IFC to finance Brookfield’s 550 MWp Bikaner solar power project

International Finance Corp. (IFC) has committed $105 million to Brookfield Asset Management’s 550 MWp solar power project in the Bikaner district of Rajasthan.

The interconnected impact of energy on real estate, industries and national development

Complete dependence on fossil fuel, which is a very volatile segment, can leave a country vulnerable to price fluctuations and geopolitical disputes. This is turn has a huge impact on the country’s economy as well. A prime example of which, can be seen with the current Ukraine- Russia crisis’s impact on the European countries rise in gas prices and subsequent economic turbulence.

India renewable growth story to continue to shine

Renewable capacity addition is expected to remain at around 15-17 GW annually, owing to significant reduction in the module prices over the past 12 months and availability of liquidity.

Financing the MSME sector to power India’s renewable energy goals

India has already seen several success stories where innovative financing has empowered MSMEs in the renewable energy sector. For instance, the Indian Renewable Energy Development Agency (IREDA) has launched schemes specifically designed for MSMEs. These schemes offer concessional loans and financial assistance, making it easier for MSMEs to undertake renewable energy projects.

$89 billion worth of investments likely to flow into the C&I RE sector in India by 2030

An additional 120 GW of C&I RE capacity is required to be set up by 2030 for India to attain its solar and wind target of 420 GW by 2030. This translates to US$89 billion worth of investments flowing into the sector between 2024 and 2030.

Green hydrogen hubs: Unfolding India’s potential

Hydrogen hubs, which are organised areas where production and utilisation facilities are closely linked, can make green hydrogen projects more viable. This cluster-based approach addresses the technical, logistical, and commercial challenges of long-distance hydrogen transport, enhances project viability, and allows for economies of scale and concentrated infrastructure.

Vibrant Energy promotes Vinay Pabba to CEO

Vinay Pabba, who is currently Vibrant Energy’s chief operating officer, will shortly be taking up the role of chief executive officer (CEO).

Industry tie-ups and innovative financing mechanisms will drive MSMEs’ renewable energy adoption in India

Innovative financing mechanisms, such as credit guarantees and first-loss coverage, are essential to funding MSMEs’ adoption of renewable energy.

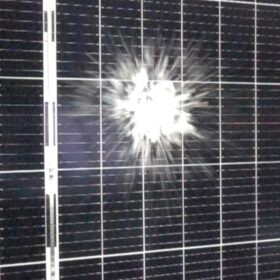

Weather-related damage to solar assets in USA exceed modeling expectations by 300%

The report from kWh Analytics, with input from several industry leaders, identified 14 risks to be aware of in the solar industry, including risks related to extreme weather, such as hail, and operational risks.

GP Eco Solutions IPO to open for subscription on Friday

The initial public offering (IPO) comprises a fresh issue of 3,276,000 equity shares with a face value of INR 10 each through the book-building route. Price band is fixed at INR 90-94 per share.