India curtailed 2.3 TWh of solar generation between May and Dec. 2025: Ember

The system operator regularly had to curtail solar generation as an emergency measure to maintain grid security, as other resources were already flexing to their maximum capabilities. Lost solar generation highlights the need for flexibility to grow at pace with solar capacity.

China PV module prices expected to hit $0.12/W in H2

China’s PV module prices are expected to hover around $0.12/W in the second half of 2026 as the removal of export VAT rebates, front-loaded demand, and persistent oversupply keep market sentiment volatile.

Pre-Budget 2026: Solar and storage industry calls for tax reforms, PLI expansion, and circular economy push

Ahead of the presentation of the Union Budget 2026–27, stakeholders across India’s solar and energy storage ecosystem have urged the government to focus on tax reforms, expansion of production-linked incentive (PLI) schemes with targeted allocations, faster viability gap funding (VGF) disbursements, additional funding for residential rooftop solar, improved access to long-term and affordable green finance, and a stronger push for circular economy initiatives and grid modernisation.

Why end-to-end solar manufacturing is India’s competitive edge

End-to-end solar manufacturing is the bridge that will reduce import reliance, stabilize costs, strengthen supply chains, support exports, and help India move confidently toward its 500 GW renewable energy goal. With the right investments and a continued focus on innovation, India is positioned not just to participate in the solar revolution, but to help shape it.

IndiGrid raises INR 1,500 crore through institutional placement

India’s first and largest publicly listed power sector Infrastructure Investment Trust (InvIT), IndiGrid, has successfully raised INR 1,500 crore through an institutional placement (IP). The placement was oversubscribed by around two times and saw strong participation from both domestic and global institutional investors.

UK to spend $20 billion on home energy upgrades, mandatory PV for new homes

Cash grants and state-backed loans to support solar and battery storage installations in millions of UK homes as part of government Warm Homes Plan. UK government says investment has the potential to triple the number of homes with rooftop solar by 2030.

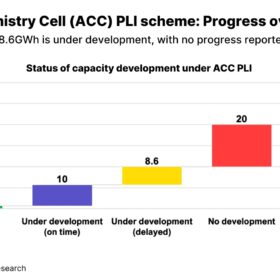

India’s PLI scheme achieves just 2.8% of targeted 50 GWh battery manufacturing capacity so far

Despite strong industry interest, India’s Advanced Chemistry Cell Production Linked Incentive (ACC PLI) scheme, launched in October 2021, is yet to translate policy ambition into realised capacity. As of October 2025, only 2.8% (1.4 GWh) of the targeted 50 GWh capacity has been commissioned within the stipulated timeline, entirely by Ola Electric—according to a new report by JMK Research and the Institute for Energy Economics and Financial Analysis (IEEFA).

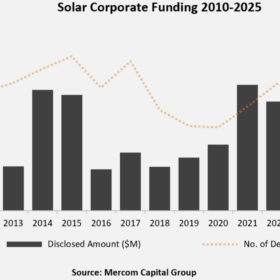

Global solar corporate funding reached $22.2 billion in 2025

While global solar corporate funding in 2025 fell to the lowest level recorded since 2020, deal count rose to its highest level since 2017. Mercom Capital Group says investors favored smaller, lower-risk, execution-ready projects last year amid policy uncertainty, trade pressures and higher financing costs.

European PV market faces potential 2026 price shock from China export tax

China’s PV manufacturing sector is operating at full capacity ahead of an April 1 export tax change, contributing to module price increases of 20% to 30% in parts of the supply chain and raising risks for price-sensitive European commercial and utility-scale projects in early 2026.

Distributed solar platform Aerem raises $15 million in SMBC-led funding round

Aerem Solutions, an end-to-end platform for distributed solar, has raised $15 million in a Pre-Series B funding round led by SMBC Asia Rising Fund, the venture capital arm of Sumitomo Mitsui Banking Corp. (SMBC).