India’s first grid-scale storage tenders to spur investment, domestic manufacturing

If Solar Energy Corp. and NTPC can successfully execute tenders for standalone energy storage systems, it could drive investment, support domestic manufacturing, and facilitate the development of new business models, according to a newly released report.

Solar module price increases to affect returns on 4.4 GW of solar

Solar cell and module prices have increased by more than 40% over the last 18 months, driven by polysilicon prices. However, bid tariffs has remained lower than what is needed to mitigate the rise in module prices. The risk of lower returns is significant for 4.4 GW of projects that have been awarded over the past 18 months, with tariffs below INR 2.2 ($0.028)/kWh.

Women salt pan workers in Gujarat to be trained as solar technicians

ReNew Power, United Nations Environment Programme, and Self-Employed Women’s Association of India (SEWA) have launched a program to train women salt pan workers in Gujarat as solar technicians. Under the initiative, 1,000 women salt pan workers will be trained as solar panel and solar pump technicians.

India’s first fractionally owned, ground-mount solar plant

A 5 MW open-access solar project in Karnataka is India’s first fractionally owned, ground-mount PV plant. Bengaluru-based Pyse is financing the INR 26 crore ($3.3 million) project through its investment platform, which allows retail investors to own a stake for as little as INR 10,000.

Discom dues liquidation to help realize INR 9,000 crore receivables for renewables sector

The receivables period for leading renewable energy generators can reduce by 40-50 days from the current 180 days, by March 31, 2024.

India needs $223 billion to meet 2030 wind, solar goals

India requires $223 billion of investment over the next eight years to reach nearly 280 GW of solar and 140 GW of wind capacity by 2030.

Solar auctions in India to attract large developers

A new report shows that renewable energy companies will continue to compete in upcoming auctions in India, undeterred by challenges such as rising materials costs and surging interest rates.

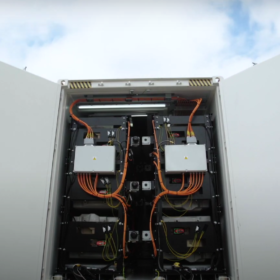

Hinduja Group invests in UK second-life battery storage specialist

Hinduja Group, an Indian multinational, has invested GBP 15 million (($18.4 million) with four other investors in Connected Energy, a developer of energy storage systems based on second-life electric vehicle batteries. The investment will help Connected Energy to scale up its operations and move into utility-scale project development.

ReNew’s operational renewables portfolio hit 7.6 GW in FY2021-22

ReNew Power’s total income rose 27% year on year to INR 69,195 million ($912 million) in fiscal 2021-22, on 130 MW of solar capacity additions in the fourth quarter alone. Its overall renewables portfolio rose to 10.7 GW at the end of March, including 7.6 GW of commissioned capacity and 3.1 GW of committed projects.

Premier Energies, Azure Power partner on solar cells, modules

Premier Energies and Azure Power have signed a strategic alliance under which Azure will invest in Premier’s 1.25 GW mono PERC cell and module facility in Telangana. It will also source 2.4 GW of solar modules from the plant over the next four years.