MUFG closes US$ 163 million finance for Azure Power’s 300 MW solar project

The latest transaction follows MUFG’s commitment to the debt funding facility for Adani Green’s under-construction hybrid portfolio of solar and wind projects in Rajasthan.

Using the oceans’ depths to store renewables, compress hydrogen

Underwater gravity energy storage has been proposed as an ideal solution for weekly energy storage, by an international group of scientists. The novel technology is considered an alternative to pumped-hydro storage for coasts and islands without mountains that are located close to deep waters, and may also be interesting for PV if used to store green hydrogen.

Solar photovoltaic quality control and waste management in India

As PV waste is set to rise rapidly in the coming decades, India needs to invest in efficient recycling technologies and devise a clear-cut policy for the safe disposal of PV waste. Guidelines for stringent quality checks and validation for both imported and locally produced solar panels are also needed to avoid early-loss solar waste.

ION Energy raises $3.6 million in latest funding round

The battery management solution provider will use the funds to grow its team, invest in product development, and expand the software business in North America and Europe.

Tata Power to exit coal by 2050

The energy company says it will use hybrid-technology projects, round-the-clock renewables, battery storage, floating solar and green hydrogen as it attempts to wind down the 69% of its energy generation fleet based on thermal power.

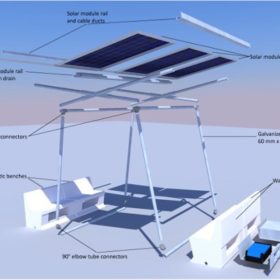

A solar pavilion for India’s rooftops

India’s energy transition will not succeed without rooftop PV and roll-out is hindered not only by a lack of household finance, but by the fact many of the nation’s flat roofs are enjoyed by residents. Germany’s international development agency has proposed a solution.

Another bidding extension for 75 MW solar in Uttar Pradesh

Developers now have until July 14 to bid for setting up the capacity in the Uttar Pradesh Solar Park. Technical bid shall be opened on July 15.

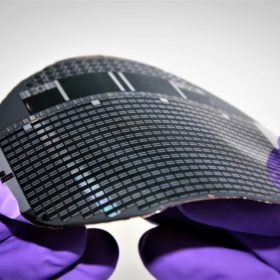

Fraunhofer ISE unveils 68.9%-efficient III-V solar cell for laser energy transmission systems

The German research institute said the gallium arsenide cell has achieved the highest efficiency to date for the conversion of light into electricity.

Fourth Partner Energy raises US$125 million in equity funding from Norwegian and US investors

The Hyderabad-based corporate solar solutions provider would use the funds towards business expansion across Indian and International markets as it targets 3 GW of installed solar capacity by 2025.

Sterling and Wilson Solar’s order book grew 72% in FY2021

However, one-off exceptional events in the fourth quarter hit the solar EPC player’s overall fiscal performance. These included a prime subcontractor going bankrupt in Australia, rising module prices, and increased freight costs.