Omani polysilicon factory reaches financial close

United Solar Holding has secured more than $900 million to complete the financing required for its 100,000 MT polysilicon manufacturing facility in Oman. Production is expected to begin during the first quarter of this year.

EU to ban Chinese inverters? – Commission proposal in Cybersecurity mulls ‘high-risk vendors-list’

The European Commission is revising its Cybersecurity Act. While presenting the proposals in European Parliament, the commission’s Executive Vice-President for Tech Sovereignty, Security and Democracy, Henna Virkkunen, said dependency on a very limited number of solar inverter suppliers could “pose a significant security risk.”

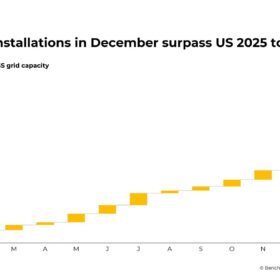

Global BESS demand jumps 51% in 2025 as installations top 300 GWh

Iola Hughes, Head of Research at Benchmark Mineral Intelligence, tells ESS News that 2026 is set to be another strong year for BESS, with forecast additions exceeding 450 GWh and no material supply constraints in sight. Meanwhile, the initial impact of rising lithium prices is already visible at the cell level, but the full effect has yet to ripple through to system pricing.

India’s transition to green steel is expected to be gradual, driven by renewables in the near term: ICRA

ICRA expects the Indian steel industry’s decarbonization to be gradual, with near-term emission reductions driven mainly by higher adoption of renewable energy and improvements in operational efficiency, as high costs and technology constraints limit faster decarbonization.

Energy storage for homes: Why hybrid inverter systems will lead the next phase of solar growth

Energy storage for homes—anchored by hybrid inverter systems—will lead the next phase of solar growth in India. Not as an upgrade, but as a necessity for a nation building toward energy independence by 2047.

Australia betting on new ‘strategic reserve’ to loosen China’s grip on critical minerals

The federal government has unveiled new details of its plan to create a $1.2 billion critical mineral reserve. Three minerals will initially be the focus: antimony, gallium and rare earths (a group of 17 different elements).

Kosol Energie signs MoU for INR 90,000 crore investment in Gujarat

Kosol Energie has signed a memorandum of understanding (MoU) with the Government of Gujarat to invest INR 90,000 crore in the State. The company said the proposed investment will support the development of advanced solar module manufacturing facilities, next-generation R&D centers, large-scale renewable energy parks, and integrated green energy ecosystems.

Solar modules under pressure: The growing risk of spontaneous glass breakage

Once considered isolated incidents, spontaneous glass breakages in solar modules are becoming more frequent, highlighting the limits of some manufacturing choices and the need for closer quality control.

Green bonds totaling $870 million issued for 2 GW solar project in UAE

Joint owners of the 2 GW Al Dhafra solar power plant Abu Dhabi National Energy Company, Abu Dhabi Future Energy Company, EDF Power Solutions and Jinko Power, alongside offtaker Emirates Water and Electricity Company, have issued the green bonds to refinance the plant’s existing debt obligations and support its continued operation.

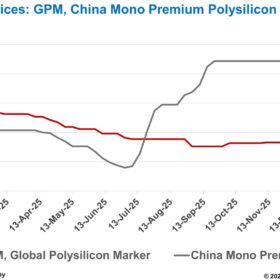

Compliance premiums lift global polysilicon prices

In a new weekly update for pv magazine, OPIS, a Dow Jones company, provides a quick look at the main price trends in the global PV industry.