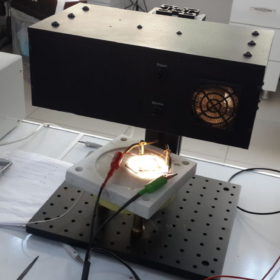

Assessing the impact of micro-cracks in solar glass

A Turkish research team has analyzed how big changes in temperature can affect absorbance, light transmittance and reflectivity in two types of solar glass. The scientists demonstrated lower efficiency in solar cells and the glass itself were attributable to a large number of micro-cracks and deformations on the glass surface.

Solar projects reprieved as Indian government declares coronavirus a force majeure

Lobby group the National Solar Energy Federation of India says around 4 GW of solar plant capacity is likely to be affected by component shortages after the outbreak of the virus in China.

Waaree signs MoU with Gujarat to set up Rs 11 billion solar modules and cells plant

Coming up at Moda village in Valsad district, this will be Waaree’s third solar modules investment in Gujarat after Surat and Umargam plants.

Large scale storage still some way off

Consultancy Bridge to India has looked into its crystal ball to predict India will add 10 GW of solar capacity this year and the same next year before deployment slows to 7 GW per year in 2022 and 2023, dogged by hurdles such as an inexplicable ongoing demand for new coal-fired power plants.

3 GW Indian solar projects at risk due to Coronavirus, says CRISIL

Delay in sourcing of PV modules from China can cause project cost and time overruns, inviting penalties for missing the commissioning date.

Bharat Heavy Electricals opens tender to procure 12m polycrystalline solar cells

The state-owned engineer has specified the dimensions of the devices required and the bid window will close on Friday.

MIT researchers say PV innovations should be deployed in niche markets first

Solar module manufacturers should begin testing new technologies in higher-value niche markets, say scientists at the U.S. institution. For example, bringing perovskite technology directly to the mainstream market remains prohibitive in terms of initial investment but segments such as building-integrated PV or microelectronics devices may offer better routes to commercial maturity.

Coronavirus could cause solar panel price spike

The coronavirus outbreak in China could raise solar module prices in the near term as manufacturers have already begun experiencing wafer and solar glass shortages. Production rates are also being affected by an extended new year holiday introduced by the authorities as a measure to deal with the virus, and the requirement workers from infected areas quarantine themselves for two weeks.

Raising the efficiency of polycrystalline cells with new luminescent EVA film

Chinese researchers have developed a pure EVA film, which they claim can enhance the conversion efficiency of conventional crystalline solar cells by around 0.50%. The film is able to convert UV light into strong visible light.

A new technique to get the right angular-tilt

US scientists are proposing a new approach to calculating the optimum angular-tilt of PV panels for a planar surface at a particular site. In their view, the new technique may unlock innovative yield optimization methods for the installation of PV systems.