What India needs to accelerate sustainable lending post-budget

The next phase of green growth will depend on how quickly capital reaches businesses that are ready to modernize, become energy-efficient, and invest in cleaner production systems. The question is no longer whether sustainable lending will grow, it is how fast we can remove the barriers preventing it from scaling.

India’s EV sector secured INR 2.23 lakh crore in investments, just 18% of the capital needed by 2030: IEEFA

IEEFA states that bridging the INR 10.3 lakh crore investment gap over the next five years will require moving beyond traditional subsidy-led approaches toward structural risk-sharing mechanisms that lower the cost of credit and attract private capital in the electric mobility sector.

Clean Max Enviro Energy raises INR 921 crore from anchor investors

Clean Max Enviro Energy Solutions has raised INR 921 crore from anchor investors ahead of its initial public offering that opens for public subscription today (Feb. 23, 2026).

Global Energy Alliance announces $25 million Grids of the Future Accelerator platform

The Global Energy Alliance for People and Planet has launched the India Grids of the Future Accelerator platform to modernize power distribution, integrate renewable energy and storage, and prepare India’s grids for rapid demand growth.

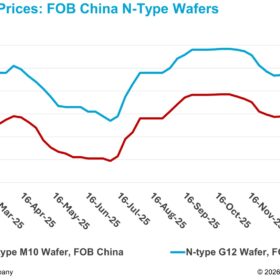

GREW Solar raises INR 1,050 crore from overseas investors to fuel capacity expansion

GREW Solar has raised INR 1,050 crore in a new funding round led by Bay Capital Investment Ltd, with participation from two other institutional investors. The company said it will use a significant portion of the proceeds to expand the manufacturing capacity of its upcoming PV cell facility from 3 GW to 8 GW.

Over 2.08 million rooftop solar systems installed under PM Surya Ghar scheme as of Dec. 2025

More than 2.08 million rooftop solar systems have been installed across India under the PM Surya Ghar: Muft Bijli Yojana as of Dec. 2025, according to the Ministry of New and Renewable Energy.

India’s Union Budget 2026–27 removes customs duty on solar glass inputs, lithium battery cell machinery, and critical minerals processing equipment

India’s Union Budget 2026–27 extends basic customs duty (BCD) exemptions on the import of capital goods used for lithium-ion cell production for battery energy storage systems (BESS), as well as capital goods required for processing critical minerals. It also removes the 7.5% BCD on sodium antimonate used in solar glass manufacturing.

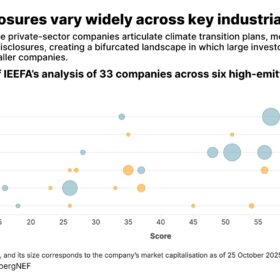

Credible transition plans key to unlocking decarbonization finance for India’s corporates

IEEFA’s assessment finds that while most companies have announced net-zero or emission reduction targets, only a limited number link these goals to capital expenditure plans, revenue assumptions or changes in business strategy, making it difficult for investors and lenders to assess the feasibility of transition pathways.

Adani Green Energy rated BBB+ with stable outlook by JCR

Japan Credit Rating Agency (JCR), Japan’s leading rating agency, has assigned Adani Green Energy Ltd (AGEL) a long-term foreign currency credit rating of BBB+ with a Stable outlook, at par with India’s sovereign credit rating of BBB+.

EV Financing 2.0: Building the Financial Backbone of India’s Green Mobility Ecosystem

As the country accelerates towards a greener future, the focus is rapidly shifting to financing the entire electric vehicle (EV) ecosystem, spanning charging infrastructure, batteries, fleet operations, and clean energy integration. This transition marks the emergence of EV Financing 2.0: a more holistic approach that goes beyond point-of-sale lending to enable sustainable, scalable, and economically viable green mobility.