Government considering viability gap funding, ALMM mandate for battery storage projects

The Indian government is considering financial incentives such as viability gap funding and green finance to encourage the adoption of energy storage systems in the country. It may also issue an Approved List of Models and Manufacturers (ALMM) mandate for battery storage systems for power sector applications.

IREDA, IIFCL team up to finance renewable energy projects

Indian Renewable Energy Development Agency Ltd (IREDA) and India Infrastructure Finance Co. Ltd (IIFCL) will engage in co-lending and loan syndication for all categories of renewable energy projects.

Andhra Pradesh requires $10-15 billion to achieve green hydrogen capacity of 500 ktpa by 2030

Andhra Pradesh requires an estimated $10-15 billion to achieve 500 ktpa green hydrogen capacity by 2030. Around 70% of this investment will be needed to create renewable energy infrastructure such as solar and wind power generation plants, with the balance for electrolyzer capacity additions.

International Solar Alliance convenes meeting of regional committee for Latin America and Caribbean region

The Fifth Meeting of the ISA Regional Committee for Latin America and the Caribbean Region took place this week, convened by the International Solar Alliance (ISA). Its primary objective was translating ambitious solar energy goals into concrete results while addressing pertinent regional issues. The meeting was presided over by Tania Masea, vice minister for new […]

Shell Energy commits over $363 million for renewable energy plant, EV charging stations in Gujarat

Shell Energy India has signed a memorandum of understanding (MoU) with the Gujarat government to invest INR 3,000 crore ($363.24 million) in building a renewable energy generation plant and EV recharge stations in the state.

HSBC announces $2 million funding to IIT Bombay, Shakti Sustainable Energy for green hydrogen innovation

HSBC India has partnered with the Indian Institute of Technology (IIT) Bombay to support innovation-led green hydrogen initiatives. It has also partnered with Shakti Sustainable Energy Foundation (SSEF) to support policy research, and technological and financial solutions for real-world application of green hydrogen in industrial clusters across four states of India.

PFC reports record profit in FY 2022-23

Power Finance Corp. (PFC), the largest lender to the Indian power sector, recorded a net profit of INR 11,605 crore in FY 2022-23.

ReNew reports profit in Q1 FY 2024

The Indian renewable energy developer recorded a net profit of INR 2,983 million ($ 36 million) for the three-month period ended June 30, 2023, compared to a net loss of INR 104 million in the corresponding period last year.

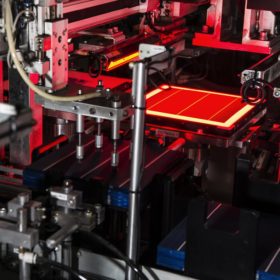

Solar sovereignty: India’s path to sustainable independence and green revolution

The Indian government is actively steering the nation towards a sustainable and environmentally-conscious energy future. However, this juncture calls for a strategic alignment of protective measures to ensure their intended outcomes, notably reducing India’s reliance on energy imports and positioning the nation as a global hub for solar manufacturing.

Gensol Engineering’s Q1 FY 2024 revenue surges 47% YoY

Gensol Engineering has posted a 47% year-on-year increase in its revenue to INR 1,517 million ($18.27 million) for the first quarter of fiscal 2023-24.