Australia betting on new ‘strategic reserve’ to loosen China’s grip on critical minerals

The federal government has unveiled new details of its plan to create a $1.2 billion critical mineral reserve. Three minerals will initially be the focus: antimony, gallium and rare earths (a group of 17 different elements).

“Waaree well positioned as trusted solar partner under Europe’s NZIA Regime”: Sunil Rathi

Waaree Energies is looking to deepen its presence in Europe as the European Union’s Net-Zero Industry Act (NZIA) reshapes solar procurement and curbs reliance on Chinese module suppliers. “As a listed, Tier-1, bankable manufacturer with a proven multi-gigawatt track record, we offer the scale and credibility European developers now prioritise,” says Sunil Rathi, executive director, Waaree Group.

Beyond energy independence: Backward integration as India’s edge

Countries reliant on imported minerals and components are rethinking energy strategies in solar, batteries, and green hydrogen. Securing upstream and midstream processes is no longer optional but essential for flexibility. India’s integrated approach across mining, processing, and manufacturing positions the country as a challenging player on the world stage.

“Placing Scope 3 emissions at the center of a corporate net-zero strategy ensures true lifecycle accountability”: GNFZ CEO

Mahesh Ramanujam, CEO of the Global Network for Zero (GNFZ), discusses why Scope 3 emissions must be at the core of any corporate net-zero strategy. He also explores the evolving global and Indian regulatory landscapes, the role of independent certification in ensuring accountability, and shares a real-world case study of how GNF helped an organization design or implement a customized pathway to tackle Scope 3 emissions.

How India finally switched on its electricity derivatives market

The introduction of electricity futures (derivatives) marks a significant step forward in modernizing India’s power market. The benefits are numerous: it offers a strong mechanism for hedging against price fluctuations; promotes more transparent and competitive price discovery; and improves overall market efficiency

CERC to finalise virtual PPA guidelines soon

The Central Electricity Regulatory Commission (CERC) is set to release final guidelines for virtual power purchase agreements (VPPAs), potentially unlocking financing opportunities for over 40 GW of uncontracted renewable energy projects across the country.

India finalizing CCUS Mission roadmap, outlay

The Union Government is finalizing the roadmap and financial outlay for the much-anticipated Carbon Capture, Utilisation and Storage (CCUS) Mission, said Rajnath Ram, Adviser for Energy, Natural Resources & Environment at government policy thinktank NITI Aayog.

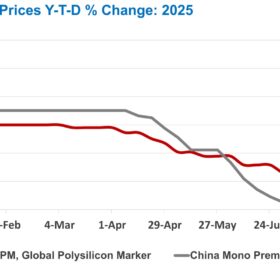

Chinese polysilicon prices stabilize after five-week 31% rally

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.

How the India-UK FTA can turbocharge clean energy cooperation and investment between the two nations

Trade is only half the story, the bigger opportunity lies in green finance. Indian renewable energy projects require an estimated $250 billion in capital by 2030. The UK, home to one of the world’s most mature green finance ecosystems, including institutions like the Green Investment Bank and large ESG-focused funds, is ideally positioned to bridge this gap.

Battery storage operations in India’s power exchanges became profitable for the first time in 2024: Ember

New battery projects commissioned in 2025 could deliver internal rates of return (IRR) of 17% by operating in power exchanges, owing to falling upfront costs and rising revenue potential, says the Ember report.