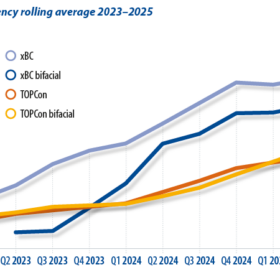

Non-stop solar innovation despite module oversupply

It’s no secret that prices throughout the solar supply chain have been at rock bottom over the past 18 months. Alex Barrows and Molly Morgan of CRU Group explore how the market reached the imbalance that caused PV prices to crash, what this has meant for innovation, and how it might affect future technology transitions.

SECI’s latest auction yields green ammonia price of INR 51.8 per kg

Solar Energy Corp of India (SECI) has discovered a new record-low green ammonia price of INR 51.8 per kg (around $591.25 per metric tonne) in its latest auction. The winning bid was placed by NTPC Renewable Energy Ltd.

Sinovoltaics updates solar module manufacturer financial stability ranking

The quality assurance provider reported India-based Insolation Energy, Waaree Renewable Technologies, and Solex Energy maintained their top three spots in the ranking this quarter. The number of companies with healthier Altmann-Z scores stayed the same at nine.

Siemens Energy India profit up 80% YoY for quarter ended June 30, 2025

Siemens Energy India Ltd (SEIL) has reported a robust financial performance for the quarter ended June 30, 2025, with net profit soaring 80% year-on-year (YoY) to INR 263 crore. Revenue from operations rose 20% YoY to INR 1,785 crore. New orders for the quarter surged 94% to INR 3,290 crore.