India’s rooftop solar installation still dismal at 3.9 GW

Rooftop solar, at 3.9 GW, accounts for only around 10% of the cumulative grid-connected solar capacity installed by the nation as of February end this year.

India’s $122bn energy stimulus spending may benefit fossil fuels most

A report says India’s energy investment commitments over the last 14 months largely feature measures for power transmission and distribution that could benefit greenhouse-gas-producing fuels more than renewables.

Adani Green Energy raises US$ 1.35 billion in debt funding

The developer has secured the revolving fund from 12 international banks. It would use the amount to initially finance its 1.69 GW hybrid portfolio of solar and wind projects to be set up in the Indian state of Rajasthan.

EV maker Euler Motors and energy service firm Smart Joules raise funding from ADB Ventures

Asian Development Bank’s new venture arm ADB Ventures, which invests in technology startups disrupting traditional sectors in the Asia Pacific, has made its first investments into the Indian startups Euler Motors and Smart Joules.

AC Energy, UPC Solar JV raises funding to develop 100 MW Rajasthan project

UPC-AC Energy Solar has closed a debt-to-equity financing deal with the US International Development Finance Corporation (DFC) to develop a 100 MW PV project in Rajasthan.

Haryana plans 93 MW solar power capacity

The Haryana Power Generation Corporation Limited (HPGCL) plans to develop 77 MW solar capacity on its own land and 16 MW on land owned by village councils.

India, Sweden to fund joint R&D in renewable energy and storage

The Department of Science & Technology, Government of India, and the Swedish Agency for Innovation Systems (Vinnova) have issued a call for joint R&D proposals in renewable energy, electric vehicles and energy storage. The deadline for the submission of proposals is May 6.

Mini-grid company Husk Power doubled revenues in 2020

Bihar-based Husk Power Systems—which operates more than 100 mini-grids in India and Africa—recorded a 90% year-on-year growth in revenues and quadrupled business customers to 5000+. It expects the growth momentum to continue in 2021, with a 125% rise in revenues.

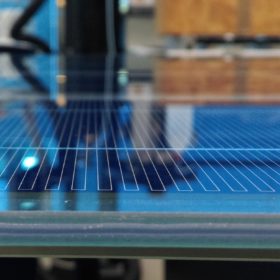

Borosil Renewables posts a 74.3% y-o-y revenue growth in first nine months

The Indian solar glass manufacturer reported net revenue of around INR 300 crore during the current fiscal’s nine months ended December 2020, with the best-ever quarterly earnings of INR 140 crore coming from the third quarter.

Indian trough highlighted by Chinese solar glassmaker

Xinyi Solar has posted bullish annual figures on the back of an astonishing rebound in the global market following Covid travails at the start of 2020. There is one national market, however, which has not been invited to the party.